$NKE (+0.58%) time to buy?

Nike

Price

Discussion about NKE

Posts

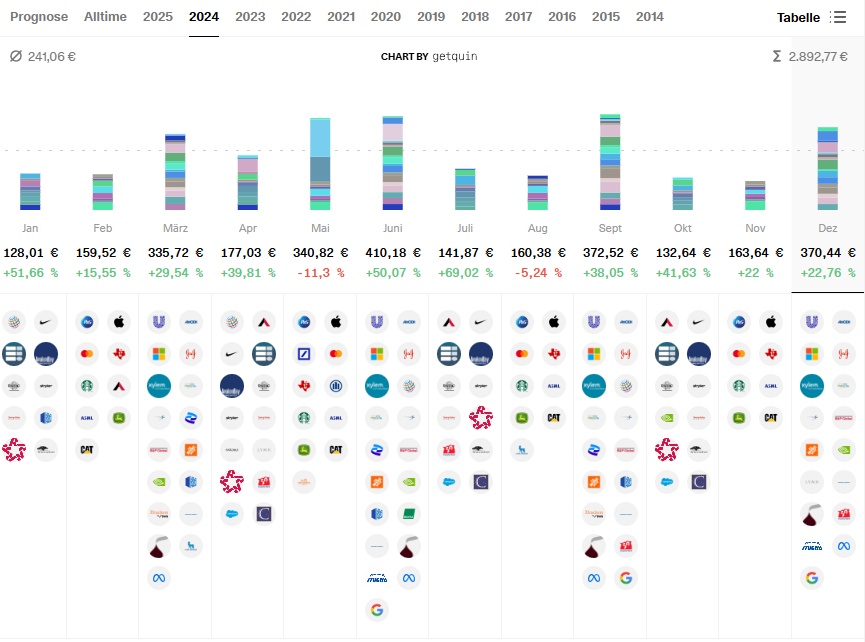

300Month in review December 2024

Last year, there was a distinct lack of snow in December. Instead, the portfolio did really well and I made progress with my crypto sell-off strategy. A small cold in the fall, despite taking good precautions, set me back in terms of ice bathing and hiking, but fortunately I was healthy again by Christmas. Unfortunately, that wasn't all... Time for a look back.

I present the following points for the past month of December 2024:

➡️ SHARES

➡️ ETFS

➡️ DISTRIBUTIONS

➡️ CASHBACK

➡️ AFTER-PURCHASES

➡️ P2P CREDITS

➡️ CRYPTO

➡️ WHAT IS REALLY IMPORTANT

➡️ OUTLOOK

➡️ Shares

$AVGO (-1.37%) is back on the tube. Wow, at +276%, the stock is now up for me. After the share cooled down a little, it went to the moon again in December.

$NFLX (-2.88%) and $SAP (+0.33%) are on a par with the previous month in terms of performance and are still in 3rd and 4th place in terms of volume. $WMT (+1.26%) . The retail chain will soon become a doubler for me.

The red lanterns will once again go to the usual suspects $NKE (+0.58%) , $DHR (-1.1%) and $CPB (-2.54%) . In terms of performance, all three stocks are down between -30% and -20%. They are the smallest positions in my main share portfolio with the $DHL (-0.51%) However, across all portfolios, the smallest positions are the new additions $SHEL (+0.22%) and $HSBA (-1.25%) .

➡️ ETFs

The ETFs are doing their thing as usual. This month, I immediately invested a refund from the previous year's utility bill in the $GGRP (-0.49%) and $JEGP (-0.07%) invested. I'm always expanding this asset class in particular with cash inflows. I don't care about timing. The money should go into the assets so that the stream of distributions keeps growing. I buy income and want cash flow.

➡️ Distributions

I received 34 distributions on 14 payout days in December. I am grateful for this additional income stream. My minimum target has been met anyway in this high-distribution month. The snowball rolling down the slope is getting bigger and bigger.

I already donated part of the dividend at the beginning of the month. This is based on the conviction that you can (and should) give something back, no matter how small, if you have the opportunity to do so.

➡️ Cashback

In November, I received €6 from redeemed Payback points, the equivalent of which I transferred from my grocery account to my settlement account. As already mentioned, there was also a credit from the utility bill. REWE and Penny have now separated from Payback, while Edeka, Netto Markendiscount and Marktkauf have joined. All three new stores are not in my immediate vicinity, which is why I will earn fewer Payback points in future. I will most likely collect the points mainly at DM. REWE and Penny now have their own bonus programs. REWE's will be exciting, as I can also save up credit with my purchases. I will deduct this discount from my grocery account and invest it in the same way as before. I'll see over the year whether it pays off more than Payback did back then.

