On January 9, 2007, the first Iphone was presented by the then CEO Steve Jobs.

Apple

Price

Discussion about AAPL

Posts

1,118The first IPhone

Portfolio Improvement + Inspo

Hey everyone,

I'm still relatively new to the market & have been investing since the beginning of December. So far I have created four savings plans $IWDA (-0.1%) , $AAPL (-0.19%) , $SPGI (+0.05%) & $NVDA (-0.35%)

I've also experimented a bit with individual shares to get a feel for the market and to show some activity. However, I'm lacking a bit of a real strategy to really make a difference ^^

Do you have any tips that would benefit a beginner like me & that I should pay attention to? For example, tips on how to build up a really well thought-out strategy, which is not really the case for me at the moment :)

I'm looking forward to your experiences & opinions!

Savings plan assessment

Hello everyone!

I'm Patrick, 28 years young and work in the IT sector. I've been on the stock market since the beginning of 2023 and have been a silent reader here for most of the time and have enjoyed following the informative contributions of some others. Now I would like you to evaluate my savings plans.

I am pursuing the following strategy $VWRL (-0.15%) and the $XMME (-0.48%) divided into 80/20. and three quality stocks: $BRK.B (-0.28%) ,$AAPL (-0.19%) and $ALV (-0.63%) - and finally gold: $WGLD (+0.13%)

I still buy individual stocks during the month. Depending on the market and the available capital.

What do you think? The aim is to continue to regularly invest all available funds in order to receive a nice dividend in the long term.

ps: I have just transferred my portfolio to TR, so I can't finalize and post this yet.

Berkshire still holds a very, very large Apple position. And then you would have 3x Apple. Better to spread the €40 from Apple

