$OKTA (-0.43%) New products and partners-led GTM strategy should continue to drive growth.

Discussion about OKTA

Posts

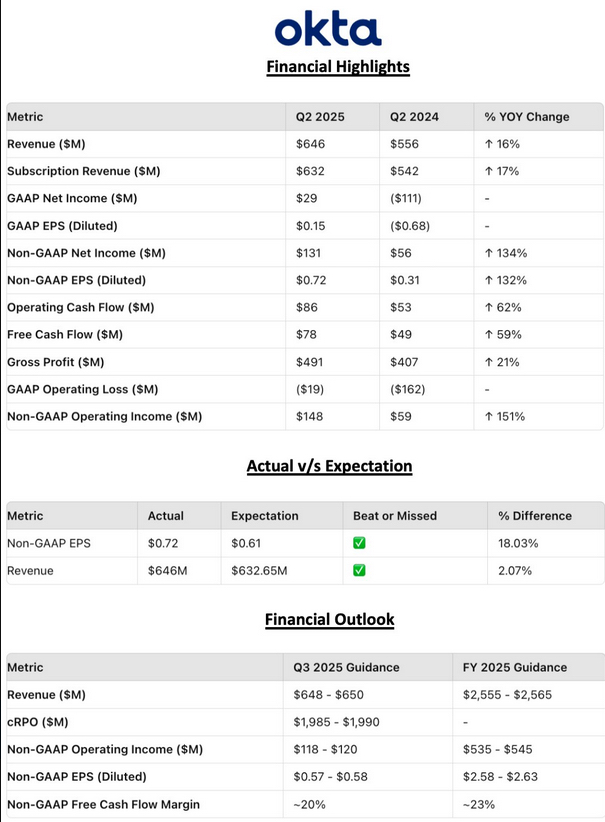

27$OKTA (-0.43%) achieved GAAP profitability for the first time in the latest quarter.

