Ozempic's quarterly sales have risen by 579 % in the last five years.

Annual sales of the drug are now approaching 20 billion dollars.

Postes

172⬆️⬆️⬆️

- EXANE BNP raises the price target for ALLIANZ SE from EUR 271 to EUR 295. Underperform. $ALV (-1,16 %)

- BARCLAYS raises the target price for AIRBUS from EUR 166 to EUR 200. Overweight. $AIR (+0,6 %)

- UBS raises its price target for SAP from EUR 237 to EUR 283. Buy. $SAP (-0,12 %)

- BERENBERG raises the price target for LVMH from EUR 695 to EUR 720. Buy. $MC (+0 %)

- EXANE BNP raises the target price for MUNICH RE from EUR 550 to EUR 560. Outperform. $MUV2 (-1,75 %)

- RBC raises the target price for SIEMENS from EUR 205 to EUR 225. Outperform. $SIE (-0,65 %)

- CITIGROUP raises the price target for STELLANTIS from EUR 12.40 to EUR 13. Neutral. $STLA

- KEPLER CHEUVREUX raises the target price for DOUGLAS from 28.60 EUR to 29.90 EUR. Buy. $DOU (+1,69 %)

- CITIGROUP raises the target price for DWS from EUR 43 to EUR 44.70. Buy. $DWS (+0,39 %)

- CITIGROUP raises the price target for FRAPORT from EUR 62 to EUR 72. Buy. $FRA (-0,92 %)

- UBS upgrades AMADEUS IT from Neutral to Buy and raises target price from EUR 67 to EUR 80. $AMS (+0,03 %)

- DEUTSCHE BANK RESEARCH raises target price for PHILIPS from EUR 25 to EUR 26. Hold. $PHIA (+1,59 %)

- DEUTSCHE BANK RESEARCH raises the target price for MAN GROUP from GBP 2.65 to GBP 2.75. Buy.

- GOLDMAN raises the target price for RIO TINTO from GBP 67 to GBP 73. Buy. $RIO (+0,21 %)

- JEFFERIES raises the price target for SIEMENS ENERGY from EUR 31 to EUR 50. Hold. $ENR (-4,05 %)

- RBC raises the target price for SCHNEIDER ELECTRIC from EUR 195 to EUR 210. $SU (-2,98 %) Underperform.

- EXANE BNP upgrades HANNOVER RÜCK from Neutral to Outperform and raises target price from EUR 265 to EUR 285. $HNR1 (-1,37 %)

⬇️⬇️⬇️

- DEUTSCHE BANK RESEARCH lowers the price target for NOVO NORDISK from DKK 1000 to DKK 900. Buy. $NOVO B (-0,45 %)

- BOFA lowers the target price for RWE from EUR 44 to EUR 42. Buy. $RWE (-1,64 %)

- JPMORGAN lowers the price target for NETFLIX from USD 1010 to USD 1000. Overweight. $NFLX (-3,21 %)

- MORGAN STANLEY lowers the price target for SYMRISE from EUR 137 to EUR 130. Overweight. $SY1 (-0,05 %)

- KEPLER CHEUVREUX lowers the target price for REDCARE PHARMACY from EUR 145 to EUR 138. Hold. $RDC (-1,23 %)

- WARBURG RESEARCH lowers the target price for BECHTLE from EUR 51 to EUR 45. Buy. $BC8 (+0,66 %)

- STIFEL downgrades WACKER CHEMIE from Buy to Hold. $WCH (-4,75 %)

- RBC lowers the price target for DAIMLER TRUCK from EUR 55 to EUR 51. Outperform. $DTG (-2,33 %)

500 coins for everyone for 3 more days + US government may sell 69,370 Bitcoin worth billions + TSMC beats estimates thanks to NVIDIA + Novo Nordisk expands AI partnership with Valo

