Here we go ;-)

iShares S&P 500 Info Technolg Sctr ETF A

Price

Discussion sur IUIT

Postes

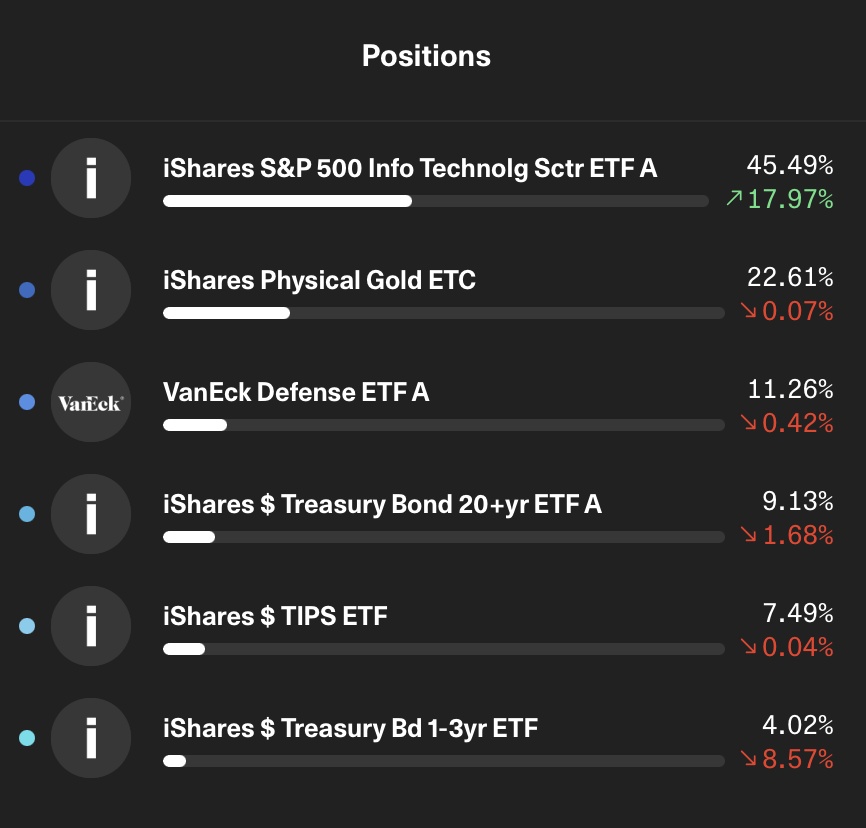

112My ETF portfolio

Only completed this month, so the gains and losses are perhaps a little strange.

The Information Tech ETF serves to invest as focused as possible in all the compounders, I would generally prefer the equal weight variant, but unfortunately it is not yet available in Europe as far as I know. The VanEck ETF is intended to protect the portfolio somewhat from geopolitical risks, and the companies are also quite interesting and all have the state as a major customer, either directly or indirectly, which I think is a very good addition. Weighting is around 55% at the beginning and will be rebalanced as soon as the equities exceed the 80-85% threshold. In this way, I hope to take as much upside as possible and leave the equity area largely unhindered.

The 22% weighting is based on the post from dear @Epi regarding gold.

Like gold, the combination of bonds is intended to take out some volatility and provide an alternative cash position. However, I am considering possibly exchanging the 1-3 year bonds for BTC.

Hello everyone,

I have recently started investing and would like to hear your opinions on my investment strategy.

I can save around €3,000 per month. I invest €2,000 of this in ETF savings plans:

- 700 € in the FTSE All-World $VWRL (-0,87 %)

1,000 € in the S&P 500 Core $CSPX (-0,88 %)

100 € in the VanEck Semiconductor $IE00BMC38736 (-1,29 %)

100 € in the S&P 500 Info Tech $IUIT (-1,46 %)

100 € in the Xtrackers Artificial Intelligence $XAIX (-1 %)

I also invest €1,000 per month in growth stocks.

I am aware that some sectors in my ETFs and even shares overlap. However, as I am deliberately aiming for an overweight in the tech sector, I am following this strategy.

I look forward to your feedback and advice! #etfs

#stockanalysis

#tech

#investing

#growth

If you want an overweighting towards the US, which I would advise against, you are welcome to take an S&P500.

I would also advise against individual stocks when you are starting out.

Profit taking:

Reallocation of 40% into $VWCE (-0,9 %) , 10% $IGLN (+1,08 %) and 50% in individual stocks $8035 (-0,11 %) , $GOOG (-0,71 %) , $ASML (-1,43 %) , $MSFT (-0,88 %)

Partial sale for first purchase $MC (+0 %)

Thinking of moving from $IUIT (-1,46 %) ETF which contains the following companies as big position:

Apple - 22%

MSFT - 18.6%

NVDA - 18.5%

Broadcom - 5.85%

Then buying only $NVDA (-2,07 %) in the saving plan? What do you think? I know it's higher risk, but the $IUIT (-1,46 %) is having lower returns.

Considering I'm not looking for short term, I would give it a few more days, specially with the US elections happening and the pending Federal Reserve’s interest rate decision.

If you want to add $ASML (-1,43 %) to the saving plan how would you go on in doing that?

I already have monthly saving plan 80% $VWCE (-0,9 %) and 20% $IUIT (-1,46 %) . For the people buying $ASML (-1,43 %) are you just buying a couple of shares and then leaving it or adding it to a saving plan?

What do u think about invest in $IUIT (-1,46 %) rather $NVDA (-2,07 %) or $MSFT (-0,88 %) or any tech companies?

I know that's safer invest in an ETF, but do u think maybe any company will fly to the moon in a few months?

considering switching my ETF from) $IUIT (-1,46 %) to $MWRD (-0,66 %) investment over 10-15 years. Please advise.

Titres populaires

Meilleurs créateurs cette semaine