US Senator Ted Cruz on Bitcoin

$BTC (+2,88 %):

"I use weekly buying for the cost averaging effect."

"I've been investing for several years, during which the value of Bitcoin has roughly tripled in value."

Postes

2 651US Senator Ted Cruz on Bitcoin

$BTC (+2,88 %):

"I use weekly buying for the cost averaging effect."

"I've been investing for several years, during which the value of Bitcoin has roughly tripled in value."

Hello getquin community!

I recently came across this platform and signed up straight away to track my portfolio more clearly. For the most part, entering my transactions worked well, but I had to enter some positions manually, especially my gold savings plans (I use the average price to simplify this). Before I share my portfolio with you and look forward to your opinions and suggestions for improvement, I'd like to briefly introduce myself:

My name is Burhan, I'm 29 years old and I come from a town in North Rhine-Westphalia. I work in the insurance industry and am completing two part-time degree courses at the same time (because free time is overrated 😉):

My way into the world of (small) investors:

I started investing - or rather, trading and chart analysis - when I was 18. Back then, I invested small amounts in leveraged products such as the DAX or WTI oil. Although I made more profits than losses during this time, I learned an important lesson: it is crucial to regularly check take-profit and stop-loss levels in order to avoid capital losses.

However, I only started investing for the long term in 2019. My first step was a savings plan with EUR 25 per month in a fund from Deka ($D6RM (-0,06 %) ) - the first dividend I received was a small sense of achievement for me. Later came savings plans for individual shares ($LHA (-0,18 %) and $SHA) and commodities ($965515 (+0,77 %)) were added. I also used my employer's capital-forming benefits (EUR 40 per month) to further expand my investment in the Deka fund.

My current investment strategy:

Over the last few years, I have tried out and learned a lot and finally developed my personal strategy:

1. basic ETFs:

With the $VHYL (-0,72 %) and the $FUSD (-0,99 %) I would like to create a stable foundation.

2.

Individual shares:

Here I deliberately focus on non-US companies (with a few exceptions) in order to diversify my portfolio and reduce the US dominance somewhat.

My selection criteria for individual stocks:

- approx. 1 %combined with an average dividend increase of 10 % over the last 5 or 10 years, or

- approx. 2,5 %combined with an average dividend increase of 5 % over the last 5 and 10 years respectively.

For example: $MS (-2,7 %) / $GGG (-0,78 %) / $CS (-1,46 %) / $ASML (-1,42 %) / $MUV2 (-1,81 %) / $CNQ (+1,04 %) / $MC (+0 %) / $TKA (+0,25 %) / $DHL (-0,34 %)

3. Gold:

My gold savings plan is still running because diversification is important - and a little sparkle in the portfolio never hurts.

4. Cryptocurrencies:

The proportion is deliberately low and I plan to concentrate only on $BTC (+2,88 %) in the future. Everything else will probably be dropped soon.

5. Cash:

Part of my capital is in a call money account so that I can react flexibly to opportunities or unexpected events - who knows when the next dip will come.

The aim of the asset class allocation:

- 37.50 % ETFs

- 37.50 % individual shares

- 10.00 % commodities

- 5.00 % cryptocurrencies

- 10.00 % Cash

In addition, a good deal is currently underway to buy real estate (purpose: rental) - I am still curious.

I hope my first post wasn't too long and that you've made it this far! 😉 I look forward to your feedback, opinions and tips - keep them coming!

Hello Getquin

How is it actually regulated if you have your coins on the exchange, for example at Coinbase $COIN (+2,02 %) up to what amount would the coins be $BTC (+2,88 %)

$ETH (+1,4 %)

$SOL (+2,23 %) covered by insurance in the event of a hacker attack, for example?

Are any of you familiar with this or do you think it would be better to store them in a wallet?

Many thanks for your help

500 coins for everyone for 3 more days + US government may sell 69,370 Bitcoin worth billions + TSMC beats estimates thanks to NVIDIA + Novo Nordisk expands AI partnership with Valo

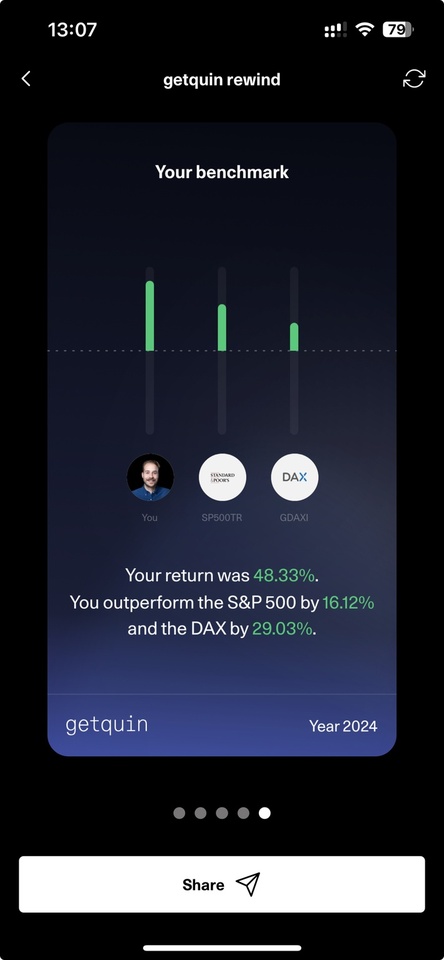

500 coins for everyone who shares their Rewind on Instagram and tags us

US government may sell 69,370 Bitcoin $BTC (+2,88 %)worth billions - price plummets

