Hello getquin community!

I recently came across this platform and signed up straight away to track my portfolio more clearly. For the most part, entering my transactions worked well, but I had to enter some positions manually, especially my gold savings plans (I use the average price to simplify this). Before I share my portfolio with you and look forward to your opinions and suggestions for improvement, I'd like to briefly introduce myself:

My name is Burhan, I'm 29 years old and I come from a town in North Rhine-Westphalia. I work in the insurance industry and am completing two part-time degree courses at the same time (because free time is overrated 😉):

- Business economist for financial services (until January 2025)

- Business administration with three specializations (until April/May 2025).

My way into the world of (small) investors:

I started investing - or rather, trading and chart analysis - when I was 18. Back then, I invested small amounts in leveraged products such as the DAX or WTI oil. Although I made more profits than losses during this time, I learned an important lesson: it is crucial to regularly check take-profit and stop-loss levels in order to avoid capital losses.

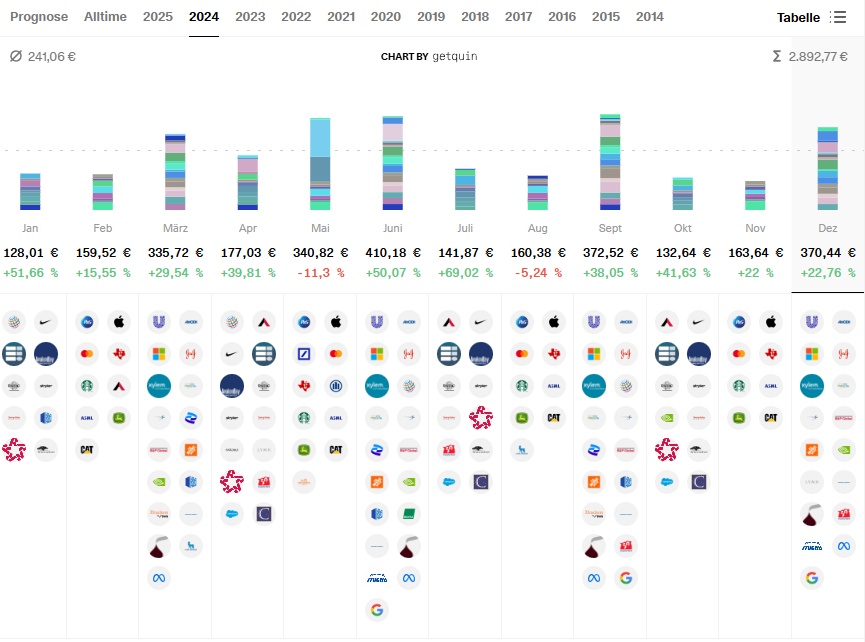

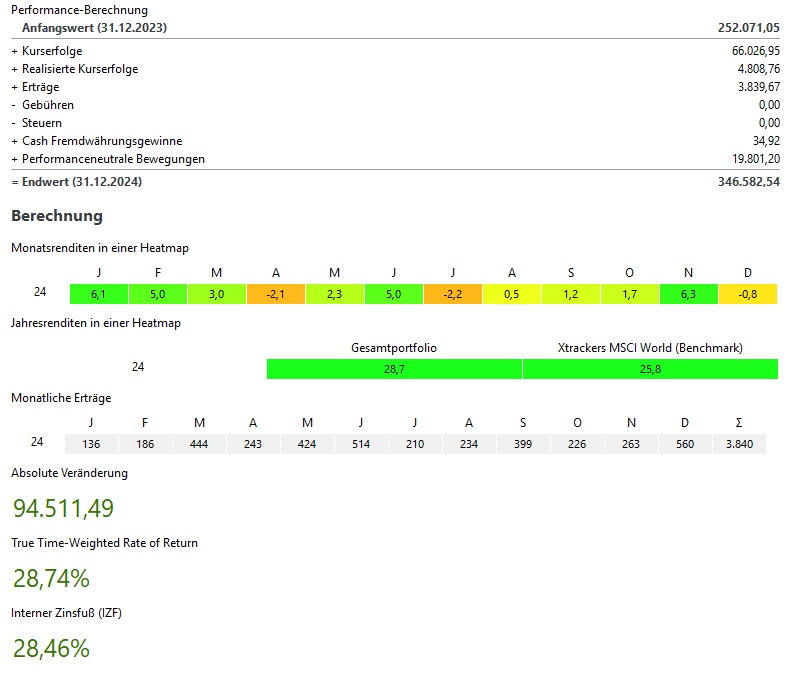

However, I only started investing for the long term in 2019. My first step was a savings plan with EUR 25 per month in a fund from Deka ($D6RM (-0,06 %) ) - the first dividend I received was a small sense of achievement for me. Later came savings plans for individual shares ($LHA (-0,14 %) and $SHA) and commodities ($965515 (+0,66 %)) were added. I also used my employer's capital-forming benefits (EUR 40 per month) to further expand my investment in the Deka fund.