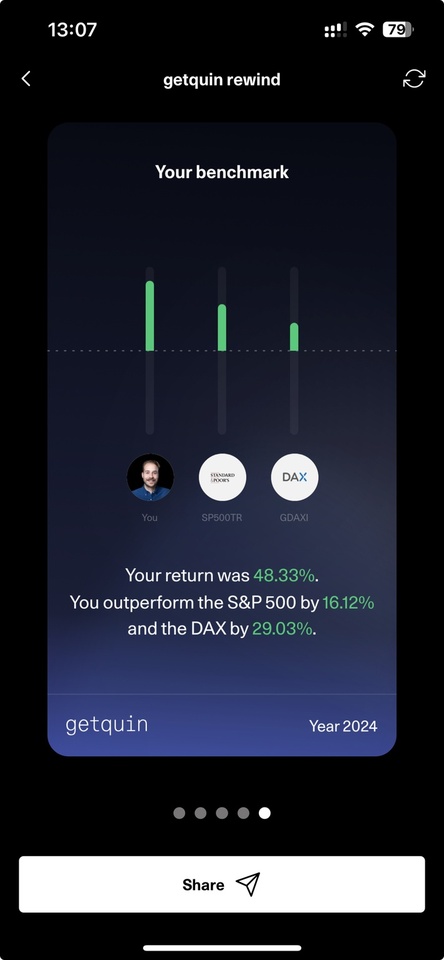

500 coins for everyone who shares their Rewind on Instagram and tags us

US government may sell 69,370 Bitcoin $BTC (-0,55 %)worth billions - price plummets

TSMC $2330beats estimates thanks to NVIDIA

Novo Nordisk $NOVO B (-0,45 %)expands AI partnership with Valo

Friday: Stock market dates, economic data, quarterly figures

Economic data

08:00 DE: Turnover in the service sector October FORECAST: n.a. previous: +0.3% yoy

08:45 FR: Industrial production November PROGNOSE: -0.1% yoy previous: -0.1% yoy | Private consumption November PROGNOSE: +0.1% yoy/-0.2% yoy previous: -0.4% yoy/+0.4% yoy

14:30 US: Labor market data December employment ex agriculture PROGNOSE: +155,000 yoy previous: +227,000 yoy Unemployment rate PROGNOSE: 4.2% previous: 4.2% average hourly earnings PROGNOSE: +0.3% yoy/+4.0% yoy previous: +0.4% yoy/+4.0% yoy

In the past, my investment strategy focused exclusively on individual shares. For the future, however, I have developed a more diversified strategy that includes both regular ETF investments and targeted individual share purchases.

My investment strategy 2025:

- 350 € in the FTSE ALL-WORLD $VWRL (-0,87 %)

- 25 € in the FTSE INDIA $FLXI (-1,18 %)

- 25 € Microsoft $MSFT (-0,88 %)

- 25 € Novo Nordisk $NOVO B (-0,45 %)

- 25 € Waste Management $WM (-0,02 %)

- 25 € McDonald's $MCD (-1,26 %)

- 25 € ASML Holding - $ASML (-1,43 %)

In addition, I build up my monthly cash reserve of € 1,500/month to ensure financial flexibility.

Probably I'll buy 1 or 2 more at the end of the month, it depends of how much money I deploy into shares (add to $ASML (-1,43 %) ), or buy new ones ($NOVO B (-0,45 %) , $CTAS (-1,59 %) )or to $BTC (-0,55 %) (i will accumulate more once the price falls below 89k as there is a monthly fvg+

As announced in my post, I am giving away all the coins that I have collected or won with this post. In addition to the 20,000 coins, there are 1,221 coins that I held as at 31.12.2024.💸💸💸💸

Every user who has donated to a recognized charitable organization in December 2024 is eligible to participate.

To participate in the raffle, all you need to do is comment on this post with the link of the organization you donated to. ⚡Please only those

who can also prove the donation in the event of winning (by means of a post / screenshot of the donation receipt - the donation amount can be concealed).

In one week I will determine the winner from all the comments.

Legal recourse is excluded. The raffle is a private action of mine

and is not connected with getquin.

@christian Thanks for the#feiertagschallenge 🙏

$BTC (-0,55 %)

$NVDA (-2,07 %)

$MSTR (+1,4 %)

$MSFT (-0,88 %)

$META (+2,21 %)

$NU (+0,66 %)

$NOVO B (-0,45 %)

$GOOG (-0,71 %)

$TSLA (+0,88 %)

$VWCE (-0,9 %)

$VUSA (-0,86 %)

$CSPX (-0,88 %)

#feiertagschallenge

#moneymanagement 💸💸💸

"The whole secret of stock market success is to lose as little as possible when you're wrong."