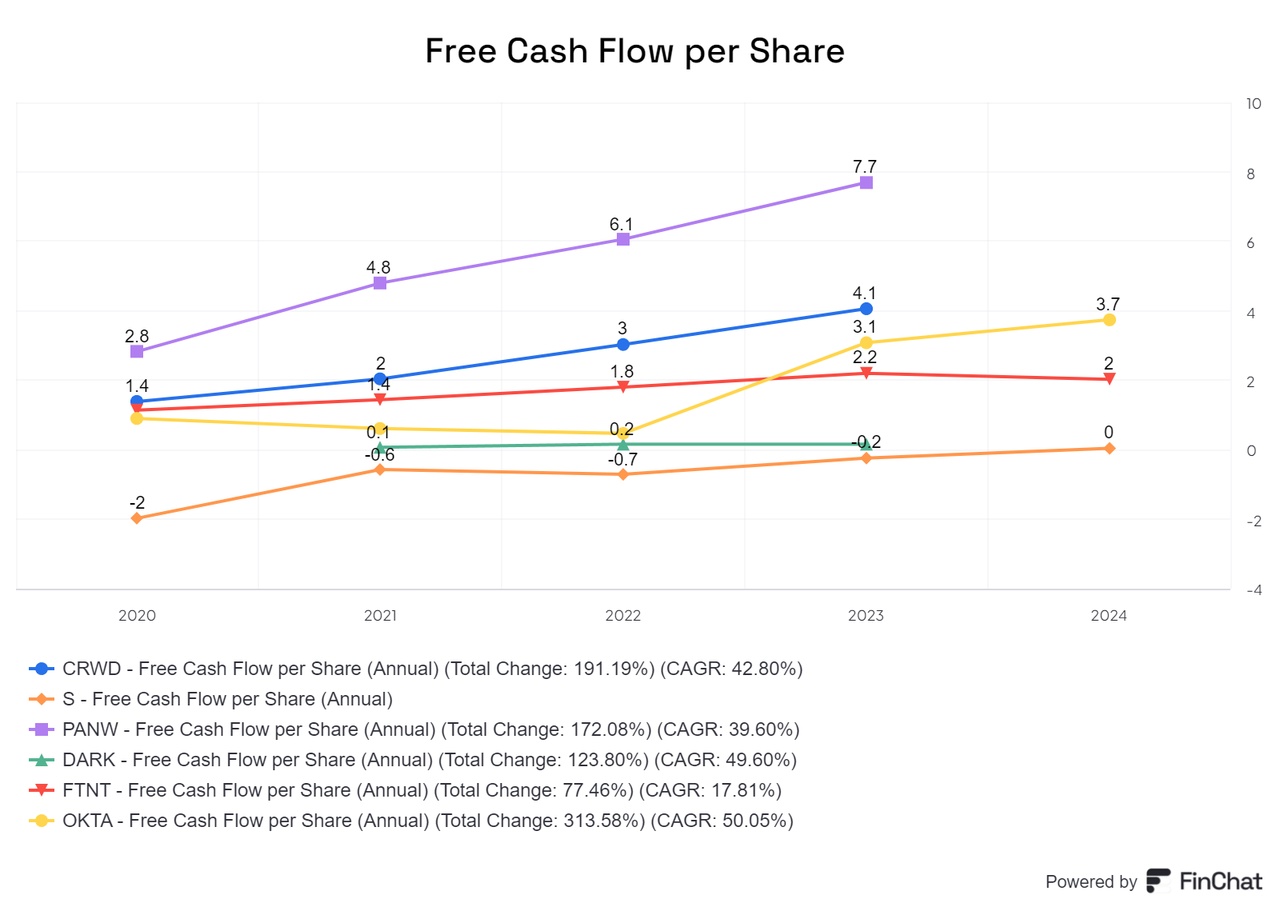

Looking at Okta's financials, it has a strong balance sheet and generates solid free cash flow.

With approximately $700 million in free cash flow expected for FY25 and potentially around 29% free cash flow margin for fiscal 2026, Okta demonstrates robust financial health.

At about 19x forward free cash flow, Okta presents a potentially appealing valuation for a company with appealing prospects. Thoughts?🤔

$OKTA (-0.43%) Q3 Earnings Highlights:

🔹 Non-GAAP EPS: $0.67 (Est. $0.58) 🟢

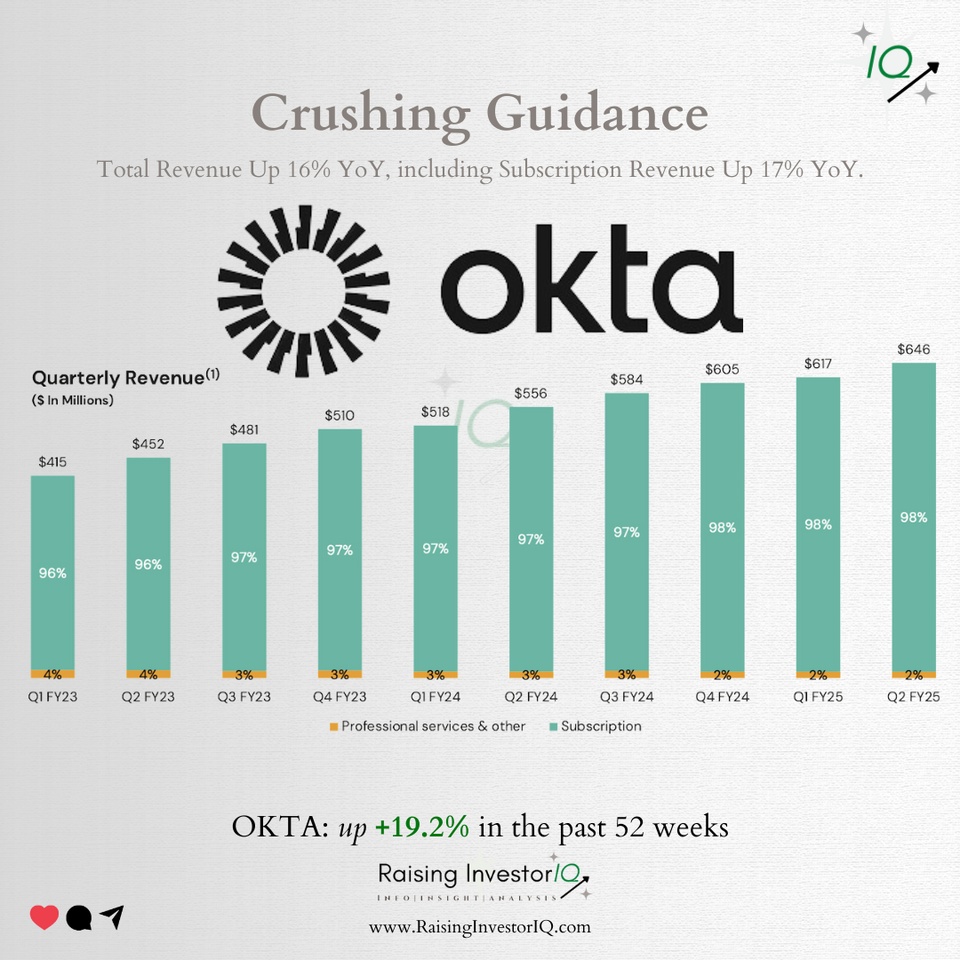

🔹 Revenue: $665M (Est. $649.7M) 🟢; UP +14% YoY

🔹 Subscription Revenue: $651M (Est. $634.7M) 🟢; UP +14% YoY

Q4 Guidance:

🔹 Revenue: $667M-$669M (Est. $651.3M) 🟢

🔹 Current RPO: $2.13B-$2.135B (Est. $2.12B) 🟡

🔹 Non-GAAP Operating Income: $154M-$156M; Operating Margin: 23%

🔹 Non-GAAP EPS: $0.73-$0.74 (Est. $0.67) 🟢

🔹 Non-GAAP Free Cash Flow Margin: ~32%

FY25 Guidance:

🔹 Revenue: $2.595B-$2.597B (Est. $2.56B-$2.57B) 🟡; Growth of +15% YoY

🔹 Non-GAAP Operating Income: $573M-$575M; Operating Margin: 22%

🔹 Non-GAAP EPS: $2.75-$2.76 (Est. $2.58-$2.63) 🟡

🔹 Non-GAAP Free Cash Flow Margin: ~25%

Key Q3 Metrics:

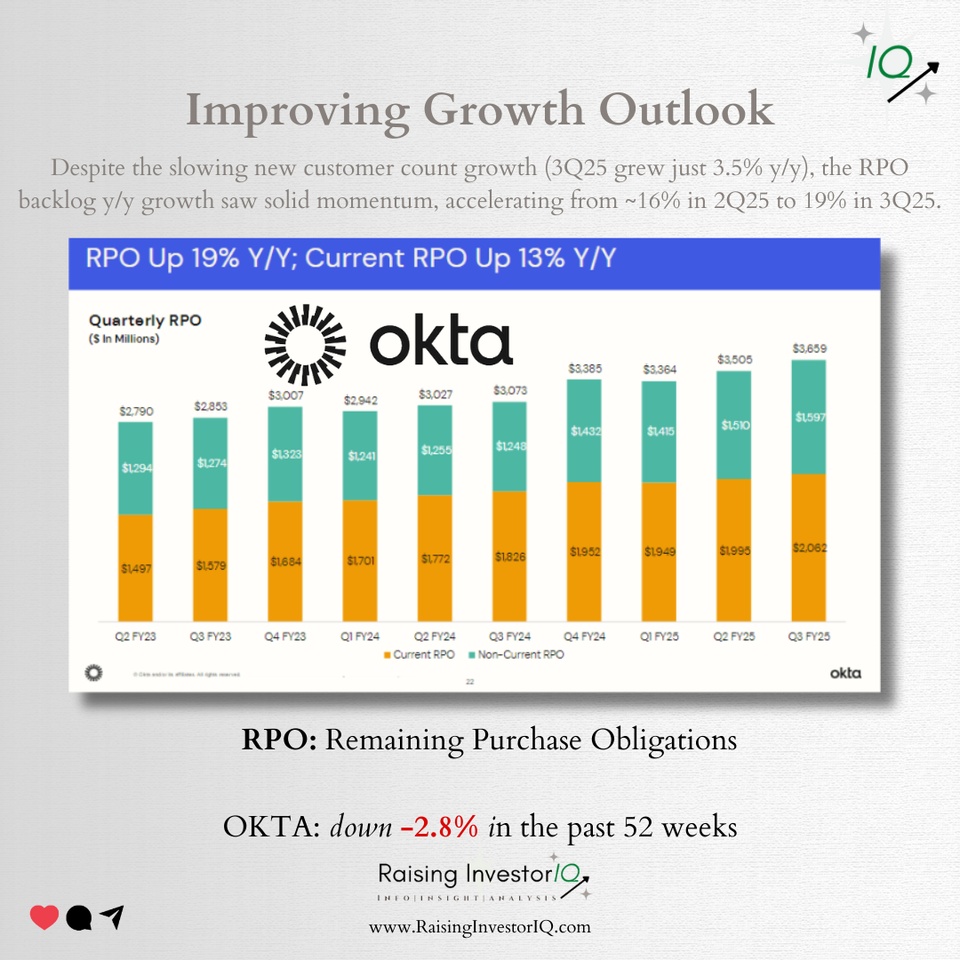

🔹 RPO: $3.659B (Est. $3.50B) 🟢; UP +19% YoY

🔹 Current RPO: $2.062B (Est. $1.99B) 🟢; UP +13% YoY

🔹 GAAP Operating Loss: $16M (-2% of revenue); Improved from -$111M (-19% of revenue) YoY

🔹 Non-GAAP Operating Income: $138M (Est. ~$121M) 🟢; 21% of revenue; UP +62% YoY

🔹 Operating Cash Flow: $159M (Est. $135.7M) 🟢; 24% of revenue

🔹 Free Cash Flow: $154M (23% of revenue); UP from $150M YoY

Operational Metrics:

🔹 Deferred Revenue: $1.44B (Est. $1.44B) 🟡

🔹 Billings: $677.5M (Est. $677.5M) 🟡

Key Highlights:

🔸 GAAP net income: $16M, compared to a net loss of -$81M YoY

🔸 Strong improvement in non-GAAP operating margins, reaching 21% from 15% YoY

🔸 Cash, cash equivalents, and short-term investments totaled $2.248B as of October 31, 2024

CEO Todd McKinnon’s Commentary:

🔸 "Our solid Q3 results were underpinned by continued strong profitability and cash flow. Investments in our partner ecosystem, public sector vertical, and large customers are yielding results, driving meaningful top-line growth. Our innovation in identity security continues to resonate with customers seeking to modernize their identity infrastructure."

As already announced in one of my last posts, here is the follow-up purchase of $11B (-1.62%)

We have now reached a relatively good bottom. Should we fall again towards €55, I would consider buying more. In addition to my own analysis (see my profile), the decisive factor for the purchase at this point in time was that 2 insiders have now struck in the sell-off. The two supervisory board members Piotr Wierzbicki and Marcin Kuciapski have generously dipped into their own pockets. Marcin in particular has been buying steadily over the last few years and has now made his biggest purchase to date.

However, I assume that the recovery could continue until the middle of next year. Then I will have to judge whether my assessments were correct.

Further additional purchases in the current market environment include:

- okta (I am invested since last Q drop, I am not iper confident in increasing position before Q3, why have you entered now?)

- Jenoptik (I really like them, but cant understand where the drop comes from)

Thanks in advance

Hello community,

What is your opinion on the Okta share and do you think one can take short-term profits at the current price?$OKTA (-0.43%)

