Earnings next week 🗓️

Heineken

Price

Discussion sur HEIA

Postes

5Analyst updates, 04.12.

⬆️⬆️⬆️

- BARCLAYS raises the price target for SIEMENS from EUR 125 to EUR 130. Underweight. $SIE (-0,65 %)

- BARCLAYS raises the target price for SIEMENS ENERGY from EUR 35 to EUR 36. Equal-Weight. $ENR (-4,05 %)

- JEFFERIES raises the target price for ADYEN from EUR 1695 to EUR 1797. Buy. $ADYEN (-0,8 %)

- JPMORGAN raises the target price for SALESFORCE from USD 340 to USD 380. Overweight. $CRM (-2,08 %)

- HSBC raises the target price for ZALANDO from EUR 37 to EUR 40. Buy. $ZAL (-4,95 %)

- JPMORGAN raises the target price for RHEINMETALL from EUR 680 to EUR 800. Overweight. $RHM (+0,08 %)

- DEUTSCHE BANK RESEARCH raises the target price for COCA-COLA HBC from GBP 31.50 to GBP 32. Buy. $CCH (-0,68 %)

- BARCLAYS raises the target price for KNORR-BREMSE from EUR 55 to EUR 60. Underweight. $KBX (-3,14 %)

- BARCLAYS raises the price target for ABB from CHF 40 to CHF 42. Underweight. $ABBNY (-0,62 %)

- BARCLAYS raises the price target for ALSTOM from EUR 8 to EUR 9. Underweight. $ALO (-2,52 %)

- HSBC upgrades MERCK & CO to Buy. Target price USD 130. $MRK (-0,26 %)

- JPMORGAN raises the target price for DSV from DKK 1685 to DKK 1800. Overweight. $DSV (+0,64 %)

- JPMORGAN raises the target price for LUFTHANSA from EUR 4.80 to EUR 5.50. Underweig$LHA (-0,14 %)

- UBS raises the target price for AROUNDTOWN from EUR 2 to EUR 3.30. Neutral. $AT1 (-1,71 %)

⬇️⬇️⬇️

- JPMORGAN lowers the target price for DHL GROUP from EUR 47 to EUR 42.50. Overweight. $DHL (-0,29 %)

- WARBURG RESEARCH lowers the target price for UNITED INTERNET from EUR 38.50 to EUR 37.30. Buy. $UTDI (-0,23 %)

- WARBURG RESEARCH lowers the target price for 1&1 from EUR 23.50 to EUR 19.10. Buy. $1U1 (-0,84 %)

- WARBURG RESEARCH lowers the target price for KWS SAAT from EUR 89 to EUR 88. Buy. $KWS (-1,37 %)

- DEUTSCHE BANK RESEARCH downgrades HEINEKEN from Buy to Hold and lowers target price from EUR 95 to EUR 76. $HEIA (-3 %)

- EXANE BNP lowers the price target for SCHOTT PHARMA from EUR 36 to EUR 28. Neutral. $1SXP (-2,71 %)

- BARCLAYS downgrades SIGNIFY to Underweight. Target price EUR 18. $LIGHT (-2,58 %)

- CFRA downgrades BRISTOL-MYERS SQUIBB to Hold. Target price USD 60. $BMY (-0,49 %)

- MORGAN STANLEY downgrades MOLLER-MAERSK to Underweight. Target price DKK 12200. $AMKBY (-1,35 %)

- BARCLAYS downgrades ANDRITZ to Underweight. Target price EUR 40. $ANDR (-0,14 %)

- JPMORGAN lowers the price target for HAPAG-LLOYD from EUR 85 to EUR 80. Underweight. $HLAG (+0,66 %)

Zusammenfassung Earnings heute morgen 👇

$IBE (-5,29 %) | Iberdrola Q3 2024 Earnings

Revenue €10.48B (est 13.81B)

Net Income €1.34B (est.€1.15B)

Boosts Interim Dividend By 14% To €0.23/share

To Hold Next Capital Markets Day In Autumn 2025

$RBGLY (+0 %) | Reckitt Benckiser Q3 2024 Earnings

Revenue $3.46 (est $3.39B)

Volume -1.4% (est -3.13%)

Price/Mix (est +0.9%)

Like-For-Like Sales -0.5% (est -1.84%)

Still Sees FY Like-For-Like Sales To Like-For-Like Sales (est -0.5%)

$HEIA (-3 %) | Heineken Q3 2024 Earnings

Adj Revenue $7.68B (est $7.78B)

Organic Adj Net Rev +3.3% (est +5.38%)

Org. Beer Volume +0.7% (est +2.02%)

Sees FY Adj Oper Profit +4% to +8%

$ROG (-1,59 %) | Roche Holding Q3 24 Earnings:

- Pharma Sales CHF11.62B (est CHF11.43B)

- Net Sales CHF15.14B (est CHF14.93B)

- Confirms FY Outlook

$DBK (-0,04 %) | Deutsche Bank Q3 24 Earnings:

- PreTax Profits EU2.26B (est EU2.02B)

- Net Rev EU7.50B (est EU7.31B)

- FIC Sales & Trading Rev EU2.1B (est EU2.01B)