➡️ Subsequent purchases

As already mentioned, there were additional purchases at $JEGP (-0.07%) , $GGRP (-0.49%) and $SPYD (-0.78%) . I always invest every little return or leftover money to further increase my portfolio. This buys me freedom.

➡️ P2P loans

I was finally able to get rid of Peerberry. Now only Mintos is hanging on my leg like a log. A mid-double-digit amount, which has long since defaulted, is still waiting to be refunded or written off.

This asset class will soon be history for me.

➡️ Crypto

All in all, December was another exciting month for crypto investors. Limit orders were triggered again for me. The last tranches $LINK (+1.33%) have left me, as has a first tranche $UNI (+3.71%) and a first tranche $BTC (+1.92%) . I have invested the proceeds in $HSBA (-1.25%) and $SHEL (+0.22%) invested in the separate portfolio. I have already explained my underlying strategy in detail, which you can read about in my articles. Recently, the crypto market has been in a sideways phase again. I'm hoping for another breakout in January to trigger further limit orders, as I still need to buy a security so that the separate portfolio pays me a return each month. So far, only two out of three quarterly months are covered. The two new stocks have even performed well in this short period of time, gaining around +3.6% within a month. The last purchase will perhaps be an ETF. You will see more about this in the coming reviews. I am already looking forward to collecting again in the coming bear market and will then certainly write an extra post with the levels at which I will gradually enter again.

➡️ What is really important

I remember December as a good month in financial terms, but unfortunately Christmas was overshadowed by tragic events this time.

After recovering from my cold at the beginning of the month a few days before Christmas Eve and getting back to my daily routine (consisting of work, running, ice swimming, hiking and my love of finance), I received the terrible news from Magdeburg. I am simply stunned and ask myself "why?". I am not affected, I am not one of the bereaved and I don't know any of the victims, the wounded or the bereaved personally, yet this event brought me down on the evenings around the Christmas holidays. Loyal readers know that I am working on a closer relationship with my ex's kids. Even though my blood doesn't run through their veins, questions ran through my mind about what if they were affected by the horrific act, or me? It could have happened anywhere. At least in the event of my untimely demise, I also made appropriate arrangements in the last few days of the year to ensure that what I leave behind ends up where I want it to be. I spent the turn of the year with the kids and the time I spent with them was the best end to the year imaginable. It's nice when connections continue to exist and you remain part of the life of the Kampfzwerge and can continue to accompany them through life.

➡️ Outlook

New year, new luck. I'll be surprised what the new year will bring. There will be a separate post for the evaluation of 2024 as a whole. I'm particularly happy because I exceeded an important goal despite a few expenses.

Links:

Social media links can be found in my profile, you can also check out the Instagram version of my review.

From 18-year-old wannabe investment banker to successful private asset manager: my (bumpy) path to €300,000 in a custody account

Part 5 of 5

/ Review of the year 2024: In the first 4 parts

of my investment story, I looked at the years 2013 to 2023.

A mixture of highs and lows. While there was a lot of learning at the beginning, the last few years are finally bearing fruit!

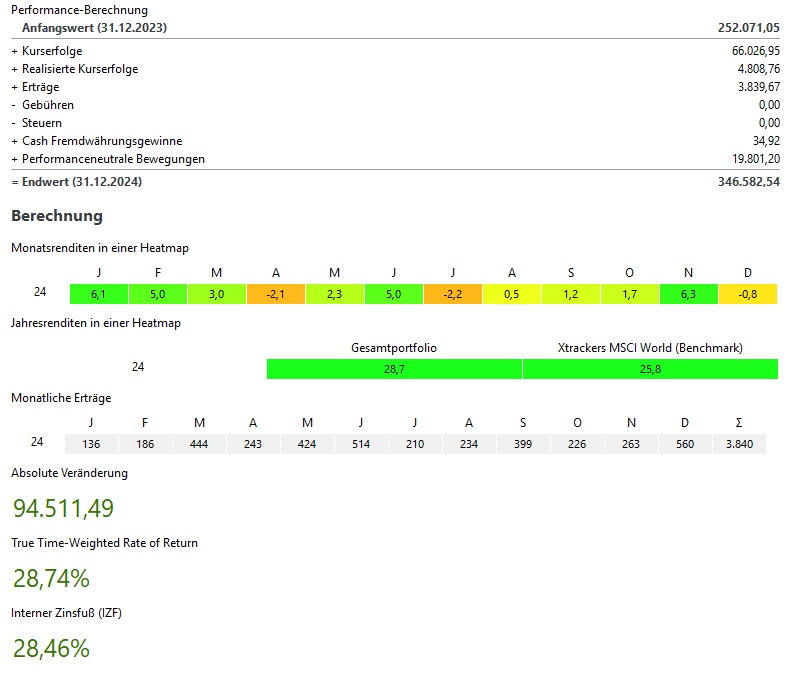

Monthly view:

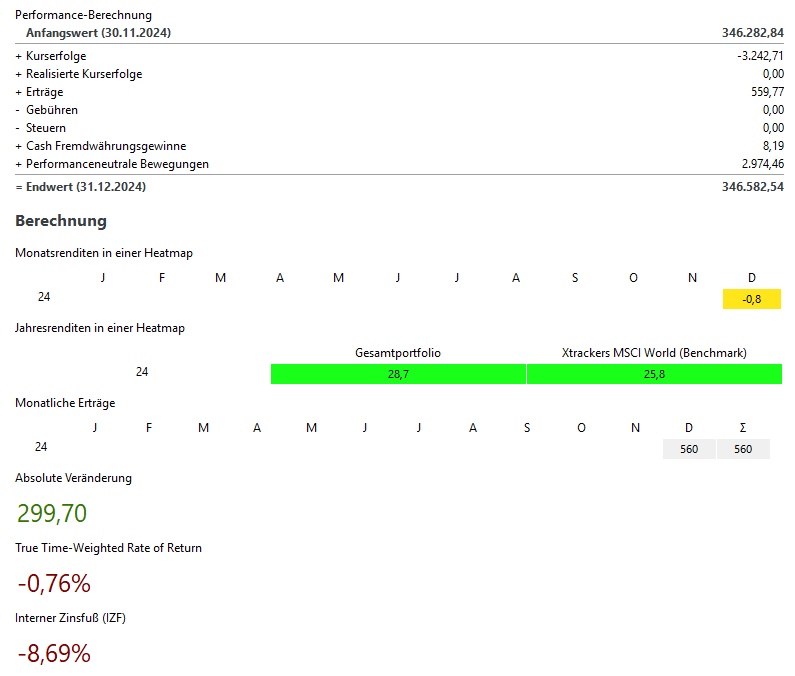

2024 was another very positive year, although December again resulted in a slight loss in the portfolio.

In total, December was -0,8%. This corresponds to price losses of -3.200€.

The MSCI World (benchmark) was -0.9% and the S&P500 -2.5%.

In the following, however, I would like to look primarily at the whole of 2024 and not

just December.

Year as a whole:

Winners & losers:

The winner par excellence is hardly surprising NVIDIA $NVDA (-2.01%) with

almost €20,000 in share price gains! And this despite the fact that I took my entire stake of ~€4,000 off the table in March.

In 2nd place follows Bitcoin

$BTC (+1.92%) with approx. 6,000€ price gains. 3rd-5th place

are shared by TSMC $TSM (-0.61%)

Alphabet $GOOG (+0.19%) and Meta

$META (+2.4%) with gains of ~€5,000 each.

On the loser side it looks very relaxed all in all.

Sartorius $SRT (+1.11%)

Nike $NKE (+0.58%)

and Bechtle $BC8 (+0.07%) have each caused share price losses of ~€1,000. They are followed by LVMH $MC (-0.14%) with share price losses of €500 and Amgen $AMGN (-0.52%) with €200.

All in all, share price losses that are not really worth mentioning.

The performance-neutral movements in 2024 were just under €20,000. This is a significant decline compared to the almost €30,000 from previous years. This was due to some private issues and the upcoming house construction.

My performance for the year as a whole was +28,8% and therefore outperformed my benchmark, the MSCI World, by 25.8%.

In total, my portfolio currently stands at ~347.000€. This

corresponds to an absolute growth of ~95,000€ in the current

year 2023. ~71.000€ of which comes from price gains, ~3.800€ from

dividends / interest and ~20.000€ from additional investments.