My current investment strategy:

Over the last few years, I have tried out and learned a lot and finally developed my personal strategy:

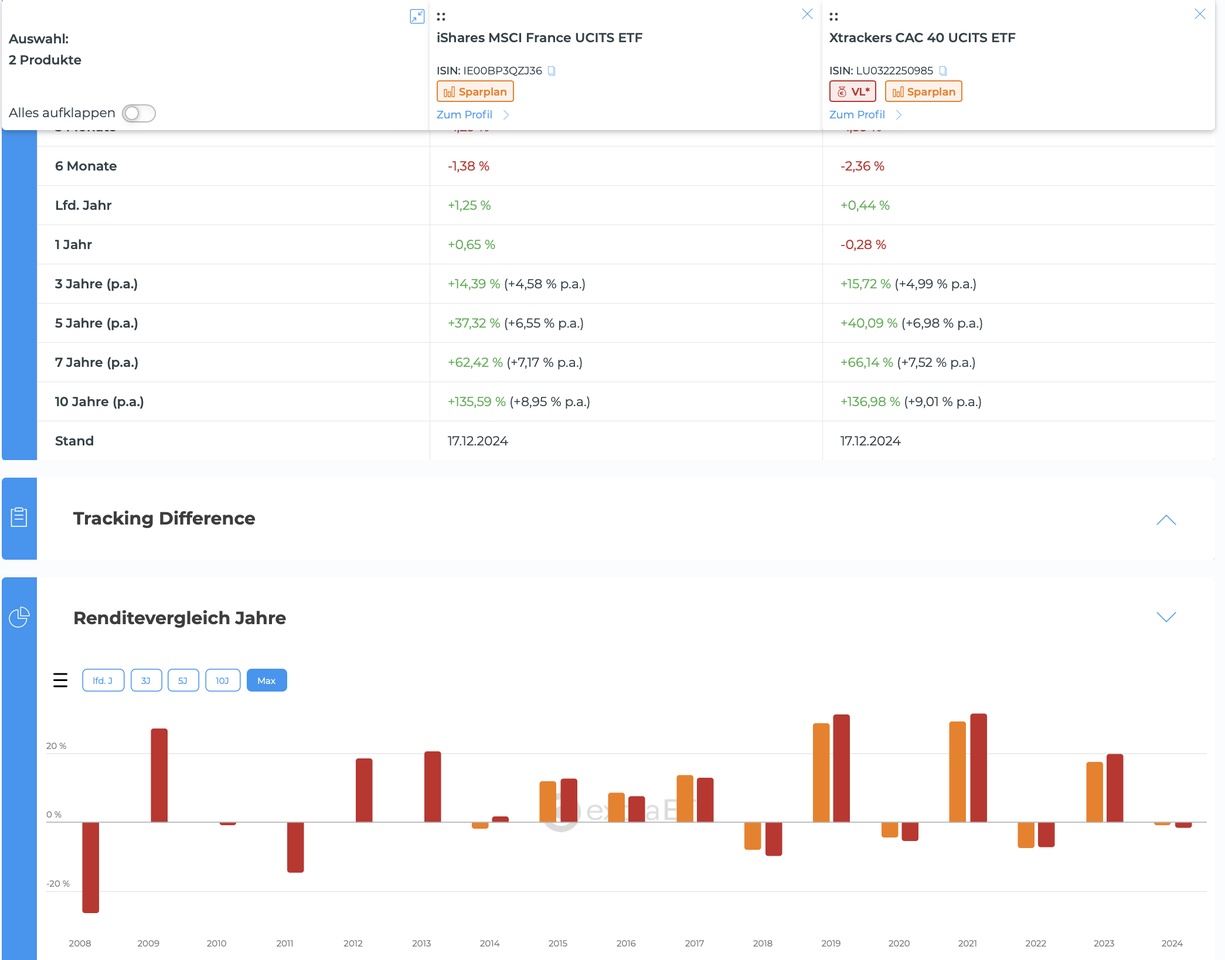

1. basic ETFs:

With the $VHYL (-0,73 %) and the $FUSD (-0,98 %) I would like to create a stable foundation.

2.

Individual shares:

Here I deliberately focus on non-US companies (with a few exceptions) in order to diversify my portfolio and reduce the US dominance somewhat.

My selection criteria for individual stocks:

- At least 30 % share price growth in the last 5 years.

- At least 10 years dividend history.

Dividend yield of either:

- approx. 1 %combined with an average dividend increase of 10 % over the last 5 or 10 years, or

- approx. 2,5 %combined with an average dividend increase of 5 % over the last 5 and 10 years respectively.

For example: $MS (-2,68 %) / $GGG (-0,91 %) / $CS (-1,46 %) / $ASML (-1,43 %) / $MUV2 (-1,75 %) / $CNQ (+1,52 %) / $MC (+0 %) / $TKA (+0,25 %) / $DHL (-0,29 %)

3. Gold:

My gold savings plan is still running because diversification is important - and a little sparkle in the portfolio never hurts.

4. Cryptocurrencies:

The proportion is deliberately low and I plan to concentrate only on $BTC (+0,06 %) in the future. Everything else will probably be dropped soon.

5. Cash:

Part of my capital is in a call money account so that I can react flexibly to opportunities or unexpected events - who knows when the next dip will come.

The aim of the asset class allocation:

- 37.50 % ETFs

- 37.50 % individual shares

- 10.00 % commodities

- 5.00 % cryptocurrencies

- 10.00 % Cash

In addition, a good deal is currently underway to buy real estate (purpose: rental) - I am still curious.

I hope my first post wasn't too long and that you've made it this far! 😉 I look forward to your feedback, opinions and tips - keep them coming!