Sensible $HBH (-0,34 %) sell and in $IWDA (-0,81 %) go in. Does the $IWDA (-0,81 %) make sense with $IUSA (-0,94 %) position ?

Thank you in advance 😊

Postes

818Sensible $HBH (-0,34 %) sell and in $IWDA (-0,81 %) go in. Does the $IWDA (-0,81 %) make sense with $IUSA (-0,94 %) position ?

Thank you in advance 😊

Hello, GQ community!

I'm 50 years old and I'm very new to this interesting world of investments.

I believe it's never too late to learn something and start a new journey.

I plan to travel for about 15 years 🤞🏼🙂

I watched a lot of YouTube videos before deciding to switch to ETFs from simple deposit accounts. Actually I don't have knowledge yet to invest in individual stocks, so I'll go all-in on a few ETFs, trying to diversify a little bit. They say is good not to be entirely exposed to the US market, even though it should be every portfolio's core.

I started with a 5k allocation and I chose $IWDA (-0,81 %) as my core, $SMEA (-0,67 %) for the European market and $AASI (-1,19 %) for a share of emerging markets ( 👉🏼 I wanted them to be Asian only, but then I realized $AASI (-1,19 %) overweight US 🙄 Why its name is so deceiving?)

In short guys, by next week I plan to allocate another 20k to boost my portfolio and then saving every month.

I'd make $IWDA (-0,81 %) at least 50% of my position, I'm considering the purchase of some $EIMI (-1,28 %) shares (more focused on EM) and maybe soon a crypto ETN/ETC (I still have to understand which is the best offered solution from my broker).

I wouldn't exceed 10% for $WGLD (+1,05 %) and 5% for the crypto.

- Do you have any tips?

- Do I already have overlaps?

- Does make sense to save on some $IS3R (-0,91 %) shares just to get a tiny boost to my returns?

- Which would be the ideal % for every allocation?

[👉🏼 If I get a negative feedback about $IS3R (-0,91 %) and $AASI (-1,19 %) I won't sell them, but just let run as it is]

Thanks in advance for any precious opinion!

Hey everyone,

I'm still relatively new to the market & have been investing since the beginning of December. So far I have created four savings plans $IWDA (-0,81 %) , $AAPL (-1,71 %) , $SPGI (-1,84 %) & $NVDA (-2,06 %)

I've also experimented a bit with individual shares to get a feel for the market and to show some activity. However, I'm lacking a bit of a real strategy to really make a difference ^^

Do you have any tips that would benefit a beginner like me & that I should pay attention to? For example, tips on how to build up a really well thought-out strategy, which is not really the case for me at the moment :)

I'm looking forward to your experiences & opinions!

19 years old, current savings plan:

400€ $IWDA (-0,81 %)

200€ $CSPX (-0,88 %)

200€ $IEFM (-0,87 %)

100€ $BTC (+2,94 %)

50€ $GOOGL (-0,59 %)

50€ $ASML (-1,34 %)

I have an additional €10,000 available, which I want to invest gradually and wait for good opportunities.

Thanks for the feedback.

Hello dear Quinies, how do you do it?

In the past, 100% of my savings plans (currently only $IWDA (-0,81 %) ) at the beginning of the month. Now they run weekly. The feeling was that the price was always expensive on the 1st and the rest of the month it went sideways or slightly down 😂😂(of course only subjective perception at the moment)

Does the swarm intelligence of the community here have information on whether one is better than the other? 😇🙏🏼

Kiss,

Larry

After various evaluations and buying/selling ETFs, I believe I’ve found the balance I want for my portfolio with these three. As for the fourth, I’m undecided whether to keep it or sell it:

$IWDA (-0,81 %) one of the most popular ETFs, with safe capital and virtually guaranteed long-term growth. It focuses on developed markets, with a 70% allocation to the US, and has a low TER.

$EIMI (-1,28 %) this complements the first ETF by covering the markets it misses, focusing on emerging markets with (in my opinion) a good distribution across countries and sectors. It also has a low TER.

$TDIV (-0,02 %) I wanted a dividend-focused ETF, and this one provides global coverage with "solid" companies where the US allocation isn’t dominant. While its TER isn’t very low, the dividends help cover broker fees and some fixed taxes. It also has room for growth, albeit moderate.

My plan is to save consistently with these three, allocating 50% to $IWDA (-0,81 %) , 20% to $EIMI (-1,28 %) , and 30% to $TDIV (-0,02 %) .

$IDVY (-0,33 %) I’m considering selling this one. It has a relatively high TER, is distribution-focused, and I don’t currently need the dividends. Additionally, it includes some companies already present in $IWDA (-0,81 %) and $TDIV (-0,02 %) .

Any thoughts or advice?

Thank you!

I'm 20, a dual student in the public sector and started investing at the beginning of December with 45k - perhaps a bit of bad timing, but the money is finally in the market. The largest positions are currently in the MSCI World ($IWDA (-0,81 %) ), an AI & Big Data ETF ($XAIX (-1 %) ) and my bling-bling gold position ($IGLN (+1,05 %) ), because a little sparkle in the portfolio never hurts. Every month, €175 goes into the MSCI World and €75 into XAIX - a solid savings plan.

In addition, I have built up a ~€1,200 position in the Nasdaq100 ETF ($CSNDX (-1 %) ) to capture the tech sector.

