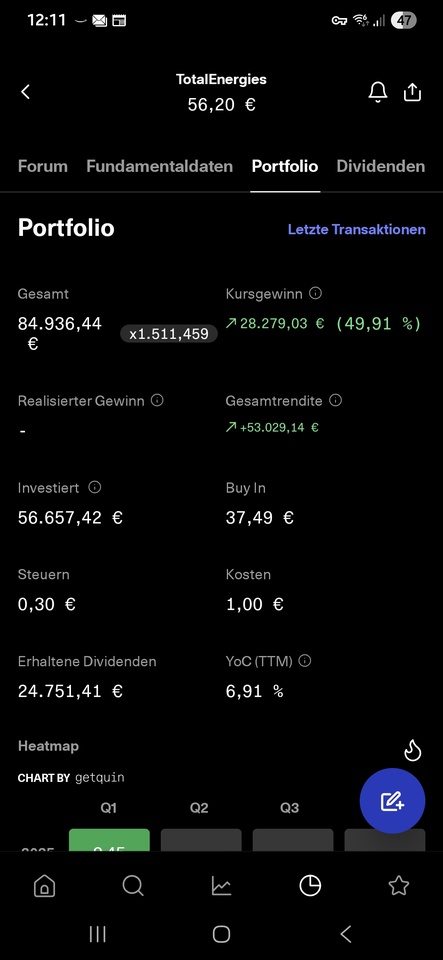

one of my best and biggest posts. Runs well

TotalEnergies

Price

Discussion sur TTE

Postes

55ChatGPT - Investment advisor

Hello everyone 🤘🏻👨🏻💻,

for fun I let ChatGPT play as my investment advisor and asked how he could invest 3.500 € in shares in shares. His answer:

📌 4x $CVX (-1,01 %)

📌 5x $TTE (-1,48 %)

📌 3x $ALV (-0,53 %)

📌 3x $JPM (-0,82 %)

📌 1x $ASML (-1,76 %)

📌 1x $AVGO (+1,3 %)

📌 10x $VHYL (-0,61 %)

Doesn't sound so wrong to me 👀.

How would you currently invest €3,500? 👆🏻🤓

Need help for dividend share

Hello everyone 🤘🏻👨🏻💻,

I have recently realized that my portfolio is not sufficiently focused on dividend stocks. I would therefore like to change this now and look forward to your recommendations! 📈💰

I currently have a few stocks on my watchlist that I'm taking a closer look at:

I'm also looking a little more closely at oil stocks at the moment, as "Drill, baby, drill" ~ Donald Trump is back in vogue.👆🏻

Which dividend stocks do you have in your portfolio or on your watchlist? I am curious! 🤘🏻🤓

YoY overview

2024:

This was my first year of investing in which I planned mostly to learn and think about what type of investor I would like to be. During my journey, quite quickly, I realized I would like to be a dividend growth investor - not saying it is best for all, but simply, what was most appealing to me.

- Total invested: 2400 EUR

- Current net value: 2779 EUR

- True gain (dividends + unrealized gain): +15,8%

I underperformed S&P500, but not sad about it. To be honest, about a 14% price gain is far more than I expected. I was aiming for a small price gain of around 4-7% and 2,5-4% YoC so can't really complain.

2025:

For this year, I would like to still be quite conservative about my expectations and keep them as in the year before - an unrealized gain of 4-7% and 2,5-4% YoC

Goals:

- Invest a total of: 6k to 8,4k EUR

- Individual stocks I plan to buy the most: $ASML (-1,76 %)

$TTE (-1,48 %)

$VICI (+0,06 %) - + if the price will be good $MAIN (-0,08 %)

$V (-0,25 %)

$PEP (-0,38 %)

$TXN (-5,03 %) - ETF I plan to buy: $SPY5 (-0,8 %)

- My priority will be making extra mortgage payments to decrease number of years needed to pay it off. I plan to do it on monthly basis. I aim to 10-18k EUR total in this year.

- Rebuild emergency fund of 2-3 months of expenses.

I plan to make posts each month about my progress so if you like to see how I'm doing, feel free to follow :)

Apollo Global Management

$APO (-0,2 %) will join the S&P500 index on December 23, 2024.

Anyone following the current news on Investor Relations has already expected this

https://ir.apollo.com/news-events/press-releases

There you will find a large number of exciting deals that you hardly ever hear about in the media

For example :

On Dec. 4, Apollo announced that funds managed by Apollo subsidiaries (the "Apollo Funds") have agreed to acquire a 50 percent stake in a Texas solar and battery energy storage system portfolio ("BESS") from TotalEnergies

$TTE (-1,48 %) to acquire. The portfolio comprises approximately 2 GW of solar and BESS facilities at strategic locations in the Texas ERCOT market, consisting of three solar projects with a total capacity of 1.7 GW and two battery storage projects with a total capacity of 300 MW. TotalEnergies will retain a 50% stake in the portfolio and will continue to operate the plants, which include Danish Fields, Cottonwood and Hill Solar I.

