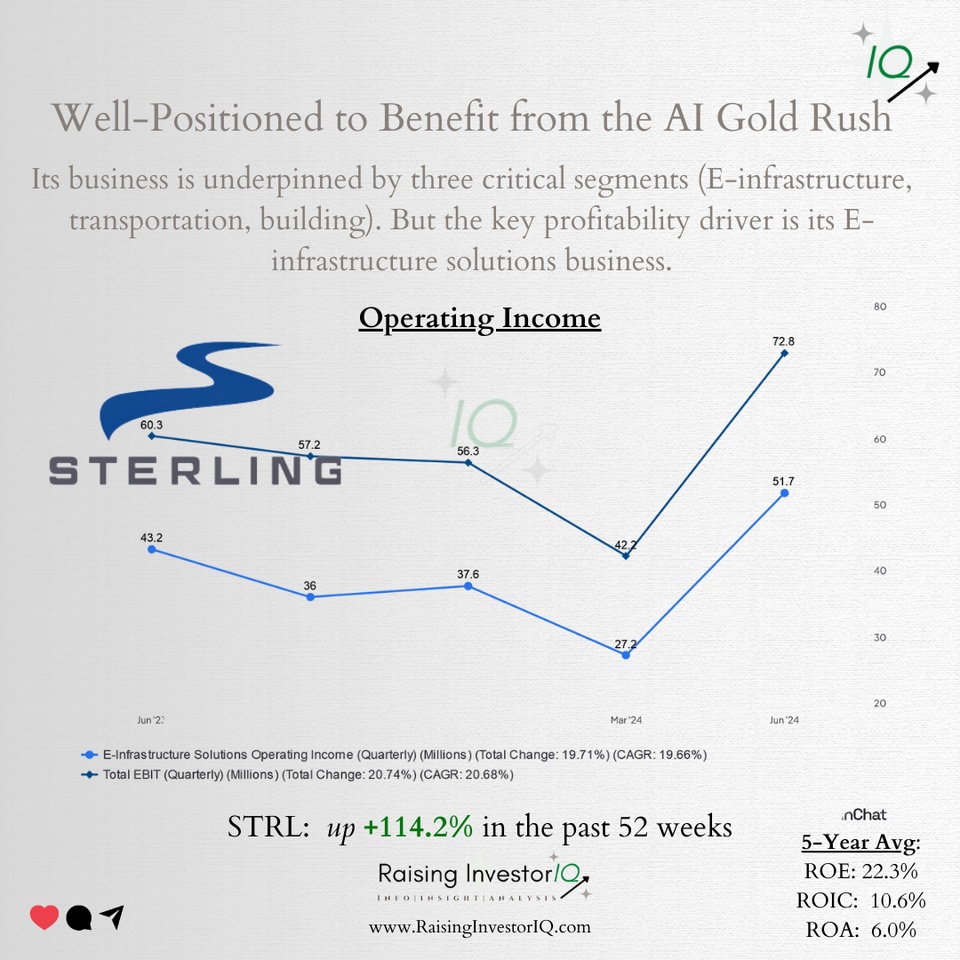

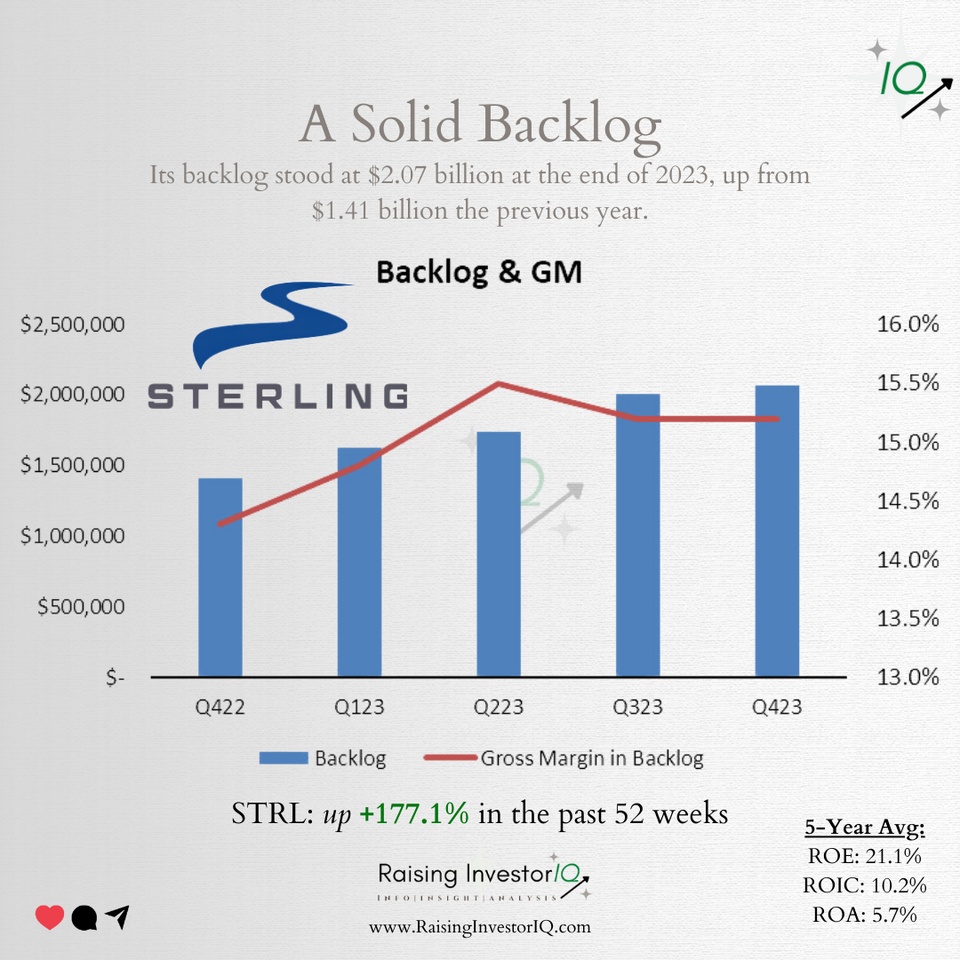

$STRL (-1.48%) provides large-scale site development services for data centers, advanced manufacturing, and e-commerce distribution centers.

