Im doing a big bet here.$ETH (+0,26 %)

Discussion sur ETH

Postes

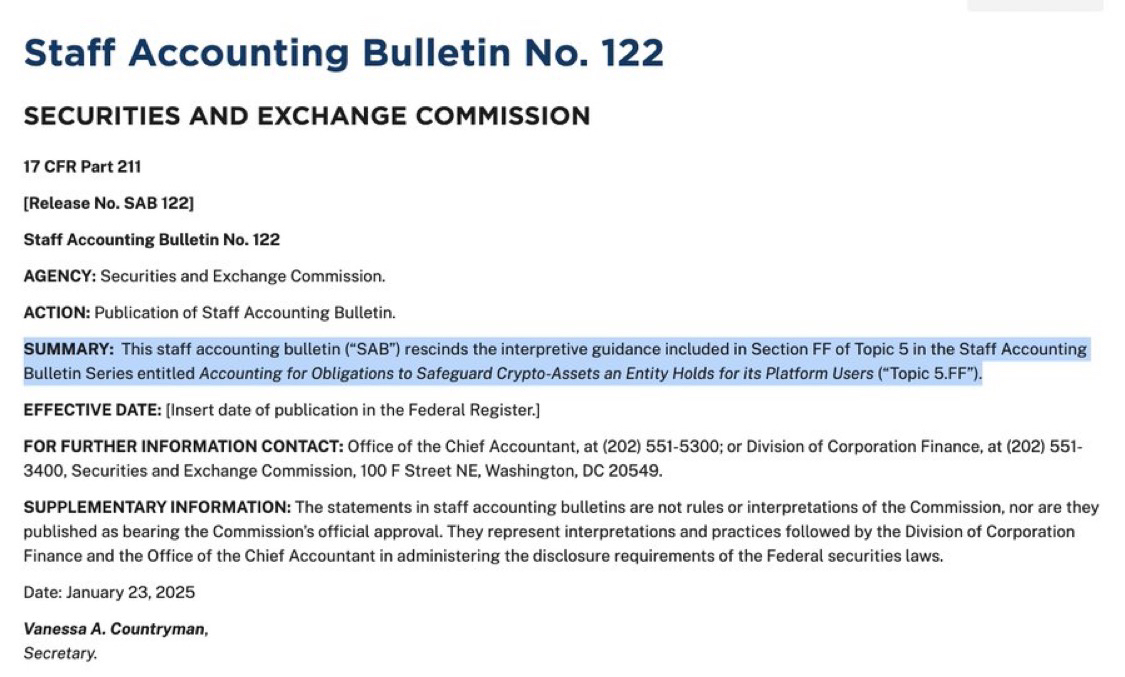

885BREAKING: 🇺🇸 SEC OFFICIALLY RESCINDS SAB 121, WHICH PREVENTED BANKS FROM CUSTODYING

$BTC (+0,11 %)

$SOFI (-1,29 %)

#bitcoin

Banks can now offer secure storage solutions for cryptocurrencies, serving institutional clients, private investors and businesses who want to store their digital assets in a trusted location.

Banks are now able to offer crypto solutions 🚀

Reminder: $SOFI (-1,29 %) was essentially forced to divest its crypto business in order to obtain its banking license.

$SOFI (-1,29 %)

$JPM (-0,82 %)

$MS (-0,59 %)

$WFC (-0,7 %)

$HOOD (+0,62 %)

$COIN (+0,46 %)

$ETH (+0,26 %)

$C (-1,27 %)

$DBK (-0,21 %)

$BAC (-0,38 %)

Chainlink and Litecoin

Still have $LINK (-1,02 %) and $LTC. Also $ETH (+0,26 %) .

What do you do with them? Everything in $BTC (+0,11 %) swap?

Thanks in advance

Trump and the next limit order

Yesterday, before Trump's inauguration, Bitcoin shot up to its next ATH. We set a new ATH at just under USD 109,000. And very close by, my next limit order was triggered. At around USD 108,000, another tranche left me. $BTC (+0,11 %) tranche left me. Just short of the ATH, but still a top selling price for the moment! The freed-up euros went straight into the $EXX5 (-0,52 %) immediately afterwards. This means that two out of three months in the special custody account are now covered by distributions. I am continuing to implement my exit strategy. The only thing missing now is the first month of each quarter with distributions. I hope that the bull market will continue for a few more weeks.

I also hope that $ETH (+0,26 %) finally gets going. Because there is still a lot of room for the limit orders.

