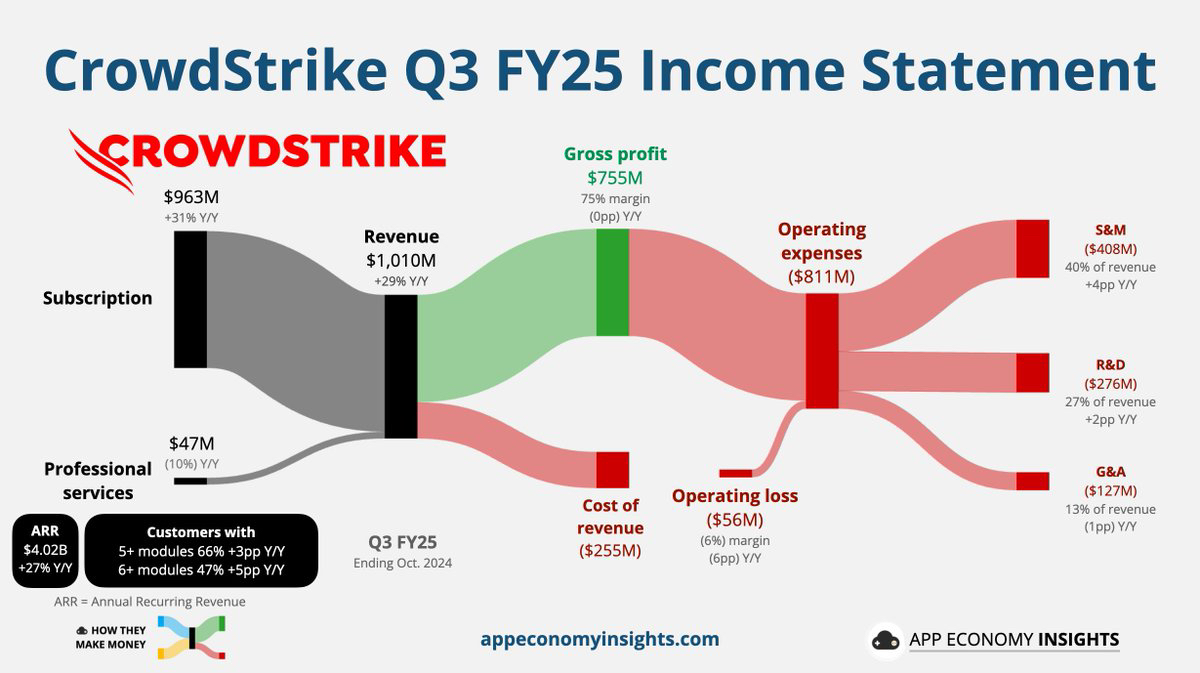

$CRWD (-2.15%) | CrowdStrike Q3 Earnings Highlights:

🔹 Revenue: $1.01B (Est. $982.8M) 🟢; UP +29% YoY

🔹 Subscription Revenue: $962.7M (Est. $933.6M) 🟢; UP +31% YoY

🔹 Professional Services Revenue: $47.4M (Est. $48.9M) 🔴

🔹 Annual Recurring Revenue (ARR): $4.02B (Est. $4.01B) 🟢; UP +27% YoY

🔹 Adjusted EPS: $0.93 (Est. $0.81) 🟢; UP +13% YoY

Q4 Guidance:

🔹 Revenue: $1.029B-$1.035B (Est. $1.03B) 🟡

🔹 Adjusted EPS: $0.84-$0.86 (Est. $0.86) 🟡

FY25 Guidance:

🔹 Revenue: $3.924B-$3.930B (Est. $3.89B-$3.90B) 🟡

🔹 Adjusted EPS: $3.74-$3.76 (Est. $3.61-$3.65) 🟢

Q3 Profitability:

🔹 Adjusted Operating Income: $194.9M (Est. $169.8M) 🟢

🔹 Subscription Gross Margin (Non-GAAP): 80%

Q3 Cash and Balance Sheet:

🔹 Cash Flow from Operations: $326M (Est. $302.5M) 🟢

🔹 Free Cash Flow: $231M

🔹 Cash and Cash Equivalents: $4.26B

Key Highlights:

🔸 Surpassed $4B in ARR, with strong module adoption (66% of customers use five or more modules).

🔸 Maintained 97% gross retention rate, reflecting customer loyalty.

🔸 Expanded partnerships with Fortinet, AWS, and NVIDIA; acquired Adaptive Shield for SaaS security.