A good idea from @christian which I like to use as an opportunity to combine knowledge contributions with a good cause.

All GQ Coins from this post, including all GQ Coins that I hold as of 31.12.2024, will be transferred to a randomly selected community member who has donated to a recognized charity in December 2024.

Legal recourse is excluded. The random principle applies - one of the donors wins! There will be a post from me after the end of the challenge, where everyone who has donated something can comment on it. One of these users / comments will then be selected at random. As soon as the donation is documented by a screenshot, I will transfer all my GQ Coins to the randomly selected donor.

Those of you who donate regularly anyway can be rewarded in this way, as well as those who may be motivated to donate.

But now to the contentAfter the rally of the last few weeks, I would like to take another look at a topic that I wrote a post about 2 years ago. It's about risk management, in particular one part of it, the money management.

What will you read below?

1. what are risks?

2. what is money management?

3. money management using an example

4. money management and you

5. conclusion

In my more than 25 years on the stock market, money management was and is the "key to success" for me in order to sustainably limit losses in the event of wrong decisions.

Investing in the stock market involves risks. But don't worry, we have control over some of them. Money management is your best friend. It helps you to limit losses and protect your profits.

Imagine you're building a house. You plan carefully, set a budget and insure it against damage. It's similar on the stock market. Money management is your blueprint that ensures that your "house" - your portfolio - remains stable, even when it storms.

In a figurative sense, money management can be thought of as an insurance deductible. With this deductible, your risk is limited and calculable.

1 What are risks?

There are essentially two types of risk:

Risks that we cannot influencesuch as the general market environment, political events such as the war in Ukraine, or the interest rate policy of national banks such as the FED or ECB.

Risks that we can influence such as "no" diversification, "no" knowledge or simply "no" risk management.

Money management is also an area that we can influence. Alongside diversification, it is the most important risk management for me.

2 What is money management?

Money management determines the capital investment and the position size on the basis of the maximum loss to be accepted. It is about determining the optimum position size.

Why is money management important?

The 3 most important tools:

3. money management using an example

How much should I risk?

A common rule is: Never risk more than 0.5% to a maximum of 2% of your total capital per investment position.

Example: Your total capital is €10,000 and you want to buy shares. According to the rules of money management, you want to risk a maximum of 1% of your total capital per position. The position size of this share is now derived from your stop loss, which limits the position to a loss of €100.

Calculation of the optimum position size using the example of €10,000 capital:

Why is this so important?

Everyone catches bad stocks or gets in at the wrong time. Imagine your assumptions are 10 times wrong. With good money management, you can still secure 90% of your capital. If, on the other hand, you lose 50% of your capital by taking too large a position, you would have to achieve 100% performance with the remaining capital just to get back to "0".

4. money management and you

Money management is not a magic potionbut a valuable tool. It requires discipline and consistency. But it's worth the effort. Well thought-out money management can help you achieve your financial goals.

There are of course differences between short/medium-term traders and long-term investors. For traders, money management and risk management in the form of stop prices is essential. For long-term investors, diversification is the means of choice; money management is more or less already done when the savings plans or the investment amount are determined.

But I also recommend that the buy-and-hold investors among you think about money management. In reality, it is not so easy to distinguish between the two, the transitions are blurred. What short-term traders need to keep an eye on at all times, long-term investors should also do from time to time. Check your position sizes and think about exit pricesi.e. adjust any stops. "Easy come, easy go" would be a shame, especially after recent bull runs.

5. conclusion

There are many imponderables on the stock market. But there is one thing you can control: your risk. With money management, you can consciously manage this risk and thus increase your chances of long-term success.

I would like to conclude my post with the well-known rules of Warren Buffet:

Rule number 1: Don't lose money

Rule number 2: Never forget rule number 1

A long post, but hopefully not TL:TR for you! Enjoy the festive season and take time for your loved ones! But I don't mean your shares or coins! 🎄🎁🎇

What is your opinion on $NOVO B (-0,45 %) ?

Will the share price fall further or is now a good time to get in?