CURRENT MARKET / SPECULATION

The crypto market is currently volatile, with slight downward movements in the leading cryptocurrencies. Bitcoin ($BTC (+0,11 %) ) is currently trading at USD 104,880, down 2.26% on the previous day.

Ethereum ($ETH (+0,26 %) ) is trading at USD 3,320.90, down a minimal 0.43%.

$BNB (+1,1 %) remains almost stable at USD 690.28.

$XRP (+0,88 %) and $ADA (+1,5 %) also show slight losses, while $DOGE (+1,23 %) remains almost unchanged at USD 0.373198.

$SOL (-1,1 %) and $AVAX (+1,64 %) are down 4.68% and 2.53% respectively. Litecoin ($LTC ) and Polkadot ($DOT (+0,04 %) ), on the other hand, show minimal changes.

Despite these short-term fluctuations, the long-term trend remains positive. Experts such as Matt Hougan from Bitwise Asset Management emphasize that fundamental factors such as institutional acceptance and technological innovations are supporting the multi-year bull market.

One should keep an eye on the volatility of the market and adjust investment decisions accordingly.

This weekend it will burn🔥🔥🔥🔥🔥🔥

This weekend should be particularly hot for cryptocurrencies, especially US-based crypto, it's already lunchtime. The stock market will be pulling its money out, as they do every Friday. Focus on crypto now so you can take profits tomorrow and Sunday. On Monday, take your profits and get out with the critters 🚩🚩🚩🚩📤

Solana $SOL (-1,1 %)

🔥🔥🔥💵🔥💵💵🔥💵🔥

ISO compatible

XRP $XRP (+0,88 %)

XLM $XLM (-2,9 %)

XDC $XDC (-0,67 %)

VELO $VELO (+0,63 %)

ONDO $ONDO (+0,71 %)

💵🔥

Meme 🚨

BONK $BONK (-1,08 %)

Pepe $PEPE (+0,14 %)

Pudgy penguin

Doge $DOGE (+1,23 %)

Shiba Inu $SHIB (+0,44 %)

As with stocks, there are risks with cryptocurrencies... Do your research and never invest more than you can afford to lose.

Crypto

If you had the choice between $BTC (+0,11 %) or $BTC (+0,11 %) , $ETH (+0,26 %) and $SOL (-1,1 %)

Which would you choose?

My investment strategy 2025

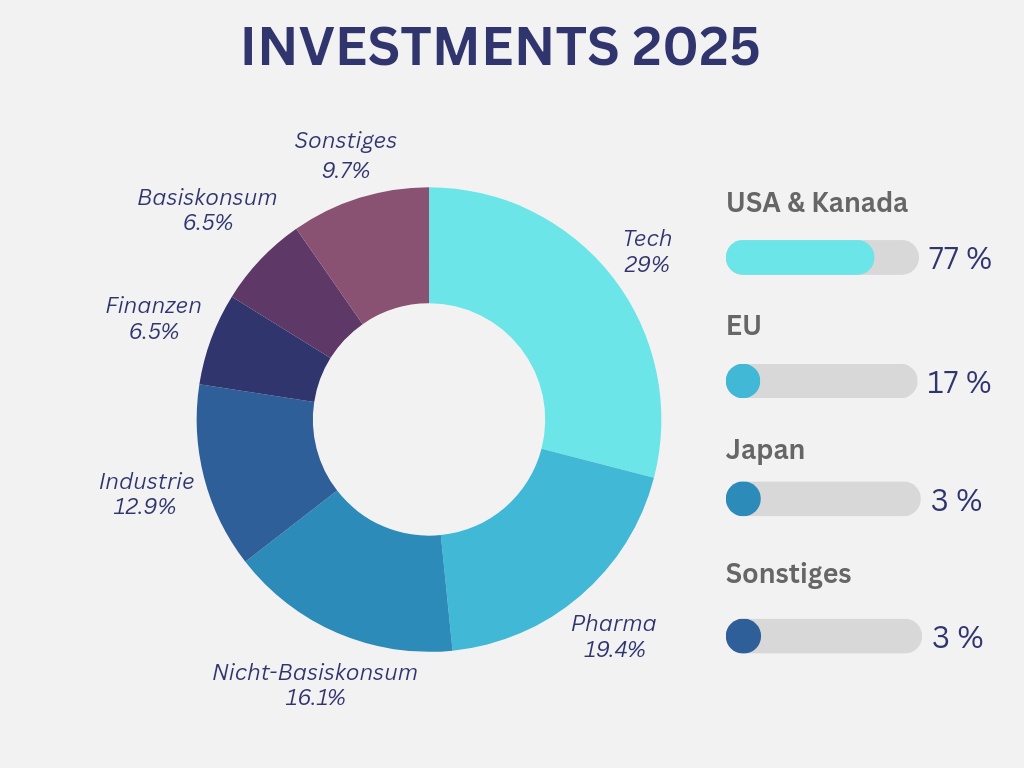

After two extremely good stock market years, the year 2025 is under particular scrutiny.