But I honestly have no idea about the share. 😅

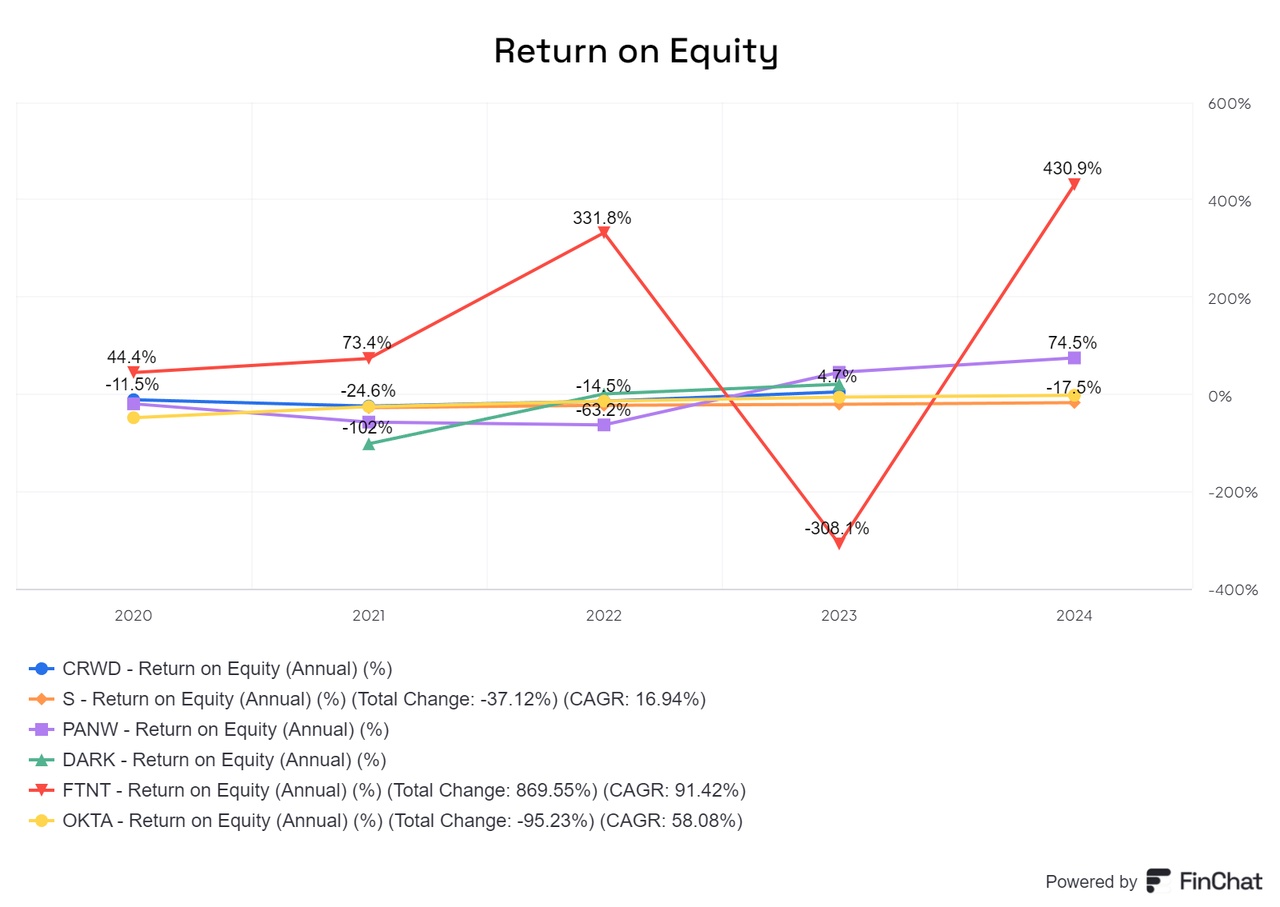

Crowdstrike Holding: The hawk that can no longer fly?

small quarterly comparison of CrowdStrike Holdings, Inc.

CrowdStrike Holdings, Inc. is considered one of the pioneers in the field of cyber security. The company specializes in cloud-based security solutions that help organizations effectively defend against modern cyber threats. With its advanced endpoint protection platform that uses AI and sophisticated algorithms to detect and defend against threats in real time, CrowdStrike has made a name for itself as a leader in innovation.

Historical development

Founded in 2011 by George Kurtz, the company has $CRWD (-1.73%) has experienced impressive growth since its beginnings. Before going public in 2019, the company increased its recurring revenue 35-fold - clear evidence of the success of its business strategy. This growth trajectory has continued in recent years: in 2023, CrowdStrike reported a 41% increase in its customer base, which now includes over half of the Fortune 500 companies.

Business model

CrowdStrike's business model is primarily based on a subscription approach, which generates around 92% of its revenue. With its Software-as-a-Service (SaaS) offering, the company ensures a stable share of recurring revenue. In addition, CrowdStrike also offers professional services, although these only account for a small proportion of revenue.

Core competencies

CrowdStrike's key strengths include:

- Data analytics and AI: Processing over 5 trillion signals per week, CrowdStrike uses advanced data analytics to efficiently identify and defend against threats.

- High customer retention: With a customer retention rate of over 98%, customer trust and satisfaction is reflected in the platform.

- Scalability and network effects: CrowdStrike's ability to process huge amounts of data and continuously learn from it gives the company a clear competitive advantage that sets it apart from new market entrants.

Future prospects and strategic initiatives

With ambitious targets for the coming years, CrowdStrike is aiming to achieve an annual recurring revenue (ARR) of USD 5 billion by the end of the 2026 financial year. To achieve this goal, the company plans to further optimize its quality standards and expand customer communication in order to strengthen customer loyalty and minimize churn.