Apollo partner Brad Fierstein said: "We are excited to partner with TotalEnergies, a leading energy company at the forefront of the energy transition, and to invest in a highly contracted, scaled renewable energy portfolio. Apollo's Clean Transition strategy allows us to be a flexible and long-term capital partner, supporting the growth of the Integrated Power business and TotalEnergies' capital recycling strategy."

Over the past five years, Apollo-managed funds have invested approximately $40 billion in energy transition and sustainability investments, supporting clean energy and infrastructure companies and projects, including offshore and onshore wind, solar, storage, renewable fuels, electric vehicles and a wide range of technologies to support decarbonization. Across all asset classes, Apollo aims to invest $50 billion in clean energy and climate investments by 2027 and sees the opportunity to deploy more than $100 billion by 2030.

Apollo is a fast-growing global alternative asset manager.

As of September 30, 2024, Apollo had approximately $733 billion in assets under management.

After being a mostly silent reader for over a year now, watching with interest what strategies and views others are pursuing:

Today I would like to share my first milestone with you - and most likely (never say never) my last.

After the last few weeks have been rather sideways, today I'm green again and have made a significant jump.

🎉A portfolio value of €1,000,000🎉

Briefly in advance:

My start in the world of finance began with a securities account that I inherited at the age of 20 due to sad circumstances. I never really got to grips with investments and 2-3 years later, I had completely different worries and suffering and would have gladly swapped the portfolio for a loved one again.

Now a little about my "strategy"

I inherited a lot of "blue chip" stocks and gradually sold some of them and opted for other stocks.

In my opinion, the "price increase" team is clearly superior to the "dividend" team at Getquin. I have always tried to find a healthy mix, and I have to admit that dividend stocks help me to get more involved with investing.

In the ~7 years I have been active so far, I have also had to learn the hard way and gain experience. Here are a few brief insights for those who are interested:

$TTE (-1,48 %) and $AI (+2,32 %) were my first self-made purchases, whereby I gradually $AI (+2,32 %) I gradually increased my holdings and fortunately was able to take a stock split with me.

My first speculative share $NEL (+0,84 %) had a price gain of 300% in the meantime, but was sold at a loss after disappointing figures.

During a professional training program during Corona, I bought shares $GME (-2,61 %) I bought shares and took part in the rollercoaster ride in which I was able to realize a profit of €1,500 from a €6,000 investment and a lot of sweating and excitement.

I bought 0.05 $BTC (+0,34 %) and was able to successfully hold it for 2 years and go from 0 to 0 before the BTC price went through the roof. You have to manage that first.

After the scandal of $WDI (-33,51 %) I thought, well the figures may be falsified but the company will have a conscience value and I burned another €1,500 at a share price of €1.22.

In addition, I couldn't quite believe the sanctions against Russia and shortly before the announcement of the sanctions $GAZP I bought shares worth €1,600.

At the end of the millions, the purchase of $PLTR (-1,03 %) where I can currently record a 450% price gain.

( Thank you Jan Böhmermann, your video about this "evil" company was the best advertisement )

I am now happy with my portfolio. In the long term, I am still waiting $WCH (+1,01 %) for a reasonably positive exit.

Of $SAP (-0,32 %) as I also work with it at work and don't see any competition in the medium term as far as customized solutions are concerned.

I would also like to increase the position of $ENR (+1,06 %) and generally increase my weighting with the Worlds funds.

I have currently set up savings plans of around €900 (€700 Worlds, €150 S&P 500, €50 EM)

In addition, I have a securities account not tracked here where I have been participating in a share program for employees for 10 years with my annual bonus payment from my employer. I also regularly watch videos of "Finanzbär" on Youtube where I am occasionally tempted to make individual purchases (e.g. $HIMS (-0,39 %) and $SHOP (+0,72 %) )

I can highly recommend it!

Fortunately, I can expect 3 salary increases in the next 12 months due to collective agreements and a change of position in the company.

I would like to use this to top up my savings plans and am considering investing €100 a month in $BTC (+0,34 %) or $MSTR (-4,88 %)

and we'll see.

My next goal?