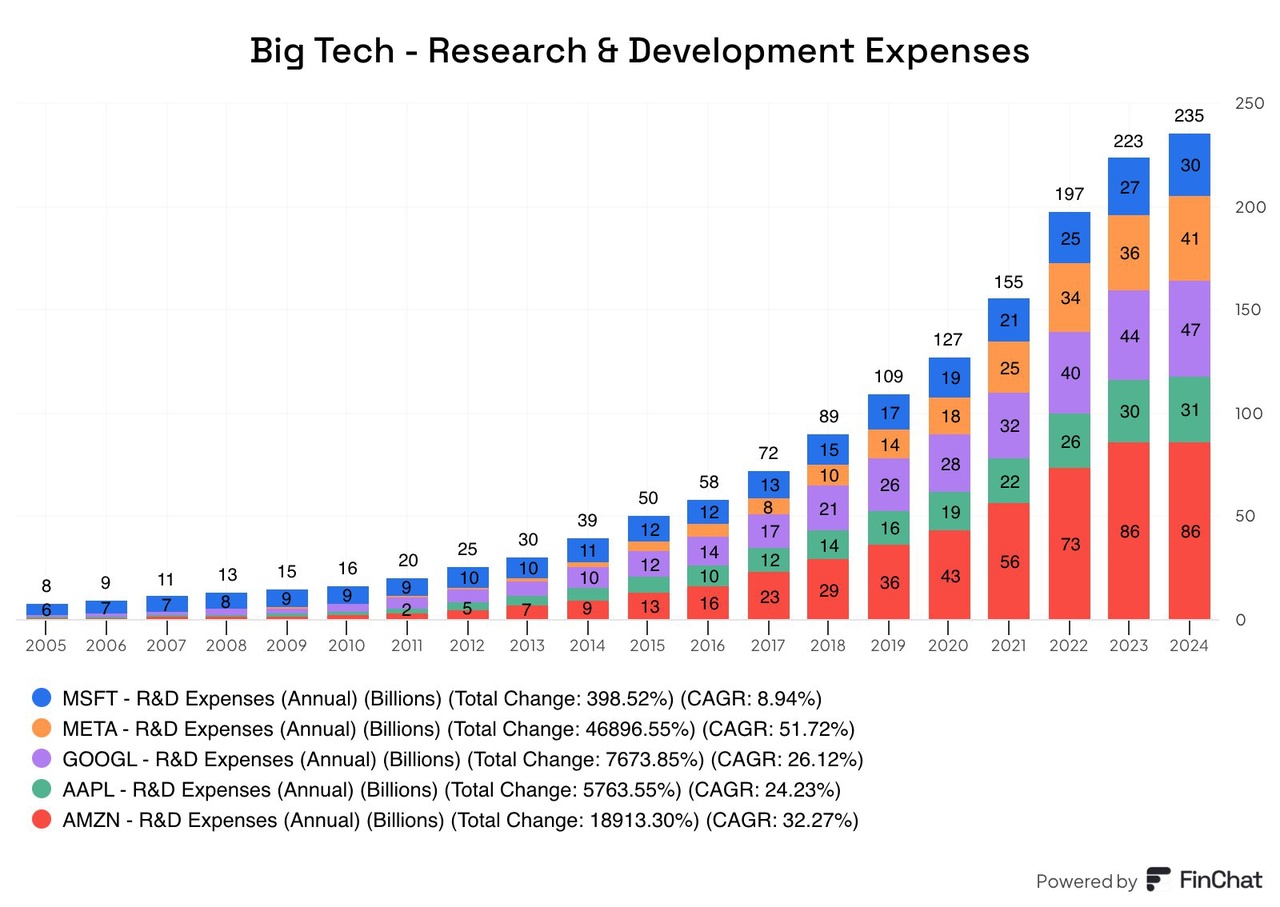

Research and development expenditure Big Tech

$MSFT (-0.32%) , $META (+0.48%) , $GOOGL (-0.21%) , $AAPL (-0.19%) , $AMZN (-0.35%)

The major technology companies spend 235 billion dollars a year on research and development.

That is a 6-fold increase compared to 10 years ago.

In my opinion, the only risk apart from regulation / break-up are the companies themselves. In the case of Meta $META, you could easily feel this 2-3 years ago with the Metaverse, when the market had the feeling that the company was backing the wrong horse. But even then, the normal advertising business was able to make up for the billions.

With Google's 47 billion, you could simply buy the entire Volkswagen Group instead...

I also wrote an article about this a few minutes ago. There was even talk of 500 billion for the Magnificent 7. Tesla and NVIDIA certainly have another large investment budget.

Apple Fitness+

Apple

$AAPL (-0.19%) today announced new features for its Fitness+ streaming service today. These include additional programs for strength training, pickleball, yoga and a new cooperation with Strava - SeekingAlpha

Graphic: Apple.com

Stocks close higher, but the S&P 500 still ended the week in the red

Dow +339.86 at 42732.13, Nasdaq +340.88 at 19621.67, S&P +73.92 at 5942.47

The stock market was in rally mode, benefiting from buying interest after the recent declines. The S&P 500 closed 1.3% higher than Thursday, but was 0.5% lower since the start of the Santa Claus rally period (last five trading days of the year and first two of the new year). The index was just below its 50-day moving average (5,944).

Gains were widely spread. Market breadth favored losers with a ratio of about 3 to 1 on the NYSE and Nasdaq. 24 of the 30 Dow components posted gains and all 11 S&P 500 sectors closed higher. The consumer discretionary sector led by a wide margin, rising 2.4%, thanks to a surge in Amazon.com $AMZN (-0.35%) and a big move in Tesla. Shares of $TSLA (+0.83%) recovered from their 20% drop from their December highs to yesterday's close.

Other mega cap names outperformed the broader stock market and boosted index performance. The Vanguard Mega Cap Growth ETF $MGK (-0.47%) closed 1.7% higher.

Apple $AAPL (-0.19%) was an exception, continuing declines related to iPhone discounting and declining demand in China.

Shares of US Steel $X (+0.21%) also went against the uptrend, slipping after the White House confirmed that President Biden will block the acquisition of Nippon Steel $NPSCY takeover. Nippon Steel Corporation and US Steel released a statement condemning the US government's decision to block the proposed acquisition of US Steel, calling it illegal.

The yield on 10-year bonds rose two basis points to 4.60% and the yield on 2-year bonds rose three basis points to 4.28%.

Apple is said to have discontinued production of the Vision Pro.

According to a report, production of the Apple Vision Pro may have been discontinued at the turn of the year. How many devices were produced in total and what will happen next?

In recent months, Apple's "spatial computer" has not necessarily been a source of positive news: Reports of poor sales figures for the Vision Pro were followed by news of reduced production in October, then there was some back and forth regarding a possible successor. Are they working on a Vision Pro 2, or does Apple prefer a cheaper headset model?

In October 2024, MacRumors reported that production of the moderately successful mixed reality device could be completely discontinued by the end of the year, citing a report by The Information and sources mentioned therein. So now, with the turn of the year behind us, the Apple Vision Pro could already be history - at least as far as its production is concerned.

