Disney

$DIS (-1.21%) announced that worldwide an estimated 157 million monthly active users ad-supported content on its streaming platforms Disney+, Hulu and ESPN+. - CNBC

Graphic: Disney

Posts

243Disney

$DIS (-1.21%) announced that worldwide an estimated 157 million monthly active users ad-supported content on its streaming platforms Disney+, Hulu and ESPN+. - CNBC

Graphic: Disney

Disney

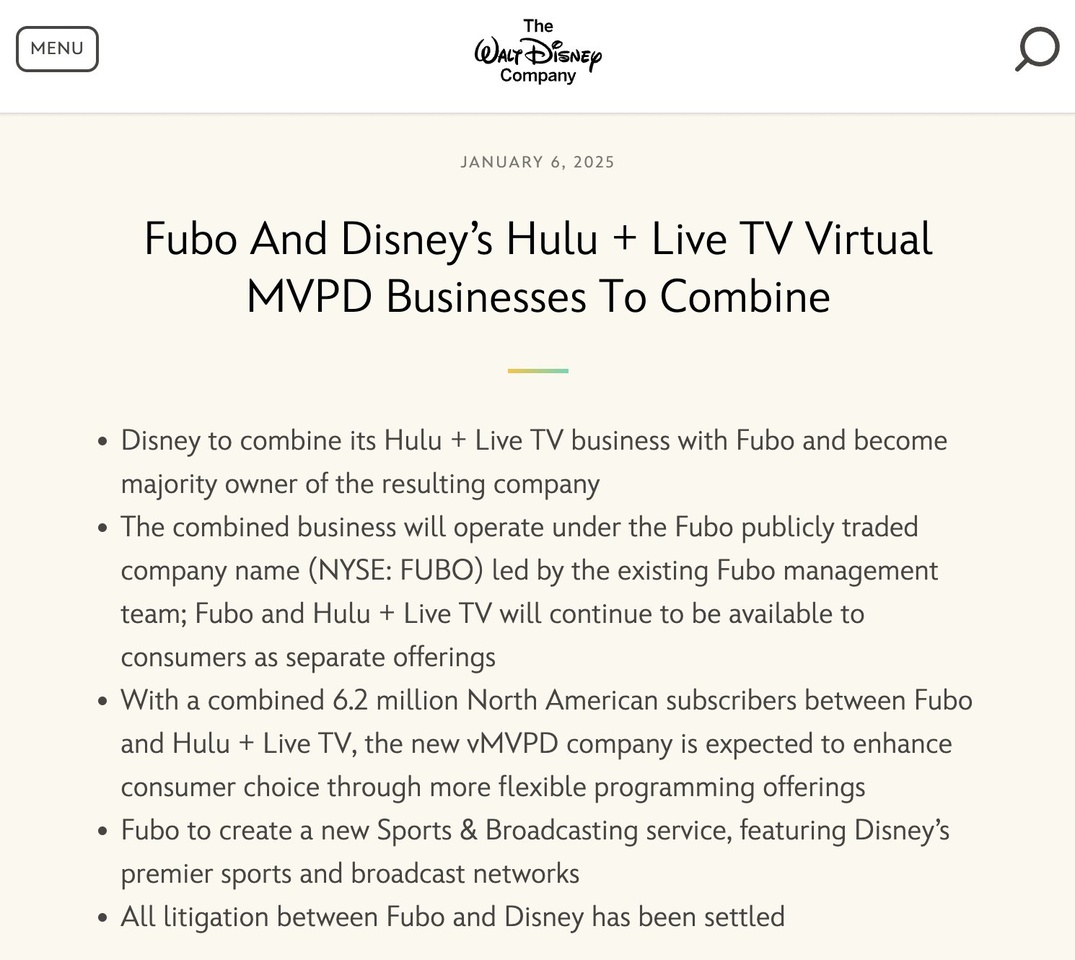

$DIS (-1.21%) and FuboTV

$FUBO have confirmed that they have reached a definitive agreement to merge the Hulu + Live TV business with Fubo merge.

"Under the terms of the agreement, upon closing, Disney will acquire a 70% interest in Fubo upon closing."

In 1936, the Disney brothers began with a dream and a mouse.

Decades later, Walt and Roy Disney built an empire that set the standard for family entertainment.

Here is the story of how visionary leadership turned Disney into a 200 billion dollar company:

Walt Disney was a storyteller and Roy Disney was a businessman.

Together they combined creativity and strategy.

Their first big idea? A cartoon mouse called Mickey.

But Walt didn't just want cartoons; he wanted animated stories that appealed to the emotions.

The release of "Snow White and the Seven Dwarfs" in 1937 was a groundbreaking moment - it was the world's first feature-length animated film.

Critics said the strategy would fail.

Instead, it became a cultural phenomenon and grossed 8 million dollars during the Great Depression.

Walt's genius lay in his ability to see the big picture.

He envisioned Disneyland, a place where stories come to life and families create memories.

Roy made sure the finances worked and bet everything on Walt's dream.

In 1955, Disneyland opened its doors.

Despite initial setbacks, it developed into the gold standard for theme parks worldwide.

The Disney brothers faced major challenges, from the financial burdens of the Second World War to internal conflicts.

But their leadership was based on trust.

Walt inspired the creative vision and Roy ensured that the business remained stable.

When Walt died in 1966, Roy ensured that Walt Disney World opened in 1971, honoring his brother's dream.

The Disney empire expanded into television, merchandise and live-action films.

In the 1980s, the company was in trouble, but the family legacy paved the way for a new direction.

Acquisitions such as Pixar, Marvel and Lucasfilm underlined the power of visionary leadership based on bold decisions.

Today, Disney is synonymous with magic, entertainment and innovation.