Continue in the same way but don't forget that you are alive NOW and treat yourself to something. And if things go well, enjoy life in a southern country in my early 40s and no longer have to work 😁

With this in mind :

Cheers 🥂 thanks to all of you

European Premarket Movers

Upside ⬆️

- Idorsia $IDIA (-6,2 %) +7.5-8.0% (exclusive negotiations for global rights to aprocitentan)

- Grieg Seaf $GSF (+0,53 %) +2.0% (Q3 results)

- Avia $AVVIY+2.0% (Keefe raised to outperform)

- iomart $IOM (-2,57 %) +2.0% (H1 results)

- Melexis [$MELE.BE] +1.5-2.0% (UBS raised to neutral)

- Frontline $FRO (-5,76 %) +1.5% (Q3 results)

- Henkel $HEN (+0,3 %) +1.5% (JPMorgan raised to overweight)

- Volvo $VOLV B (+0,22 %) +1.5% (JPMorgan raised to overweight)

- Equinor $EQNR (-2,23 %) +0.5-1.0% (Berenberg raised to buy)

- Nestle $NESN (-0,58 %) +0.5% (Morgan Stanley raised to equal weight)

- Volkswagen $VOW3 (+1,32 %) +0.5% (Agrees with SAIC to sell Xinjiang plant in China)

Downside ⬇️

- Pets at Home $PETS (+3,69 %) -8.5% (H1 results)

- Elekta $EKTA B (-0,22 %) -7.0% (Q2 results, misses estimates, affirms guidance)

- Nokian $TYRES (+0,97 %) -2.2% (JPMorgan cuts to underweight)

- easyJet $EZJ (-1,19 %) -1.0% (FY results and guidance)

- Reckitt Benckiser $RKT (+0,55 %) -0.5% (board update)

- Air France-KLM $AF (+0,63 %) -0.5% (in talks to acquire 20% of Air Europa)

- TotalEnergies $TTE (-1,48 %) -0.5% (Exane cuts to neutral)

- Norsk Hydro $NHY (+2,49 %) -0.5% (launches NOK6.5B improvement program)

Zusammenfassung Earnings heute morgen:

$STLAM (+0,49 %) | Stellantis Q3 2024 Earnings

Net Rev. €32.96B (est €35.94B)

Still Sees FY Adj. Oper Margin 5.5% To 7% (est 7.11%)

May Pursue Share Buyback Next Year: CFO

Backs FY Guidance

$$MAERSK A (-1,54 %)

| AP Moeller Maersk Q3 2024 Earnings

Rev $15.76B ($15.12B)

EBITDA $4.80B (est $3.96B)

Ocean Rev. $11.11B (est $10.57B)

Loaded Freight Rate ($/FFE) $3,236 (est $2,850)

Still Sees FY Underlying EBITDA $11B To $11.5B

$TTE (-1,48 %)

| TotalEnergies Q3 2024 Earnings

Adj EPS $1.74 (est $1.83)

Adj Net $4.07B (est $4.27B)

Adj. EBITDA $10.05B (est $10.42B)

Production 2.41M BOE/D (est 2.41M)

DACF $7.01B (est $7.5B)

$SHEL (-2,47 %)

| Shell Q3 2024 Earnings

Adj EPS $0.96 (est $0.85)

Adj Profit $6.03B (est $5.39B)

Net Debt $35.3B (est $37.9B)

Oil & Gas Output 2.80M BOE/D)

Cash Flow From OPS $14.68B (est $12.08B)

Announces A Share Buyback Program Of $3.5B

$CARL A (+0,43 %) | Carlsberg Q3 2024 Earnings

Rev. DKK20.48B (est DKK20.6B)

Organic Rev. +1.3% (est +2.57%)

Organic Volume Growth -0.2% (est +1.34%)

$STM (-2,81 %) | STMicroelectronics Q3 24 Earnings:

- Net Rev $3.35B (est $3.24B)

- Sees FY Net Rev $13.27B, Saw $13.2B To $13.7B

- Sees Q4 Net Rev $3.32B (est 3.38B)

- Sees Q4 FY24, Q1 FY25 Rev Decline Above Seasonality

$ING (-0,31 %) | ING Q3 24 Earnings:

- Net Income EU1.88B (est 1.69B)

- Net Interest Income EU3.69B (est EU3.83B)

- Loan-Loss Provision EU336M (est EU340.8M)

- Announces EU2.5B Shares Buy Back

$BNP (+0,74 %) | BNP Paribas Q3 24 Earnings:

- Net Income EU2.87B (est EU2.89B)

- Rev EU11.94B (est EU11.98B)

- Loan-Loss Provision EU729M (est EU835.6M)

- FICC Sales & Trading Rev EU1.20B (est EU1.06B)

$GLE (+0,62 %) | Societe Generale Q3 24 Earnings:

- Oper Expenses EU4.33B (est EU4.41B)

- Net Banking Income EU6.84B (est EU6.6B)

- Net Income EU1.37B (est EU1.27B)

- Equities Rev EU880M (est EU857.4M)

