Hello $EQAC (-1.13%) !

Coca-Cola

Price

Discussion about KO

Posts

454AI - Why I continue to believe in the outperformance of the US and (big) tech

Today I read in the Deutsche Bank newsletter (Perspectives in the morning), which makes me believe that the US and tech will continue to outperform.

1. massive investments:

The Magnificent 7 alone are planning investments in research and development of 500 billion dollars!

Even if this will certainly not all flow into AI investments, it is safe to assume that it will be one of the main areas of investment.

To put this into perspective: Instead of investing in research and development, the Magnificent 7 could use this money to buy the entire Volkswagen Group about 10 times over.

Alternatively, they could also buy Mercedes, BMW, Adidas, BASF, Allianz, Munich Re, Deutsche Börse, Deutsche Bank, DHL and e.on!

The main beneficiary will certainly continue to be NVIDIA

$NVDA (-2.35%) but also Broadcom

$AVGO (-1.8%) and TSMC

$TSM (-1.1%) will certainly benefit, as will many other companies in the sector.

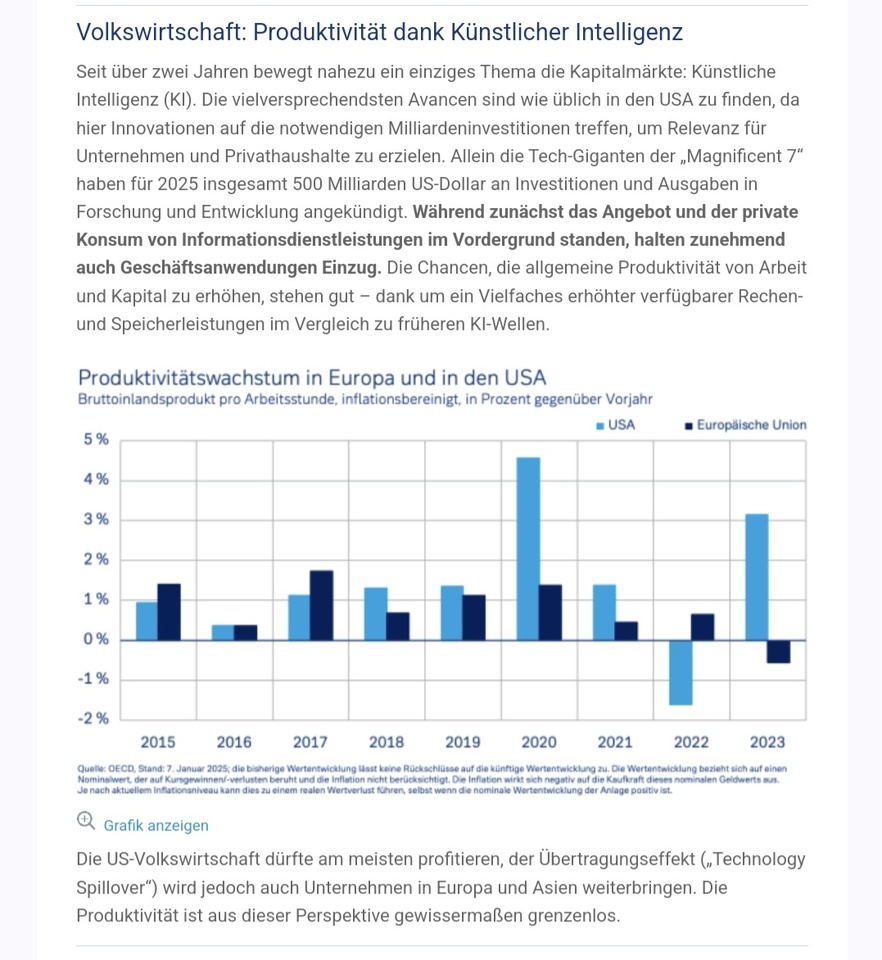

2. productivity increases

Deutsche Bank assumes that the many investments of the last two years will slowly have an impact on the productivity of the economy as a whole.

In recent years, NVIDIA in particular has benefited from the massive investments made by the Magnificent 7. Based on this, they have developed AI applications that can now be used by the economy as a whole and thus increase productivity in the wider economy. can lead to productivity gains in the wider economy.