Dividend:

- The dividends in December were 17% above the previous year at ~€370

- Amgen is in the lead with over 50€ (gross) dividend every 3 months

- For the year as a whole, my dividends amounted to ~2.900€ and thus almost 25% over 2023

Buys & sells:

- I bought in December for a significantly reduced ~500€

- As always, my savings plans were executed:

- Blue chips: Lockheed Martin $LMT (-0.19%) Republic Services $RSG (+0.56%) Thermo Fisher $TMO (+0.61%) ASML $ASML (-0.7%) Northrop Grumman $NOC (-0.95%) Itochu $8001 (-1.84%) Constellation Software $CSU (-1.71%) Hermes $RMS Salesforce $CRM (-1.97%) MasterCard $MA (-1.73%) Deere $DE (-0.77%)

- Growth: -

- ETFs: MSCI World $XDWD (-0.72%) and the WisdomTree Global Quality Dividend Growth $GGRP (-0.49%)

- Crypto: Bitcoin $BTC (+1.92%) and Ethereum $ETH (+0.77%)

- There were no further sales in December

Target 2024 & outlook 2025:

My goal for 2024 was to reach €300,000 in the portfolio. Due to the

extremely positive market performance in the current year, my portfolio stands at ~€ 350,000 at the end of the year. I was therefore able to significantly exceed my target.

What will happen in 2025? The logical target, of course, would be 400.000€ to be achieved. However, due to the upcoming house construction, part of the assets will be invested in the house construction. If I include the property in my statement of assets, the target of €400,000 would of course not change.

However, as I am more likely to be tracking my liquid assets here, I will probably

probably refrain from doing so.

Therefore, my year-end target for 2025 will probably be closer to the final balance for 2024. So around €350,000 at the end of 2025.

How are things looking for you? Have you already thought about your plans for 2025?

Finally, I wanted to say thank you again for all the positive reactions to my investment story!

https://linktr.ee/mister.ultra

#dividends

#dividende

#rückblick

#depotupdate

#aktie

#stocks

#etfs

#crypto

#personalstrategy

I like your posts and really enjoy reading them

Good luck with building your house 🍀

Some “minor” adjustments

Followed someone’s advice and switched to growth stocks, I agree it wasn’t a good idea to invest in dead dividend stocks when my investments are this small.

I am trying to create a somewhat balanced but aggressive portfolio to get the potential of smashing big profits in the next few years but at the same time not gamble all of it.

$AMD (-3.13%)

$NKE (+0.58%)

$INTC (-3.44%) are looking very juicy right now, will continue the shopping spree over the next few months, advice needed and welcomed

Boeing and 6 More Contrarian Stocks for 2025

Boeing $BA (-0.77%)

Merck $MRK (+0.35%)

Nike $NKE (+0.58%)

Ulta Beauty $ULTA (+1.73%)

Roku $ROKU (-3.47%)

Wayfair $W (-0.51%)

Peloton $PTON (-1.09%)

recommendations for my portfolio?

Hi there, currently surpassed the 5k mark and I am very happy about it. I keep a concentrated portfolio and want to focus on companies with a lot of growth potential. Currently looking at $GOOGL (+0.34%) and $NKE (+0.58%) but I am still searching for a stock in the finance space. Do you have any recommendations or comments about my portfolio?