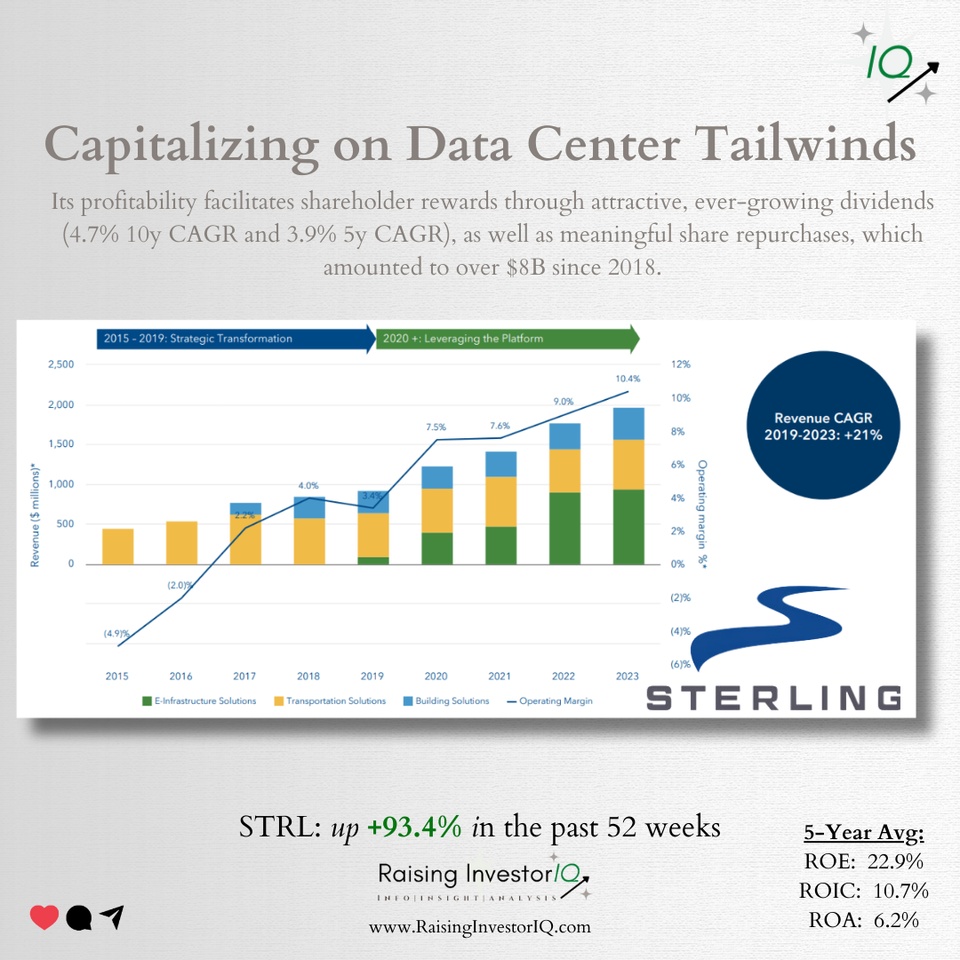

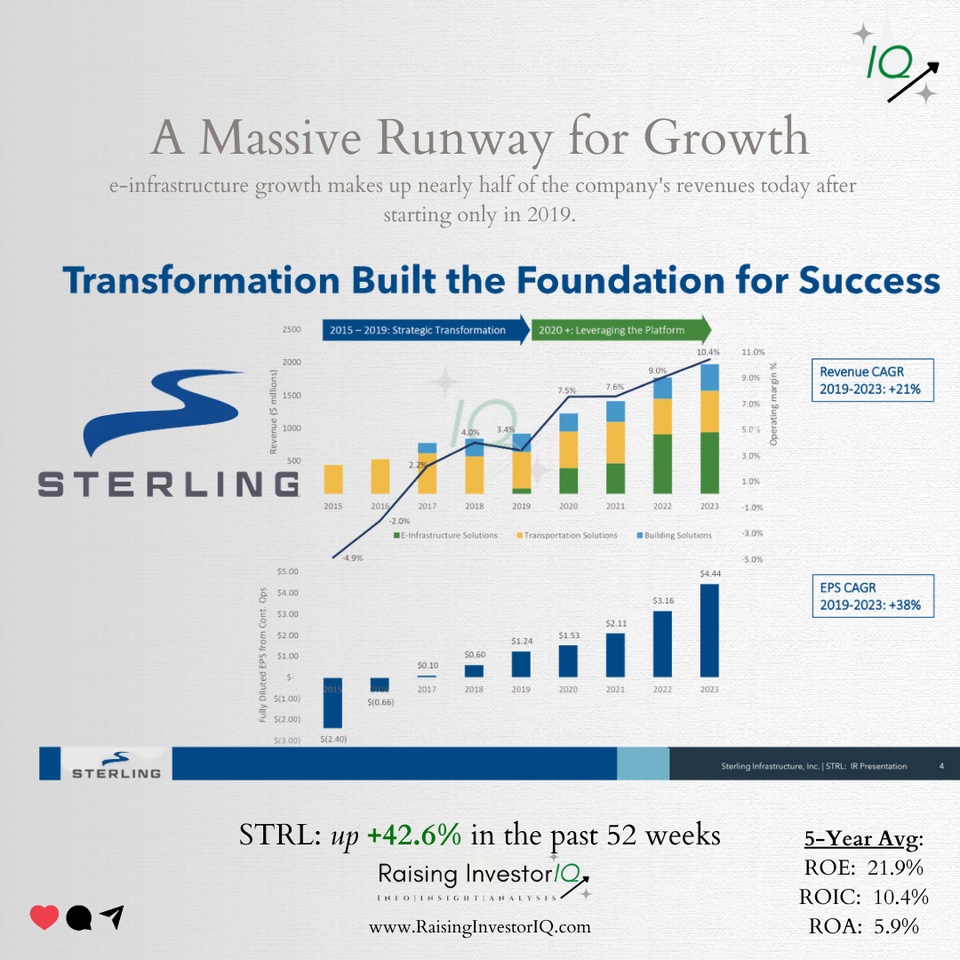

Its E-Infrastructure Solutions segment originated only five years ago, but it is already the company's largest revenue stream with a 45% share.

Additionally, STRL's operating margin started improving notably after the segment's origination.

Is this company on anyone's watchlist?🤔