In an increasingly competitive market environment, in which heavyweights such as Microsoft and Alphabet are also intensifying their cyber security solutions, CrowdStrike is relying on its innovative strength and ability to react quickly to new threats. In the future, the company would also like to optimize its margins and further increase its operational efficiency in order to maintain its market position in the long term.

Current performance of the CrowdStrike share

Over the course of the year, CrowdStrike shares have gained an impressive 86%, which is primarily due to the high level of acceptance and distribution of the platform. Since the IPO on June 12, 2019, the share has even achieved remarkable growth of 372 %. Nevertheless, the share reached higher values in the past before plummeting significantly following an incident on July 19. This raises the question of what happens next and how CrowdStrike is positioned compared to its competitors.

The incident on July 19

July 19 presented CrowdStrike and its CEO with one of the biggest challenges in the company's history. On this day, a configuration update was uploaded to the platform that paralyzed numerous customer systems. The company's own security mechanisms had classified the update as unknown and shut down the systems as a result. Whether this should be seen as proof of CrowdStrike's incompetence or as proof of the software's functionality remains controversial. In any case, shareholders reacted with concern: the share price fell by 42%. The main reason for this was uncertainty about the consequences of this incident.

The consequences of the incident

According to the CEO, the July 19 event had a significant impact on the last two weeks of the quarter. While CrowdStrike quickly mobilized teams to support customers and continued to close contracts, including significant nine-figure expansion contracts, the CFO added that it is too early to assess the exact legal exposure in terms of potential legal consequences. However, customer contracts contain limitations of liability and CrowdStrike has insurance policies in place to mitigate the potential impact of certain claims. Despite the challenges, CrowdStrike remains strongly committed to customer retention and is well positioned to invest in the business for the long term.

The question remains as to how the company will recover from the incident in the long term. Despite some deterred customers, trust appears to be largely intact, supported by discounts and the quality of the product. In addition, CrowdStrike has responded quickly to the problem, investing significant resources and launching customer loyalty programs to restore trust. Conclusion: There is currently nothing to suggest that the incident poses an existential problem for the company.

The current figures

The latest business figures, which are not yet included in the images, continue to show solid growth:

- Revenue: revenue increased to US$963.9 million, up 32% year-on-year and 4.6% quarter-on-quarter, despite the significant impact of the incident.

- Gross profit: Gross profit was USD 726.471 million, up 4.4% quarter-on-quarter.

- Net Income: Net income amounted to USD 46.690 million, an increase of 9% quarter-on-quarter.

These figures are fundamentally positive, but leave open the question of whether there are still challenges in customer retention. The long-term development remains to be seen, but the company's reactions and measures suggest that CrowdStrike is well on the way to regaining the trust of its customers and continuing to grow.