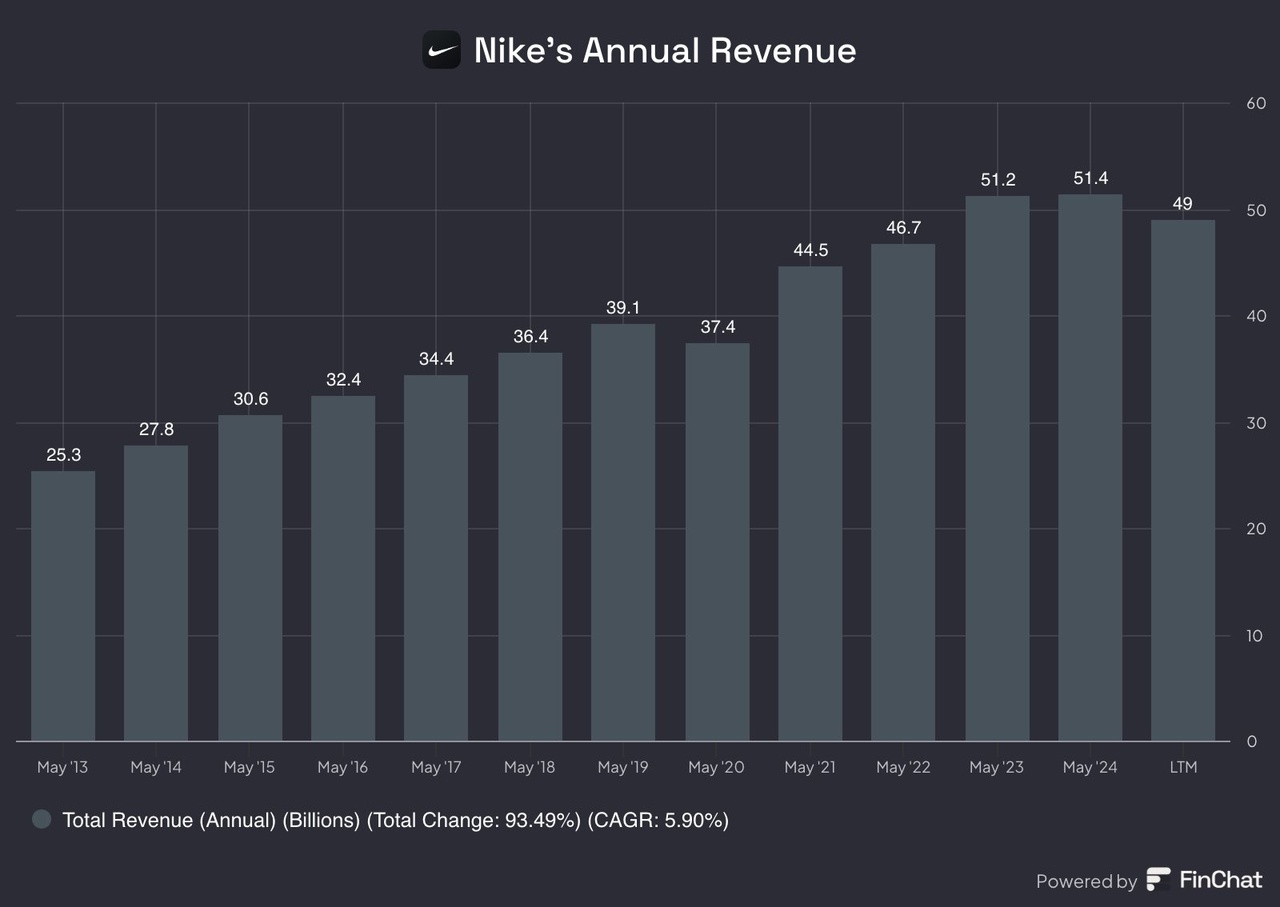

Nike sales development ✔️

Nike

$NKE (+0.58%) last year generated sales of 49 billion USD an increase from 27.8 billion USD in 2014.

Analyst updates, 20.12.

⬆️⬆️⬆️

- DEUTSCHE BANK RESEARCH raises the price target for NIKE from USD 82 to USD 84. Buy. $NKE (+0.58%)

- RBC raises the price target for ALPHABET A SHARE from USD 210 to USD 235. Outperform. $GOOGL (+0.34%)

- RBC raises the price target for AMAZON from USD 225 to USD 255. Outperform. $AMZN (-1.01%)

- RBC raises the price target for META from USD 630 to USD 700. Outperform. $META (+2.4%)

- ODDO BHF raises the target price for MUNICH RE from EUR 540 to EUR 555. Outperform. $MUV2 (-2.09%)

- ODDO BHF upgrades HERMES to Neutral. Target price EUR 2315. $RMS (-0.63%)

- ODDO BHF raises the target price for AIRBUS from EUR 168 to EUR 180. Outperform. $AIR (+0.64%)

- ODDO BHF raises the price target for FRAPORT from EUR 58 to EUR 61. Outperform. $FRA (-0.92%)

- JPMORGAN raises the target price for FEDEX from USD 366 to USD 370. Overweight. $FDX (-0.06%)

⬇️⬇️⬇️

- GOLDMAN lowers the price target for NIKE from USD 97 to USD 91. Buy. $NKE (+0.58%)

- BOFA lowers the price target for NIKE from USD 95 to USD 90. Buy. $NKE (+0.58%)

- ODDO BHF downgrades CARBIOS to Neutral. $ALCRB (-0.45%)

- KEPLER CHEUVREUX lowers the price target for LANXESS from EUR 31 to EUR 30. Buy. $LXS (-2.7%)

- HAUCK AUFHÄUSER IB lowers the target price for DEUTZ from EUR 8.50 to EUR 7. Buy. $DEZ (-1.6%)

- BARCLAYS lowers the price target for VERTEX from USD 509 to USD 418. Equal-Weight. $VRTX (-0.59%)

- GOLDMAN lowers the price target for BIRKENSTOCK from 59.10 USD to 57.90 USD. Neutral. $BIRK (+2.03%)

- GOLDMAN downgrades TEAMVIEWER from Buy to Neutral and lowers target price from EUR 17 to EUR 12. $TMV (+0.17%)

Trending Securities

Top creators this week