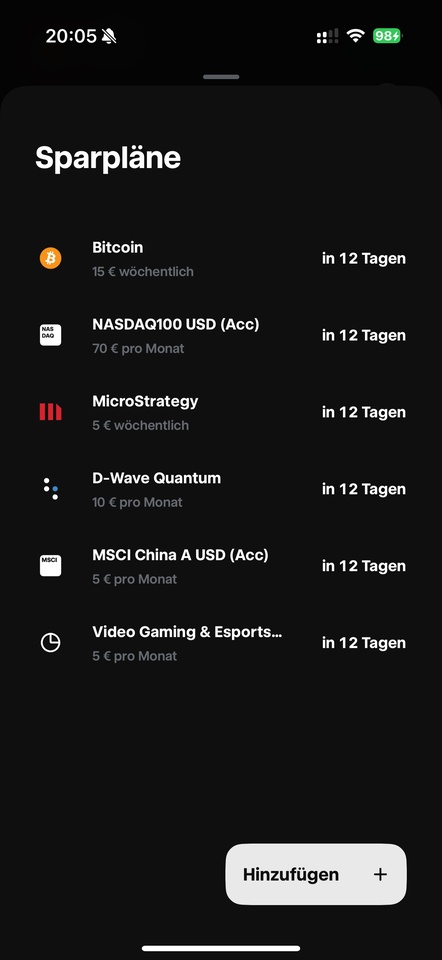

The savings plans from the screenshot are still running: Bitcoin $BTC (+2,94 %) (€ 15 per week), MicroStrategy $MSTR (+1,51 %) (€5 per week), Nasdaq 100 (€70 per month), D-Wave Quantum $QBTS (-7,23 %) (€ 10 per month), MSCI China (€ 5 per month) and Video Gaming & Esports (€ 5 per month). Incidentally, the small €5-10 savings plans are my kind of gambling - a little gambling is a must.

On top of that, my mom runs another Nasdaq 100 savings plan with €80 per month. This means that a total of €500 flows into my savings plans every month.

Edit: I want to increase my $BTC (+2,94 %) position significantly in the medium to long term, apart from the savings plan. I want my crypto share to be at least as large as my gold share.

Oh yes, and because it can't be wild enough: I still hold a Palantir long bill and - now it's getting exotic - a bill on orange juice concentrate ($DE000SB3T5A9 ). Well.

The portfolio is in place, the savings plans are running - now it's time to wait and see where the journey takes us. Gold is shining, tech is growing, orange juice... let's see whether the market will be freshly squeezed or sour.

I wish you all another bullish 2025!

Good evening everyone,

I currently still have 250 euros in euro coins. I bought them all at the issue price and didn't pay any shipping costs. That was the only reason for buying them at the time.

True to the motto: you can't go wrong with anything.

In the meantime, I would rather see the €250 in $IWDA (-0,81 %) or so. I don't really expect to make a profit when selling the euro coins, as I believe they are traded at face value.

I'm much more concerned about where I can sell them. Basically, I would consider selling them privately via classified ads/Facebook groups. Alternatively, I would also ask my bank. I wrote an email to MDM, but of course they only take larger quantities.

Does anyone have any experience or ideas?

For those who are interested:

3x 20 Euro Hans im Glück

1x 20 Euro Human dignity is inviolable

2x 20 Euro Immanuel Kant

1x 20 Euro Berthold Brecht

1x 20 Euro Erich Kästner

2x 20 Euro Ludwig van Beethoven

1x 25 Euro Ore Mountains candle arch

3x 5 Euro Tropical Zone (2017)

2x 5 euro subtropical zone (2018)

I started at the last quarter of last year and started of with $VUSA (-0,86 %) now this year i want to expand my ETF’S for more stability any advise ?

I was personally thinking to add these to my portfolio: $SPPW (-0,84 %) or $IWDA (-0,81 %) , $SPYI (-0,72 %) , $VWRL (-0,87 %)

any feedback is welcome

I started investing in the stock market in June 2021. I was still on short-time work at the time, but I still managed to lay the foundation for my wealth with a savings rate of 60-70% (approx. 1,000 to 1,200 euros). Reaching the first 10,000 euros in particular was a huge challenge - it felt like an eternity.

But I kept at it: From 50,000 euros onwards, things went noticeably faster, and the step from 50,000 to 100,000 euros was almost a no-brainer. With individual stocks like $NVDA (-2,06 %) at the low point in 2022 and an investment in the $EQQQ (-0,79 %) as core & first $BTC (+2,94 %) purchases, which I unfortunately sold at the end of 2023, I was able to achieve good returns; before that, I had invested the majority in a classic $IWDA (-0,81 %) invested before I reallocated.

However, this year was a turning point: in March 2024, I sold the majority of my positions and invested just under EUR 94,000 in Bitcoin - just before the halving. It was a calculated risk, and it paid off and I look back on this year on the stock market very happily.

Looking ahead to next year is just as exciting: from March 2025, I plan to make my first Bitcoin sales and gradually add to the proceeds when good opportunities arise in shares I have already invested in. In the long term, however, I would like to hold 0.5 Bitcoin - both as a hedge and as a strategic position.

At the end of the year, my portfolio stands with a strong performance of ~ 35.1 %. I can look back on a successful year and look forward to the challenges and opportunities ahead. I wish you all a happy new year, good luck and good health for 2025. Stick to your goals - it's worth it!

Meilleurs créateurs cette semaine