TSMC $2330beats estimates thanks to NVIDIA

Novo Nordisk $NOVO B (-0,45 %)expands AI partnership with Valo

Friday: Stock market dates, economic data, quarterly figures

Economic data

08:00 DE: Turnover in the service sector October FORECAST: n.a. previous: +0.3% yoy

08:45 FR: Industrial production November PROGNOSE: -0.1% yoy previous: -0.1% yoy | Private consumption November PROGNOSE: +0.1% yoy/-0.2% yoy previous: -0.4% yoy/+0.4% yoy

14:30 US: Labor market data December employment ex agriculture PROGNOSE: +155,000 yoy previous: +227,000 yoy Unemployment rate PROGNOSE: 4.2% previous: 4.2% average hourly earnings PROGNOSE: +0.3% yoy/+4.0% yoy previous: +0.4% yoy/+4.0% yoy

Last year, there was a distinct lack of snow in December. Instead, the portfolio did really well and I made progress with my crypto sell-off strategy. A small cold in the fall, despite taking good precautions, set me back in terms of ice bathing and hiking, but fortunately I was healthy again by Christmas. Unfortunately, that wasn't all... Time for a look back.

I present the following points for the past month of December 2024:

➡️ SHARES

➡️ ETFS

➡️ DISTRIBUTIONS

➡️ CASHBACK

➡️ AFTER-PURCHASES

➡️ P2P CREDITS

➡️ CRYPTO

➡️ WHAT IS REALLY IMPORTANT

➡️ OUTLOOK

➡️ Shares

$AVGO (-1,19 %) is back on the tube. Wow, at +276%, the stock is now up for me. After the share cooled down a little, it went to the moon again in December.

$NFLX (-3,17 %) and $SAP (-0,16 %) are on a par with the previous month in terms of performance and are still in 3rd and 4th place in terms of volume. $WMT (+1,54 %) . The retail chain will soon become a doubler for me.

The red lanterns will once again go to the usual suspects $NKE (+0,12 %) , $DHR (-1,35 %) and $CPB (-3,19 %) . In terms of performance, all three stocks are down between -30% and -20%. They are the smallest positions in my main share portfolio with the $DHL (-0,34 %) However, across all portfolios, the smallest positions are the new additions $SHEL (+0,32 %) and $HSBA (-0,24 %) .

➡️ ETFs

The ETFs are doing their thing as usual. This month, I immediately invested a refund from the previous year's utility bill in the $GGRP (-0,57 %) and $JEGP (+0,22 %) invested. I'm always expanding this asset class in particular with cash inflows. I don't care about timing. The money should go into the assets so that the stream of distributions keeps growing. I buy income and want cash flow.

➡️ Distributions

I received 34 distributions on 14 payout days in December. I am grateful for this additional income stream. My minimum target has been met anyway in this high-distribution month. The snowball rolling down the slope is getting bigger and bigger.

I already donated part of the dividend at the beginning of the month. This is based on the conviction that you can (and should) give something back, no matter how small, if you have the opportunity to do so.

➡️ Cashback

In November, I received €6 from redeemed Payback points, the equivalent of which I transferred from my grocery account to my settlement account. As already mentioned, there was also a credit from the utility bill. REWE and Penny have now separated from Payback, while Edeka, Netto Markendiscount and Marktkauf have joined. All three new stores are not in my immediate vicinity, which is why I will earn fewer Payback points in future. I will most likely collect the points mainly at DM. REWE and Penny now have their own bonus programs. REWE's will be exciting, as I can also save up credit with my purchases. I will deduct this discount from my grocery account and invest it in the same way as before. I'll see over the year whether it pays off more than Payback did back then.

➡️ Subsequent purchases

As already mentioned, there were additional purchases at $JEGP (+0,22 %) , $GGRP (-0,57 %) and $SPYD (-0,91 %) . I always invest every little return or leftover money to further increase my portfolio. This buys me freedom.

➡️ P2P loans

I was finally able to get rid of Peerberry. Now only Mintos is hanging on my leg like a log. A mid-double-digit amount, which has long since defaulted, is still waiting to be refunded or written off.

This asset class will soon be history for me.