- After two years with price increases of over 20%, can it go any higher?

- How will Trump affect the stock market? Liberal policies vs. tariffs?

- Inflation and interest rate trends - will the central banks continue to lower rates or will inflation return?

What will not change is my basic investment strategy. I will continue to invest in dividend growth stocks and buy them every month via a savings plan - regardless of other influences and developments.

Investment amount:

In my private life, building a house is a big issue. My monthly savings will therefore be significantly lower in 2025 than in previous years.

In the last few years, my savings sum was usually between €1,500 and €2,500.

I will now reduce this significantly to approx. 700€ per month.

The rest will go into a call money account to save money for additional costs, kitchen, furniture and so on.

However, I am absolutely aware that €500-700 is still a very high investment amount per month.

Around half (€250) already comes from dividend income, which I will reinvest.

Investment breakdown:

This year, the majority of my investments will again be in individual stocks with the following allocation:

I will continue to overweight the USA and underweight Europe (especially Germany).

My main focus will also remain on the technology and pharmaceutical sectors with almost 50%. This is where I continue to see the greatest growth in the long term - both for sales, profits and dividends.

There will be no changes to the savings plans for the time being. I will not be adding any new shares to my savings plan for the time being.

In addition, I will continue to invest the net savings from private health insurance compared to statutory health insurance in the WisdomTree Global Quality Dividend Growth

$GGRP (-0,59 %)

In total, that's around €90 per month + the one-off premium refund of over €2,000 for 2024.

The capital-forming benefits from my employer flow into an MSCI World

$XDWD (-0,67 %) with finvesto.

In addition, €100 goes into two crypto savings plans every month. 65 flows into Bitcoin

$BTC (+0,11 %) and €35 in Ethereum

$ETH (+0,26 %)

Dividend expectation:

For this year, I also expect around 15-20% more dividends than in 2024.

This would mean total dividends of €3,300-3,500 for 2025.

What is your investment strategy for 2025?

i like your strategy very much as i have a similar strategy. about 70/30 dividend stocks, only one-off purchases, no savings plans and purely equities without ETFs. main focus also on the USA and mostly blue-chip companies.

just started investing much later. most of the money was invested at the end of 23/beginning of 24 so performance is still limited.

as a beginner I also sold too early/buy too late...

but after 1.5 years I received almost 20% and 3000€ dividends.

in year 25 i will collect over 5k in dividends.

with a portfolio value of just under 300k and an age of 35, i consider this strategy to be a good one for me, even with a view to prices that are no longer as profitable as the last two years, i have more or less decided on this mix in order to have a positive cash flow even in bad times.

Do crypto savings plans still make sense?

Does it still make sense to run my current savings plans in $BTC (+0,11 %)

$ETH (+0,26 %)

$SOL (-1,1 %)

$XRP (+0,88 %)

$ADA (+1,5 %) or only in $BTC (+0,11 %) to run?

Kind regards, Timur.

A simple Bitcoin savings plan will bring you the most joy in the long term :)

My portfolio + "investment strategy"!

Hello folks

Next month my time as an apprentice will come to an end.

To mark the occasion, I've spent the last few weeks thinking about what my wealth accumulation strategy should look like...

I would like to share these thoughts/strategy with you to either gather inspiration or suggestions for improvement.

I invest in ETFs and crypto in a ratio of 70/30!

For the ETFs I use the $IWDA (-0,69 %) as a basis and the $IUIT (-1,69 %) for hopefully above-average returns.

Ratio 70/30.

With crypto, I'm going for $BTC (+0,11 %) , $ETH (+0,26 %) and $SOL (-1,1 %) at a ratio of 50/30/20.

My goal is to have a portfolio value of €25,000 by the end of 2025!

I'm aware that the ratios don't match yet, but I'm currently working on it...

What is your opinion?

Titres populaires

Meilleurs créateurs cette semaine