- Seeking Authorisation For Buybacks

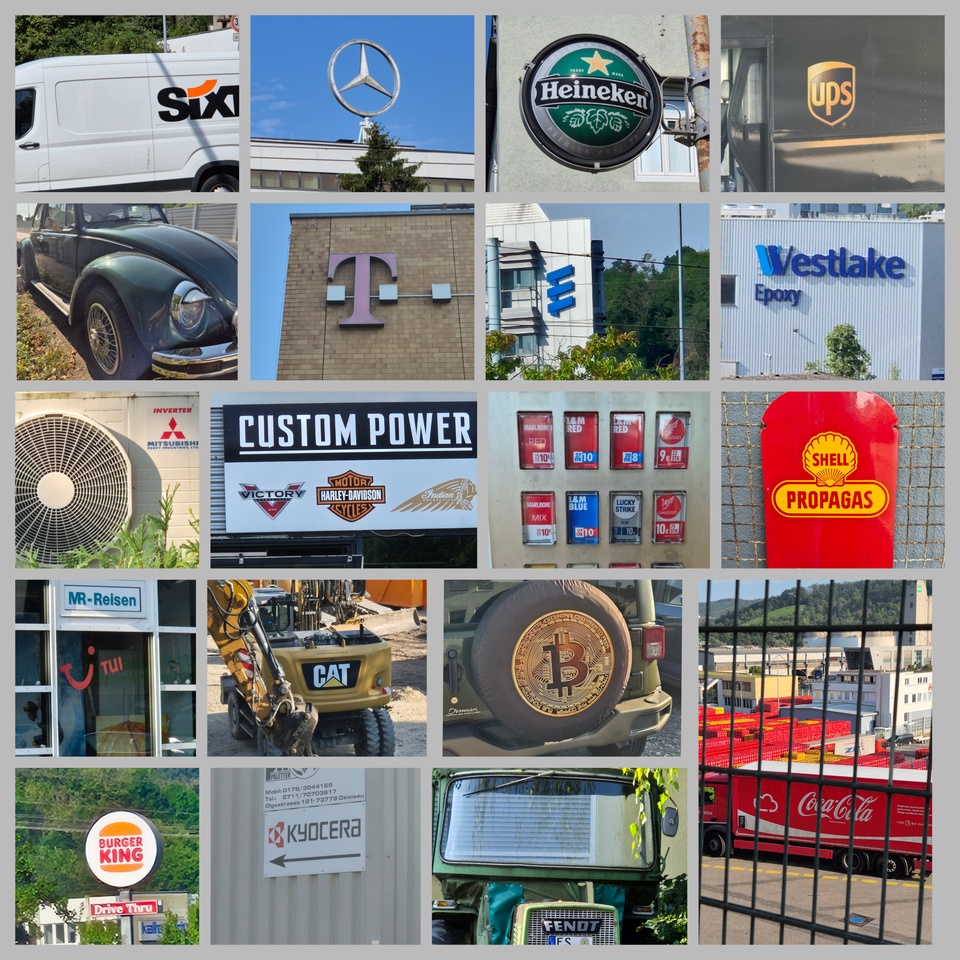

Share march, 30km route with 35 share companies

First day of vacation, 32°C and a 30km walk towards Stuttgart. I was able to find over 35 stock companies along the route.

Highlight, $BTC (-0,69 %) Bitcoin logo on the wheel arch of the Jeep.

In addition to the car brands, $MBG (+3,87 %)

$DTG (-2,33 %)

$VOW (+1,45 %)

$BMW (+0,87 %)

$VOLV B (-3,29 %)

$TSLA (+0,88 %)

$1211 (-1,92 %)

$P911 (-0,77 %)

$F (-0,63 %)

$8058 (+0,96 %) I was able to discover numerous other companies that were new to me.

New for me was $6971 (+1,49 %) Kyocera, a manufacturer of electronic devices from Japan and $WLK (+1,4 %) Westlake Chemical from the USA.

From Germany there were also $SIX2 (-0,57 %) Sixt $DTE (-0,12 %) Telekom $TUI1 (-2,8 %) Tui $AGCO (+1,39 %) (Fendt) $256940 Eberspächer (supplier to the automotive industry) $SIE (-0,65 %) Siemens $EBK ENBW $DHL (-0,29 %) Post and $ALV (-1,16 %) in the process.

Other companies:

$CAT (-2,49 %) Caterpillar $HEIA (-3 %) Heineken $HOG (-2,84 %) Harley Davidson $PM (-2,94 %) Philip Morris $NKE (+0,17 %) Nike $AAPL (-1,69 %) Apple $005930 Samsung $UPS (-2,52 %) UPS $SHEL (+0,32 %) Shell $V (-1,41 %) Visa $MA (-2,03 %) Mastercard $KER (-0,27 %) Kering

$KO (-0,6 %) Coca-Cola $QSR (-1,04 %) Restaurant Brands (Burger King)

$O (-1,52 %) Reality Income (leased to Decathlon)

Would you have recognized everything? It's interesting what you discover when you consciously look around.

Out of interest, please link if you post something similar 🫡 or use the #aktienmarsch

Today I looked at the $HEIA (-3 %) and $CARL A (-1,73 %) shares.

The setback of the $HEIA (-3 %) share brought me closer to the brewery groups. After a little research, I had bought 8 shares of the $HEIO (-2,88 %) purchased. It should be noted that I opted for the holding company here. I considered the lower P/E ratio and the slightly higher dividend to be more advantageous.

Perhaps someone here has a different opinion on this and would like to share it with regard to the holding company and the actual "core company".

I also look forward to lively discussions about the worthwhile nature of investing in brewery groups.

I would then like to ask another question.

With the $CARL B (-1,51 %) and $CARL A (-1,73 %) shares, I naturally noticed the voting rights.

How much would this variable affect you as an insignificant small shareholder?

In my opinion, I would take the share that is currently more favorable or has performed better historically.

Titres populaires

Meilleurs créateurs cette semaine