Rest in peace, Vision Pro - but Apple is keeping the option of reviving it open

Apple's Vision Pro was never able to achieve high sales figures, the range of applications was too small, while the hefty price of just under 3,500 US dollars was too high. As a consequence of the low demand, Apple had already cut back production of the headset in summer 2024.

According to MacRumors (via The Information), enough components were produced in total to build 500,000 to 600,000 Vision Pro devices. This is in line with estimates by renowned Bloomberg reporter Mark Gurman, who estimated in December 2024 that around half a million units may have been sold by the end of the year. Apple could therefore still have a few tens to hundreds of thousands of MR glasses in stock to meet further demand.

However, MacRumors also reported a few days ago that there are still thousands of unassembled components in stock and that the production facilities are not yet to be dismantled. This means that Apple would theoretically be able to ramp up production again at any time should demand increase again - although this is unlikely.

Apple's Vision Pro: Which model will be the next?

The development of its successor, the Vision Pro 2, has probably been put on hold for at least a year, while the focus is instead to be on a more affordable model for around 1,500 dollars.

As MacRumors claims to have learned from suppliers, a total of around four million non-Pro headsets are to be produced in the future, which is probably Apple's response to the low demand for the first Vision Pro. Originally, eight million units were planned for production, as can also be seen from the MacRumors report.

However, it is not certain that Apple will really concentrate on a more affordable MR headset first. Bloomberg expert Gurman continues to assume that the Apple Vision Pro 2 will be released between fall 2025 and spring 2026, as t3n also reported in November.

The future of mixed reality at Apple is therefore likely to remain exciting for some time to come, although its first attempt does not necessarily have to be considered a flop. In terms of revenue, the Vision Pro got off to a similar start to the first iPhone. So maybe this really was just the beginning ...

https://t3n.de/news/apple-vision-pro-produktion-eingestellt-1666210/

My stock market year 2024

As a 17-year-old student, my first (full) year on the stock market really went better than expected. Initially, I wanted to invest a small part of my "assets" and outperform my call money account - and I did so successfully. My TWR is 59.67%I think that's really impressive for a beginner.

Now to my investments:

My year got off to a rather negative start with the sell-off of Neotech-Metals $NTMC (-1.38%) a "tip" from a relative - with a 77% loss, I decided to see this investment as a learning opportunity, which in retrospect was worth it. At least I only lost €126 on my first bet.

Savings plan

Throughout the year, I had my savings plan running at €150 per month:

60€ in $XDWD (-0.08%) -> Later 100€ $VWCE (-0.16%)

45€ in $XMEU (+0.02%) -> Later 50€

45€ in $RBOT (+0.18%) -> Deducted

Since I moved my securities account from Deutsche Bank to ING in April, I no longer have to hold 3 stocks, but can focus on 2.

However, when I turn 18 in April '25, my portfolio will probably move to TR or Scalable.

Investments:

I also had several smaller investments this year $NVDA (-0.35%) investments this year, which I had chosen without any premonition, just because I like their graphics cards. But that was probably the first stroke of luck in my stock market "career".

I also bought more of them:

21.10. 5 x @ 127,45€

16.11. 2 x @ 134,11€

20.11. 3 x @ 139,63€

This brings me to a total of 20 shares and a price gain of 20.12%.

However, this position is slowly becoming too large for me, which is why I will probably realize partial profits soon.

Another new addition to my portfolio were 2 Tesla shares $TSLA (+0.83%) which I didn't even hold for a month, but I was able to take a short-term gain of 27.23%, i.e. €175, which really tastes good in such a short time.

The top winner for me this year was clearly the Apple share $AAPL (-0.19%) which brought me almost 43%. Fortunately, my parents support my interest in the stock market and gave me an Apple share for Christmas instead of an Apple product. In the time since I bought this share until today, it has actually gained 52%, which is of course a great increase in value for a gift. I also received the "bitcoin standard", which is a really great book so far!

So total return is 1632€, of which about 850€ realized.

Goals 2025:

> First, I will probably halve my Nvidia position so that I can buy my first car.

> Leave savings rate at €150 in months without income, increase drastically in months with salary

> More investments in individual shares

> First investments in Bitcoin (I know, volatile, but I'm very interested in the technology behind it)

> Even better financial education, especially with regard to investments

I try to save as much as possible and give up as little quality of life as possible. I am thrifty, but I also like to buy nice clothes or invest in friendships and family, because in the end that is still the most important thing in life!

With this in mind,

A successful year 2025 to all!