This in turn leads to rising margins and cash flows, which in turn can drive the markets.

3 Trump and a friendly economic policy

I continue to believe that the US economy will remain strong thanks to a very pro-business America First policy under the incoming Trump administration. Europe and Asia could certainly suffer from this, but I don't see any major risks for the US there

4. high valuation / Isn't all this already priced in?

The high valuation is often cited as a counter-argument. However, it is worth taking a closer look here:

PE Ration:

- NVIDIA $NVDA (-2.35%) : 55

- Microsoft $MSFT (-1.23%) : 35

- Alphabet $GOOG (-0.09%) : 26

- Meta $META (+1.56%) : 29

Forward PE Ratio:

- NVIDIA: 32

- Microsoft: 28

- Alphabet: 21

- Meta: 24

A few other classic stocks for comparison:

- Coca-Cola

$KO (-0.49%) : 25 (Forward: 20) - McDonalds

$MCD (-0.57%) : 25 (Forward: 23) - Procter & Gamble

$PG (-1.62%) : 28 (Forward: 22)

If you look at the forward PE for 2 years from now, many Big Tech companies are valued more favorably than the stocks mentioned above.

But isn't that already priced in? Of course, Big Tech is expected to continue to deliver and if the forecasts do not materialize, there will certainly be a major downside.

However, this would also weigh on the indices as a whole, dragging all other stocks down with them. Furthermore, some of the big tech stocks are not necessarily more expensive on a current basis.

An Alphabet share is cheaper than Procter & Gamble from a pure P/E perspective and about the same price as a Coca-Cola or McDonald's.

I won't go into more detail on stocks like Palantir

$PLTR (-1.22%) which currently have a P/E ratio of over 300 and a forward P/E ratio of 150.

This does not mean that I am assuming that the share price will fall sharply, I have simply not done enough research on the company and have focused more on Big Tech

What does this mean for Europe?

An ASML

$ASML (-0.79%) will certainly also benefit from these developments. And European companies will also purchase AI applications to increase their productivity.

However, on the one hand, the investment money in the USA will end up with the big tech companies, and on the other hand, there will certainly be much stricter regulations, which will restrict or at least delay the growth in productivity.

What do you think? Do you also believe in a further tech & USA outperformance?

Watchlist for the 2KW 2025

A quick overview of the stocks I am trying to get into the portfolio for the coming week. The limit orders can be adjusted to the market. However, I will start with this on Monday morning

Fastenal - limit EUR 69.50 $FAST (-0.06%)

Coca Cola limit 58.50 EUR $KO (-0.49%)

Watsco limit 451,50 EUR $WSO (-0.47%)

Waste Management Limit 195.00 EUR $WM (-0.1%)

UnitedHealth Limit 490 EUR $UNH (+1%)

Philip Morris limit EUR 117 $PM (-1.61%)

Lockheed Martin Limit 460.00 EUR $LMT (-0.29%)

Iron Mountain Limit 100 EUR $IRM (-1.23%)

Have a nice rest of Sunday .