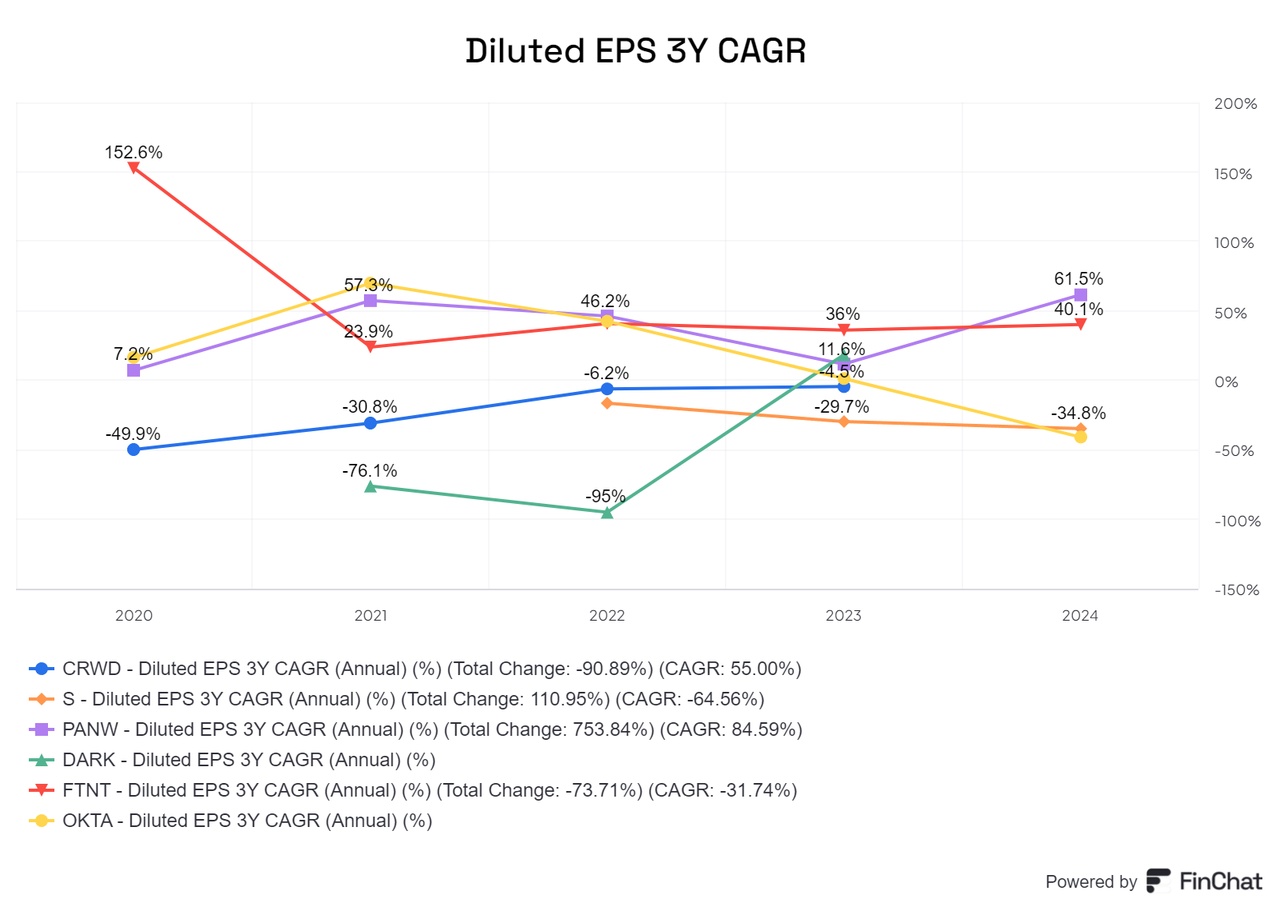

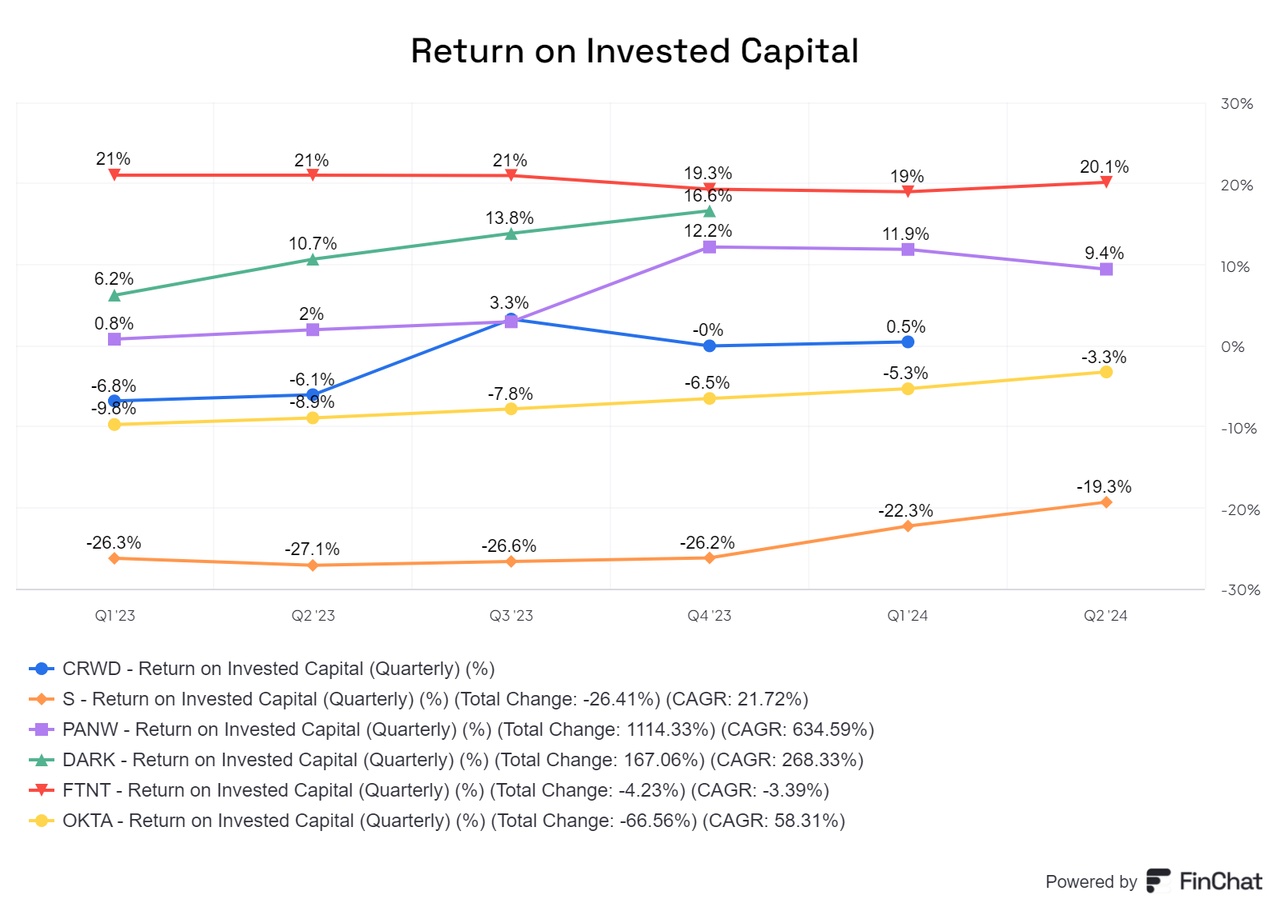

(Image 4&6)

Concerns and challenges for CrowdStrike

Despite the solid performance, there are some key challenges that CrowdStrike needs to address:

- Customer Commitment Packages and margin pressure: the introduction of customer loyalty programs, which essentially act as discount promotions, could put pressure on margins and profits in the short term. Even if these measures do not play a decisive role in the long term, the risk of a temporary decline in profitability remains.

- Strong competition: Competition in the cyber security market is intense and many competitors also offer attractive products. CrowdStrike must therefore emphasize even more clearly why its solutions are superior and what unique advantages they offer. Differentiation from the competition will be crucial in order to secure and expand market share.

- Legal risks and lawsuits: Despite existing safeguards and limitations of liability, potential legal disputes pose a significant challenge. Particularly in the USA, where lawsuits are often used strategically, there is a risk of high financial claims that could place a considerable burden on CrowdStrike.

Comparison with the competition