➡️ Crypto

All in all, December was another exciting month for crypto investors. Limit orders were triggered again for me. The last tranches $LINK (+3,06 %) have left me, as has a first tranche $UNI (+10,19 %) and a first tranche $BTC (+2,88 %) . I have invested the proceeds in $HSBA (-0,24 %) and $SHEL (+0,32 %) invested in the separate portfolio. I have already explained my underlying strategy in detail, which you can read about in my articles. Recently, the crypto market has been in a sideways phase again. I'm hoping for another breakout in January to trigger further limit orders, as I still need to buy a security so that the separate portfolio pays me a return each month. So far, only two out of three quarterly months are covered. The two new stocks have even performed well in this short period of time, gaining around +3.6% within a month. The last purchase will perhaps be an ETF. You will see more about this in the coming reviews. I am already looking forward to collecting again in the coming bear market and will then certainly write an extra post with the levels at which I will gradually enter again.

➡️ What is really important

I remember December as a good month in financial terms, but unfortunately Christmas was overshadowed by tragic events this time.

After recovering from my cold at the beginning of the month a few days before Christmas Eve and getting back to my daily routine (consisting of work, running, ice swimming, hiking and my love of finance), I received the terrible news from Magdeburg. I am simply stunned and ask myself "why?". I am not affected, I am not one of the bereaved and I don't know any of the victims, the wounded or the bereaved personally, yet this event brought me down on the evenings around the Christmas holidays. Loyal readers know that I am working on a closer relationship with my ex's kids. Even though my blood doesn't run through their veins, questions ran through my mind about what if they were affected by the horrific act, or me? It could have happened anywhere. At least in the event of my untimely demise, I also made appropriate arrangements in the last few days of the year to ensure that what I leave behind ends up where I want it to be. I spent the turn of the year with the kids and the time I spent with them was the best end to the year imaginable. It's nice when connections continue to exist and you remain part of the life of the Kampfzwerge and can continue to accompany them through life.

➡️ Outlook

New year, new luck. I'll be surprised what the new year will bring. There will be a separate post for the evaluation of 2024 as a whole. I'm particularly happy because I exceeded an important goal despite a few expenses.

Links:

Social media links can be found in my profile, you can also check out the Instagram version of my review.

Thailand has launched a pilot project in Phuket that aims to integrate Bitcoin $BTC (+2,88 %) and other cryptocurrencies into the tourism industry. The aim is to attract crypto investors and digital nomads. To this end, measures are being taken to prepare companies, hotels and restaurants for cryptocurrencies. This will make it easier for travelers to pay with Bitcoin and Co. The project aims to position Phuket as an innovative destination and at the same time strengthen tourism through technological developments. If successful, the concept could be expanded to other regions in Thailand.

https://fintechnews.sg/106216/thailand/thailand-crypto-payment-phuket/

Good evening getquin community,

I would be interested to know....

Do any of you have a $BTC (+2,88 %) savings plan in place?

If so, how often (weekly, monthly, ...) does your savings plan run and, above all, when (day of the week)?

You can also tell us how much you invest in a savings plan, but of course you can also keep it private. 😊

I look forward to every answer! 🐍

A US court has cleared the way for the liquidation of 69,370 seized bitcoins from the dark web marketplace Silk Road. The US government could thus collect 6.5 billion dollars and get one over on future US President Donald Trump - but not without obstacles.

According to a leaked court document from December 30 this week, US District Judge Richard Seeborg has finally approved the sale of the largest Bitcoin holdings ever seized at federal level. The cryptocurrencies originated from Silk Road, an illegal dark web platform that was shut down in 2013. They represent the remains of transactions related to illegal activities.

With this decision, the claims of several plaintiffs have been finally dismissed. These include the investment firm Battle Born Investments, which had asserted its ownership rights as part of insolvency proceedings involving a person it believed to be the original owner.

The decision comes at a politically charged time, shortly before Donald Trump's inauguration on January 20. The US president-elect, who said at a crypto conference in Nashville last July: "Never sell your Bitcoins", also promised to create a strategic Bitcoin reserve. Selling the coins already owned by the state is therefore unlikely to be in his interest.

However, the ruling alone does not guarantee immediate liquidation, as asset forfeiture at the federal level involves multiple administrative steps and potential appeal options.

But it's not just the bureaucratic hurdles that make a sale of Bitcoin before Donald Trump's inauguration unlikely. It's also common for government agencies not to take controversial actions during the transition period before a new president takes office. Although the Democrats oppose Trump, they are likely to place more emphasis on their "good guy" image, which they campaigned on.

What impact do you think this will have on the $BTC (+2,88 %) will have or, if it is implemented, how low it could fall

Probably I'll buy 1 or 2 more at the end of the month, it depends of how much money I deploy into shares (add to $ASML (-1,42 %) ), or buy new ones ($NOVO B (-0,45 %) , $CTAS (-1,57 %) )or to $BTC (+2,88 %) (i will accumulate more once the price falls below 89k as there is a monthly fvg+

Meilleurs créateurs cette semaine