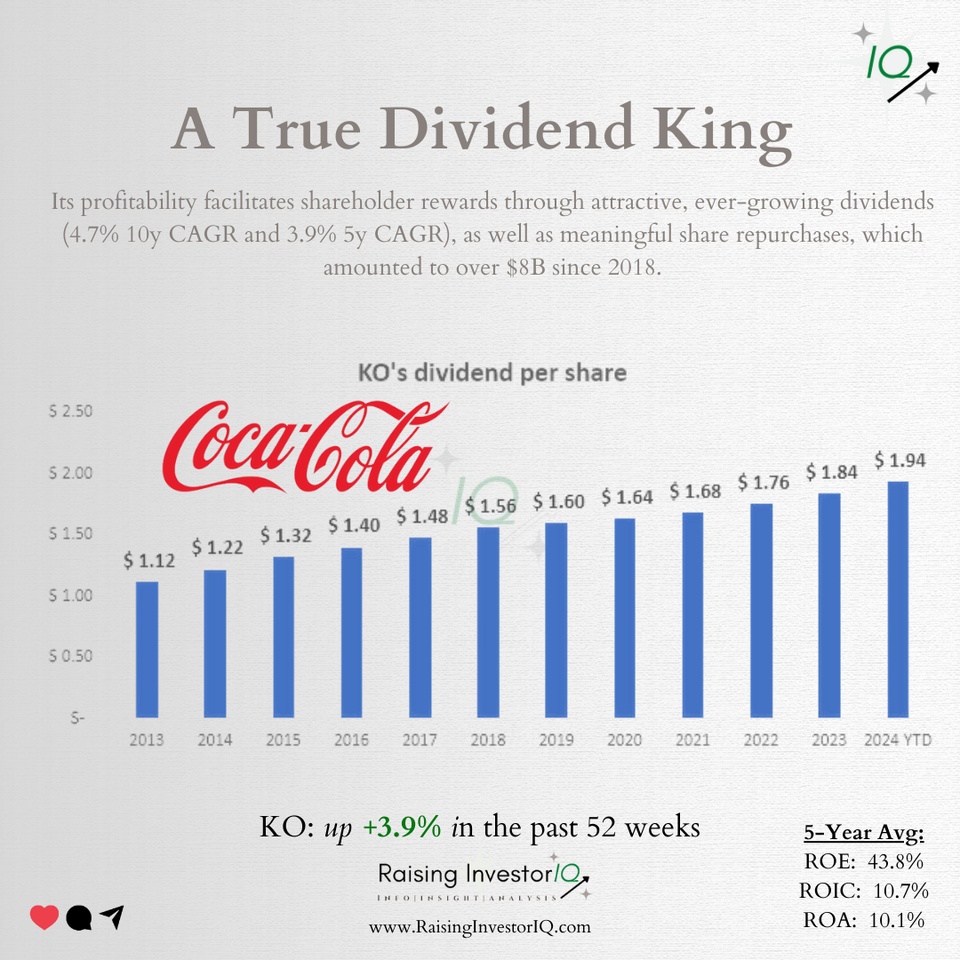

A True Dividend King

$KO (-0.49%) is now offering a very competitive dividend yield, trading at fair value.

The company has increased dividends for 61 consecutive years, with a 70% payout ratio, and it can maintain dividends even amidst volatility.

Help with remodeling

Good evening!

I've had my portfolio for a few years now (2018) and was very involved with stocks when I was young, but since about 2021 I've lost the time and desire to do so and wanted to let everything run long, which was of course a mistake...

For about 1 month now, I have been motivated again to change this situation and to stick with it in the long term.

Titles like: $BAYN (+0.75%) , $BRN (-0.72%) , $SVA (+3%) , $PHE (-0.7%) and $HYSR (+0%) I have been holding them for ages and always hoped that they would go through the roof and missed the chance to sell them when the wind was blowing so that I could cut my losses... so I would rather hold them now than sell them because I missed the chance.

Title like: $KO (-0.49%) and $HBH (-0.82%) I bought a new one last week to lay a good foundation for the realignment ... Long on dividends.

The fund: $Raiffeisen Wachstum (RZ) T I had to take out at the time, I can no longer give the exact reason, as I have repeatedly taken out the necessary small change over the years and have kept the thing running for 2 years (monthly approx. 150€ as a savings plan permanent investment), whereby I am ready to switch this money at any time.

So much for the information on the portfolio ... I would like to try to limit my losses a little over the next 3, 5, 10, 20 years and make my portfolio healthy in the long term.

Budget apart from what is in my portfolio, which could of course be reallocated, would be around €3000.

Stocks like : $NOVO B (-0.17%) and $O (-0.53%) would really appeal to me right now.

Please give me some feedback or information, I am grateful for everything.

Greetings Julian 😃

A good starting point:

https://getqu.in/nN2cDl/ https://getqu.in/nN2cDl/

Detailed share analysis Microsoft

Detailed share analysis Microsoft $MSFT

- Performance

- Cloud computing

- Investments in

- Realignment & reorganization

- Windows 11

- Artificial Intelligence

- Copilot

- Own CPUs: Maia 100 AI Accelerator & Cobalt 100 CPU

- New Coca-Cola deal

- Apple's AI partner

- Update glitch

- Outlook

$AAPL (-2.01%)

$KO (-0.49%)

$MSFT (-1.23%)

Link: https://www.ideas-magazin.de/2025/ausgabe-273/maerkte/microsoft-zentraler-player-auf-weltweitem-computermarkt/?utm_source=techaktien-instagram&utm_medium=influencer&utm_content=aktie&utm_campaign=ideas-magazin

The price trend depends solely on whether there are more fools than papers or more papers than fools.