What started with one mouse has become a 200 billion dollar empire that influences generations around the world.

But at its core, the Disney story is about family - a partnership between two brothers who shared a dream and pursued it with passion.

+ 6

The Chief Financial Officer of Disney

$DIS (-1.21%) predicts future price increases for the streaming service - statement at the UBS conference.

Disney

$DIS (-1.21%) has announced a dividend of 1,00 USD per share for 2025, compared to 0,75 USD per share for the 2024 financial year.

Disney $DIS (-1.21%) announced its Board approved a cash dividend of $1.00 per share, a 33% increase from last year’s $0.75 per share.

Disney

$DIS (-1.21%) and ESPN are testing a generative AI avatar called "FACTS".

This AI bot uses data from ESPN Analytics to provide analytics and is intended to complement the hosts of the SEC Nation show on ESPN, reports The Verge.

Analyst updates, 19.11.

⬆️⬆️⬆️

- JEFFERIES raises the price target for NETFLIX from USD 800 to USD 1000. Buy. $NFLX (-3.23%)

- DEUTSCHE BANK RESEARCH raises the price target for SIEMENS from EUR 200 to EUR 210. Buy. $SIE (-0.94%)

- DZ BANK raises the price target for WALT DISNEY from USD 115 to USD 130. Buy. $DIS (-1.21%)

- KEPLER CHEUVREUX raises the target price for ALZCHEM from EUR 69 to EUR 73. Buy. $ACT (+0.47%)

⬇️⬇️⬇️

- BOFA downgrades SIEMENS from Buy to Neutral and raises target price from EUR 196 to EUR 200. $SIE (-0.94%)

- BERENBERG lowers the price target for BAYER from EUR 28 to EUR 22. Hold. $BAYN (+0.87%)

- BERENBERG lowers the price target for SMA SOLAR from EUR 21 to EUR 14. Hold. $S92 (-0.37%)

- DZ BANK downgrades SHOPIFY from Hold to Sell and raises target price from USD 68 to USD 91. $SHOP (-5.72%)

- STIFEL lowers the price target for BECHTLE from EUR 50 to EUR 45. Buy. $BC8 (+0%)

- WARBURG RESEARCH lowers the price target for JUNGHEINRICH from EUR 49 to EUR 47. Buy. $JUN3 (-2.68%)

- HAUCK AUFHÄUSER IB lowers the target price for KNAUS TABBERT from EUR 16 to EUR 8. Sell. $KTA (+0.39%)

- DEUTSCHE BANK RESEARCH lowers the price target for JOST WERKE from EUR 70 to EUR 60. Buy. $JST (-4.11%)

- GOLDMAN lowers the price target for TEAMVIEWER from EUR 18 to EUR 17. Buy. $TMV (+0.07%)

Analyst updates, 15.11. 👇🏼

⬆️⬆️⬆️

- JEFFERIES raises the price target for ASML from EUR 760 to EUR 840. Buy. $ASML (-0.79%)

- RBC raises the price target for TESLA from USD 249 to USD 313. Outperform. $TSLA (-0.1%)

- JPMORGAN raises the price target for WALT DISNEY from USD 125 to USD 128. Overweight. $DIS (-1.21%)

- JPMORGAN raises the price target for SIEMENS from EUR 215 to EUR 230. Overweight. $SIE (-0.94%)

- BARCLAYS raises the target price for SIEMENS ENERGY from EUR 21 to EUR 35. Equal-Weight. $ENR (-4.58%)

- LBBW raises the target price for EON from EUR 13.80 to EUR 13.90. Buy. $EOAN (-4.58%)

- HAUCK AUFHÄUSER IB raises the target price for ADESSO from EUR 80 to EUR 85. Hold. $ADN1 (-1.13%)

- DEUTSCHE BANK RESEARCH raises the target price for BURBERRY from GBP 7.40 to GBP 8.60. Hold. $BRBY (+1.21%)

- BERENBERG raises the price target for TALANX from EUR 76.20 to EUR 91.10. Buy. $TLX (-3.22%)

- BERENBERG raises the price target for HAPAG-LLOYD from EUR 163 to EUR 169. Hold. $HLAG (-0.38%)

⬇️⬇️⬇️

- JPMORGAN lowers the price target for BAYER from EUR 34 to EUR 25. Neutral. $BAYN (+0.87%)

- SANTANDER downgrades SHELL from Neutral to Outperform and lowers target price from GBP 30.50 to GBP 30. $SHEL (-0.04%)

- WARBURG RESEARCH lowers the price target for SECUNET from EUR 216 to EUR 210. Buy. $YSN (-2.92%)

- METZLER lowers the price target for SIXT-STÄMME from EUR 105 to EUR 95. Buy. $SIX2 (-0.06%)

- ODDO BHF lowers the target price for MERCK KGAA from EUR 187 to EUR 176. Outperform. $MRK (+0.72%)

- METZLER lowers the price target for SMA SOLAR from EUR 20 to EUR 16. Hold. $S92 (-0.37%)

- DEUTSCHE BANK RESEARCH lowers the price target for GRENKE from EUR 28 to EUR 24. Buy. $GLJ (-2.16%)

- BERENBERG lowers the target price for K+S from EUR 15.70 to EUR 14.70. Buy. $SDF (+1%)

- BERENBERG lowers the price target for AUMANN from EUR 17 to EUR 14.50. Hold. $AAG (-2.24%)

- BERENBERG lowers the price target for DERMAPHARM from EUR 58 to EUR 50. Buy. $DMP (+1.13%)

- BARCLAYS lowers the price target for SYMRISE from EUR 123 to EUR 115. Equal-Weight. $SY1 (-0.32%)

Top creators this week