🔹 Adj EPS: $1.85 (Est. $1.76) 🟢; UP +45% YoY

🔹 Adj Revenue: $14.44B (Est. $14.16B) 🟢; UP +5.7% YoY

Q1 FY25 Guidance

🔹 Adjusted EPS: $0.70 - $1.00 (Est. $0.76) 🟢

🔹 Revenue Growth: 7% - 9% YoY

🔹 Operating Margin: 6% - 8%

FY 2025 Full-Year Guidance

🔹 Adjusted EPS: Above $7.35 (Est. $7.45) 🟡

🔹 Free Cash Flow: Greater than $4B

🔹 Pre-Tax Income: Greater than $6B

Q4 Operational Metrics:

🔹 Passenger Revenue: $12.82B (Est. $12.62B) 🟢; UP +5.3% YoY

🔹 Cargo Revenue: $249M (Est. $204.3M) 🟢; UP +32% YoY

🔹 Passenger Load Factor: 84% (Est. 84.7%) 🔴; Flat YoY

🔹 Available Seat Miles (ASM): 72.04B (Est. 71.12B) 🟢; UP +5.2% YoY

🔹 Revenue Passenger Miles (RPM): 60.39B (Est. 60.27B) 🟢; UP +4.7% YoY

🔹 Adjusted Net Income: $1.20B (Est. $1.15B) 🟢; UP +46% YoY

🔹 Yield per Passenger Mile: $21.22; UP +0.5% YoY

FY 2024 Highlights

🔹 Adjusted Revenue: $57.0B; UP +4.3% YoY

🔹 Operating Income: $6.0B

🔹 Adjusted EPS: $6.16; UP +43% YoY

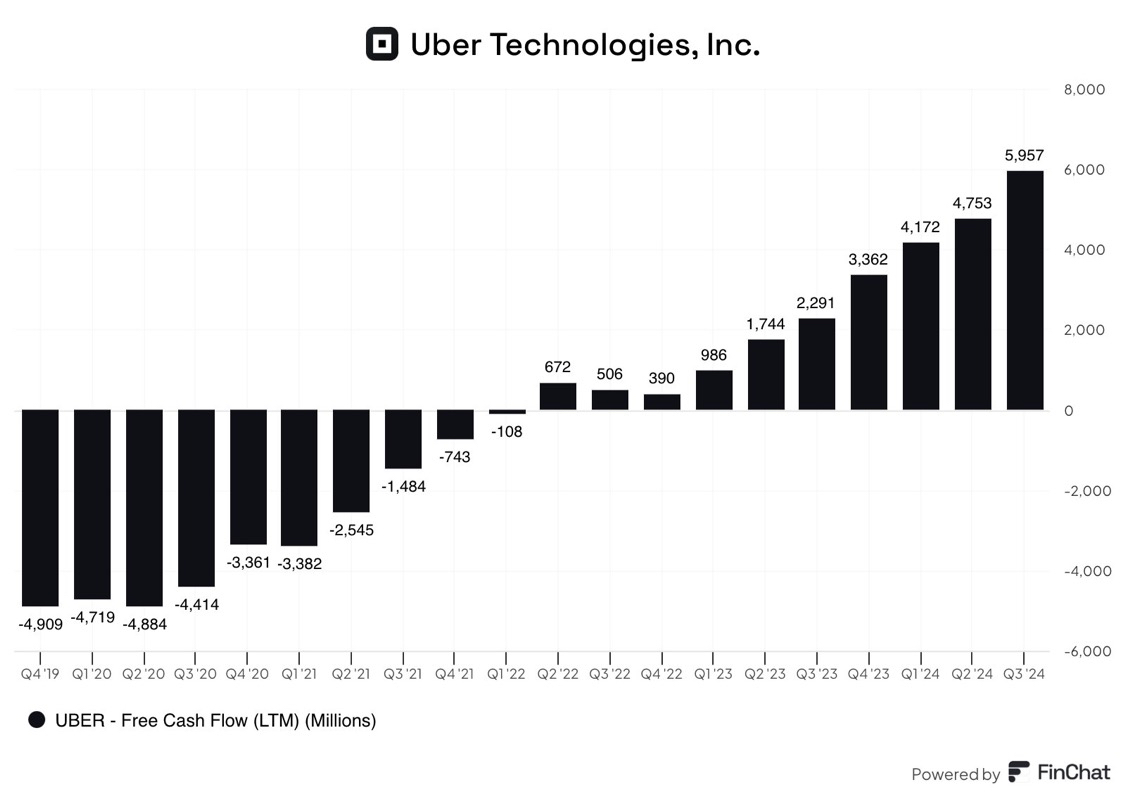

🔹 Free Cash Flow: $3.4B

🔹 Adjusted Fuel Price per Gallon: $2.56; DOWN -10% YoY

🔹 Adjusted Debt to EBITDAR: 2.6x (vs. 3.0x YoY)

Operational Highlights

🔸 Fleet Expansion: Took delivery of 38 aircraft in FY24, including A321neo, A220-300, A330-900, and A350-900.

🔸 Network Growth: Added 13 new Latin America routes and new transatlantic routes, including Minneapolis to Copenhagen.

🔸 Operational Excellence: Earned the Cirium Platinum Award for operational excellence for the fourth consecutive year.

CEO Ed Bastian's Commentary

🔸 “2024 was a standout year, reflecting Delta’s differentiation and industry leadership. We’re set to deliver the best financial year in our history in 2025, driven by strong demand and premium product offerings.”

CFO Dan Janki's Insight

🔸 “Our operational efficiency and disciplined cost management supported industry-leading results. We remain focused on sustaining efficiency gains as we move into 2025.”