The year is drawing to a close. That's why I'm looking at my portfolio again today as a kind of year-end wrap-up. On Monday, another €1000 will be invested in the Community Depot. Nothing else is actually planned.

The reorganization in the main portfolio is largely complete and I am not yet 100% satisfied with the position sizes. Some fine-tuning is still required. In the case of dips, I will probably add to one or two positions.

Still under construction are $FMC (-1.68%)

$SOLB (-1.95%) and $SHEL (+0%)

$MAIN (-0.08%)

$O (-0.53%) dividends will continue to be reinvested.

$DTE (-0.64%) will also be kept and increased again at some point. $KO (-0.49%) It's an on-off position for me, I'm actually Team Pepsi, but every time I think the price is right, I buy again.

Everything is going according to plan in the savings plan portfolio. I'm currently putting around €600 per month into it. That's income from my part-time farm. There's enough money in the account in case something breaks down and all the machines are fairly new anyway. A maximum of 10 years old. In other words, they should normally last for the next 20 years. Ok, I still have my old Case 644 from 1968, but it's broken less over the year than the 3-year-old Steyr 😀

Cash reserve for subsequent purchases is about 190k, which is currently at 3.5% interest at the Volksbank.

My company's year-end bonus is probably around 30k, which will go into an ETF in January I'm still thinking about whether Nasdaq, World or dividends.

So and now a few happy holidays to all

For long-term

My portfolio shows a breakdown into different sectors and areas:

trade Republic: the shares and ETFs

scalable Capital : the gold

This is just the portfolio I want to hold for the next few years with a long-term savings plan. And if necessary, individual purchases where the opportunity arises, I think I am now quite well positioned or what do you think of the portfolio.

Stocks that I would like to hold for the long term

- Technology:

$MSFT (-1.23%) Microsoft,- $AAPL (-2.01%) Apple,

- $ASML (-0.79%) ASML

- Consumer goods:

- $KO (-0.49%) Coca-Cola,

- $MCD (-0.57%) McDonald's.

- Finance and insurance:

- $ALV (-1.58%) Allianz,

- $V (-1.03%) Visa

- Real Estate:

- $O (-0.53%) Realty Income.

- Armor:

- $LMT (-0.29%) Lockheed Martin.

- Retail:

- $WMT (+1.52%) Walmart.

- Various sectors:

- $8001 (-1.84%) Itochu

- Health

$JNJ (+1.38%) Johnson & Johnson

ETF as core overlaps are relatively unimportant to me in this area :)

- FTSE All World :

-Global Quality Income:

and then as a supplement

$BTC (+1.59%) bitcoin

and gold $EWG2 (+1.25%)

My conclusion after two months on the stock market

Two months ago, on the exact day of my 18th birthday, I enthusiastically started my career as an investor. The first purchase was an $VWRL (-0.84%) ETF, which I will save in the future. I also bought a few individual shares, a tech ETF and an Asia EM ETF.

For entertainment and out of interest, I bought a few altcoins through my broker. (as I still have a very long investment horizon) I save Bitcoin via Relai.

My entry with the $VWRL ETF was a well-considered decision, as it offers broad diversification and represents a solid basis for my long-term strategy. With the additions of individual stocks, the tech ETF and the Asia EM ETF, I have tried to take advantage of targeted growth opportunities and align my portfolio accordingly. .

The investment in altcoins and the regular Bitcoin purchases via Relai were more of an experiment for me. However, I will continue to invest in Bitcoin as, after doing some research, I am now convinced of its potential as a store of value.

Of course, it has to be said that I entered the market in mid-October shortly before the American elections, which was a good time. This allowed me to participate in the year-end rally and make a good return of 6.2%. However, this was very much influenced by the Destiny Tech 100 fund.

Incidentally, I received my first dividends today ($KO (-0.49%) & $GOOGL (+0.05%) ), which made me very happy, even if it was only a tiny amount

For 2025, I have set myself the goal of having 15k invested and continuing to pursue my core-satellite strategy with ETFs, individual shares and Bitcoin.

Best regards

sar_inv

Trending Securities

Top creators this week