Compared to the competition, CrowdStrike must continue to prove its innovation leadership and the added value of its platform. While competitors are also active in the areas of cloud security and AI-supported solutions, CrowdStrike's success depends on how well it manages to defend its position as market leader and strengthen customer loyalty at the same time.

(the rest)

+ 3

Earnings times today (+6h for CEST) ⏰

Real-time results & analysis: https://t.me/Aktien_Stammtisch

Good times to invest have actually always been when nobody was interested in earnings...

Have you ever thought about how companies actually get their ticker symbols?

Of course, you can make it as easy as Okta and $OKTA (-0.43%) or just take Meta $META (+2.21%) , $UBER (+1.66%) , $SAP (-0.12%) etc. or you can be clever like Porsche with $P911 (-0.77%) or Salesforce with $CRM (-2.08%) and advertise the product with your own ticker.

But then there are also companies that omit a letter from their name for no reason, such as $BAS (-0.59%) , $PEP (-2.49%) or $TSLA (+0.88%) and there are really crazy ones that simply use $AAPL (-1.69%) instead of $APPLE or $BAYN (+0.72%) instead of $BAYER. Steve Jobs can't tell me that there was nothing better than writing Apple with two A's back then.

And of course there are $AFX (+3.79%) and $KO (-0.6%) the ticker has nothing to do with the actual name.

Finally, there is also the faction that simply uses the classic $C (-2.38%) , $O (-1.52%) , $V (-1.41%) or $F (-0.63%) which at least makes sense because it really is much shorter.

Trending Securities

Top creators this week