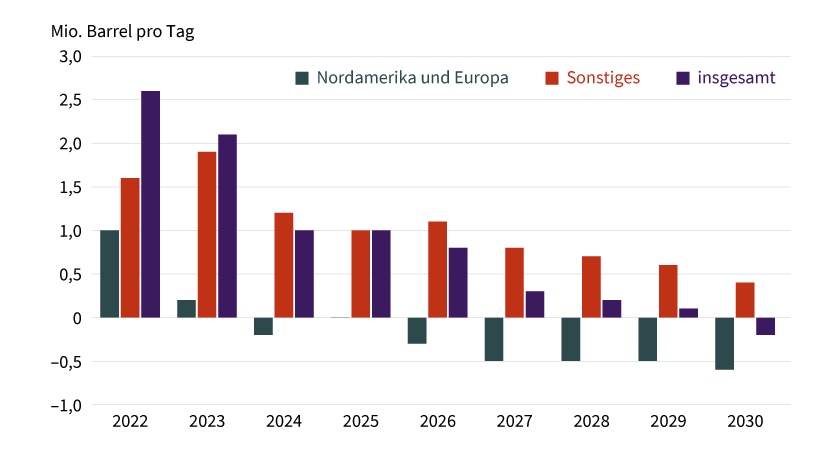

Detailed oil price analysis 🛢️⛽️

Oil demand

China, Europe & USA

Slowing momentum

Peak in fuel demand

Rising production capacities

Impending oversupply

OPEC+

#FinX

#Aktien

#Öl

#Benzin

$SHEL (-2,47 %)

$GB00B03MM408

$RDS.A

$BP. (-0,4 %)

$XOM (-2,04 %)

$CVX (-1,01 %)

$SLB (+0,06 %)

$OXY (-2,75 %)

$APA (-1,61 %)

$TTE (-1,48 %)

$ENI (-1,41 %)

$GAZP

And what influence hydrogen has on the demand for oil.

02.10.2024

Middle East escalation drives oil and armaments, airlines weak + Boeing considers billion-euro capital increase

Oil stocks benefited from the news of a possible conflagration in the oil-rich Middle East, as this is associated with the risk of a shortage of the raw material. Chevron $CVX (-1,01 %) , Exxonmobil $XOM (-2,04 %) and ConocoPhillips $COP (-2,25 %) gained up to 2.4 percent in New York. In Europe Totalenergies $TTE (-1,48 %) and Eni $ENI (-1,41 %) rose by up to 1.4 percent. In times of war, it is also not unusual for arms manufacturers to see share price gains. In the USA, for example Lockheed Martin $LMT (-0,65 %) and RTX $RTX (-1,53 %) recorded gains of around 2.7 percent in some cases, while in Europe Rheinmetall $RHM (-1,68 %) was particularly popular in Europe, with a rise of more than 5 percent. BAE Systems $BA. (-2,19 %) were 3 percent higher.

The situation was different for shares in tourism groups and airlines. For the latter, the risks of higher kerosene prices are increasing. Some travel destinations may also be canceled for the time being and the risk of terrorist attacks is increasing. Investors in Tui $TUI1 (+0,88 %) saw their share price fall by 2.5 percent. For the share price of Lufthansa $LHA (+1,81 %) fell by more than 2 percent. IAG $IAG (-1,5 %) lost 3.9 percent. Shares in US airlines such as American, Delta and United Airlines fell by up to 2.4 percent.

The US aircraft manufacturer Boeing $BA (-1,46 %) is considering a capital increase in the double-digit billion range in its ongoing crisis, according to insiders. The company is considering issuing new shares worth at least 10 billion US dollars (just under 9 billion euros), the Bloomberg news agency reported on Tuesday, citing people familiar with the matter. The fresh money from shareholders is intended to fill the manufacturer's coffers, which are becoming ever emptier as a result of years of ongoing crisis with flight bans and production restrictions as well as the recent strike by tens of thousands of employees. A Boeing spokesperson declined to comment. According to insiders, it is likely to be at least a month before Boeing gets serious about such a capital increase

Economic data, quarterly figures

Stock market holiday in China

ex-dividend of individual stocks

Cisco Systems USD 0.40

Quarterly figures / company dates Europe

07:00 Grenke new business 3Q

09:00 Gea Group Capital Markets Day

No time specified: Totalenergies Investor Day - 2024 Strategy & Outlook

Economic data

- 11:00 EU: Labor market data August Eurozone Unemployment rate Forecast: 6.4% Previous: 6.4%

- 14:15 US: ADP Labor Market Report September Private Sector Employment PROGNOSE: +128,000 jobs previous: +99,000 jobs

Titres populaires

Meilleurs créateurs cette semaine