My development in this area has been very mixed. After I sold in December $WBA (+27,46 %) after a risky purchase - to lower the buy in - with +/- 0, my investment in $AFX (+3,79 %) was abruptly terminated, leaving me with a hefty loss, and shortly afterwards I unfortunately also lost my shares in $UNH (+2,56 %) but still with a profit of 8%. Today I decided to recoup my losses and sold my $BMY (-0,49 %) sold. It was a nice trade, plus the €245 dividend plus the payment on February 3rd. The uncertainty in the sector has become too great for me and I want to watch from the sidelines what the new US government will do. Marty Makary as the planned head of the FDA will certainly not strike as brutally as some fear, but there could be changes and difficulties in the area of approval procedures. This would also affect Bristol, which should and must bring a few good products from its pipeline onto the market in the next few years. The acquisition of Karuma together with the approval of KarXT has provided a brief boost, but is not enough to compensate for the expiry of patent protection for Revlimid, Opdivo and especially Eliquis in the next few years. They account for over USD 12 billion of sales and patent protection expires in the EU in 2026 and in the US in 2028. This does not mean that Eliquis will no longer be sold, but a not insignificant proportion is likely to be lost to generics. In addition, CMS has already negotiated price reductions of 56% for 2026. Coupled with the political uncertainties, I have taken the money with me for the time being and will wait and see. I still have to deal with $NOVO B (-0,45 %) ...., which is currently the biggest loss-maker in my portfolio with a drop of almost 17%.

Please let me know your assessment of the market in this sector.

⬆️⬆️⬆️

- BERENBERG raises the price target for SIEMENS from EUR 215 to EUR 245. Buy. $SIE (-0,65 %)

- BERNSTEIN raises the price target for SIEMENS ENERGY from EUR 15 to EUR 22. Underperform. $ENR (-4,05 %)

- JPMORGAN PUTS SARTORIUS ON 'POSITIVE CATALYST WATCH' - 'OVERWEIGHT' $SRT (-0,21 %)

- GOLDMAN raises the price target for FRAPORT from EUR 87 to EUR 90. Buy. $FRA (-0,92 %)

- UBS raises the price target for NORDEA from EUR 145 to EUR 146. Buy. $NDA FI (-0,27 %)

- BERNSTEIN raises the target price for SCHNEIDER ELECTRIC from EUR 275 to EUR 280. Outperform. $SU (-2,98 %)

- UBS raises the target price for WPP from GBP 6.80 to GBP 7.20. Sell. $WPP (-1,15 %)

- BERNSTEIN raises the price target for ALSTOM from EUR 17 to EUR 24. Market-Perform. $ALO (-2,52 %)

- STIFEL upgrades HERMES from Hold to Buy and raises target price from EUR 2150 to EUR 2560. $RMS (-0,67 %)

- INFINEON +4.2% - 'TOP PICK' OF THE UBS $IFX (+0,04 %)

⬇️⬇️⬇️

- RBC downgrades UNILEVER from Sector-Perform to Underperform and lowers target price from GBP 48 to GBP 40. $ULVR (-1,57 %)

- BERNSTEIN downgrades ABB from Market-Perform to Underperform and lowers price target from CHF 46 to CHF 45. $ABBN (-1,41 %)

- BERNSTEIN downgrades SIGNIFY from Outperform to Market-Perform and lowers price target from EUR 30 to EUR 24. $LIGHT (-2,58 %)

- DEUTSCHE BANK RESEARCH lowers the price target for UMICORE from EUR 10.50 to EUR 10. Hold. $UMICY

- DEUTSCHE BANK RESEARCH lowers the price target for DOCMORRIS from CHF 45 to CHF 25. Hold. $DOCM (+0,1 %)

- BERENBERG lowers the price target for HORNBACH HOLDING from EUR 100 to EUR 94. Buy. $HBH (-0,48 %)

- CITIGROUP downgrades ROLLS-ROYCE from Buy to Neutral. $RR. (+0,79 %)

- JEFFERIES lowers the target price for BHP GROUP from GBP 22.50 to GBP 21.50. Hold. $BHP (-0,82 %)

- JEFFERIES lowers the price target for GLENCORE from GBP 5.50 to GBP 4.50. Buy. $GLEN (-1,08 %)

- JEFFERIES lowers the target price for RIO TINTO from GBP 64 to GBP 60. Buy. $RIO (+0,21 %)

- BERENBERG lowers the target price for NOVO NORDISK from DKK 975 to DKK 725. Hold. $NOVO B (-0,45 %)

Meilleurs créateurs cette semaine