2024 Recap: My review and goals for 2025

Summary of the stock market year 2024:

-Impressive performance: In 2024, the S&P 500 gained 24% one of the strongest performances since 1950, driven by a few dominant stocks. Nasdaq around 30%, gold 12% and Bitcoin tops everything with almost 50%.

-Focus on the "magic 7": Nvidia, Tesla, Meta and co. were major contributors to performance, with these top stocks delivering over 30% earnings growth recorded.

-Shift to ETFs: Over 1 trillion dollars flowed into ETFs, while actively managed funds 450 billion dollars lost.

-Political uncertainties: Donald Trump's inauguration brought risk-on sentiment, but also volatility and regulatory risk.

-International markets: While the DAX fell by 19% the Dow Jones remained at 13% lagged behind. China showed "solid" growth, but geopolitical tensions remain palpable

Review of the stock market year 2024

Exceptional market performance

The S&P 500 closed the year with a gain of 24% (similar to last year) - one of the best performances since 1950. The dominance of the "Magic 7" - $NVDA (-0.35%) Nvidia (+180%), $TSLA (+0.83%) Tesla (+74%), $META (+0.48%) Meta (+70%), $AMZN (-0.35%) Amazon (+50%), $GOOGL (-0.21%) Google (+40%), $AAPL (-0.19%) Apple (+30%) and $MSFT (-0.32%) Microsoft (+15%) - shaped 2024, with these companies averaging +30% earnings growth, while the rest of the S&P 500 only achieved +4%. Their average price/earnings (PE) ratio of 30 is significantly higher than the $VUSA (-0.09%) S&P 500 average of 22.7 and shows that the market continues to expect strong growth. Excluding the ten largest stocks in the index, the PE falls to 18, highlighting the dependence of market performance on a small number of players.

ETFs and the relocation of capital

The year 2024 was characterized by a mass shift of capital into ETFswith a record inflow of over 1 trillion dollarswhile actively managed funds 450 billion dollars outflows from actively managed funds. This reinforces the dominance of large companies and changes the market structure in favor of passive strategies.

Economy and politics: influence of Trump and the Fed

The inauguration of Donald Trump as the 47th US president brought a new dynamic to the markets. The Fed adjusted its inflation expectations and raised the neutral interest rate to 3,1%which initially led to rising yields and a stronger dollar. Despite higher inflation expectations, the Fed plans to cut interest rates in 2025 and 2026.

International markets and China

The DAX rose by 19% and benefited from export-oriented companies. In the USA, the Dow Jones remained at 13% behind. China's economy continues to grow "robustly", but geopolitical tensions, particularly in the technology sector, are weighing on international relations. The PMI data for the service sector in China surprised positively, but sustainability remains questionable.

Personal insights and goals

The year 2024 showed me once again how important patience and discipline are when investing. I would like to:

1.Develop better analysis tools: Improve my TradingView indicators and evaluate financial data more efficiently.

2.Strengthen emotional control: Act less emotionally and impulsively and focus on rational decisions.

3.Live in the moment: Focusing more on the here and now and finding a balance between planning and appreciating the present.

4.Be more realistic: Recognize that investing is a privilege and appreciate it accordingly.

5.Increase efficiency: Continue to optimize my processes for analyzing and evaluating individual stocks.

I am very satisfied with my performance this year and hope that you have also come a little closer to your goals. Another post on my expectations for 2025 will follow today or tomorrow.

Future plans for posts

I intend to write more posts in the near future. I want to cover topics that are particularly important to me and that I think could be interesting and useful for many of you. Here are some of my planned topics:

1. crypto on-chain analysis

I would like to discuss the transparent nature of the blockchain to better understand who is buying and who is selling. On-chain data offers fascinating insights into the behavior of market participants, e.g. by tracking wallet movements, whale activity and long-term holder trends. The aim is to make more informed decisions and avoid emotional missteps.

2. tradingView indicators for company data visualization

I am working on a series of indicatorsto visualize specific aspects of company performance and facilitate analysis. Planned are

- Earnings Predictability

An indicator that shows at a glance how how reliably the management forecasts and expectations. This makes it easier to assess the stability and planning reliability of the company.

- Margin Dominance

This is about margin pressure and to recognize the pricing power of a company. The aim is to highlight companies with sustainable competitive advantages and stable margins.

- Debt Management

This indicator visualizes how healthy a company's debt This indicator visualizes how healthy a company's debt is, whether debt is taken on or reduced strategically and whether this is done at times when it is cheap or expensive.

- Capex Cycle Analysis

A visualization of the investment cycle of a company. The aim is to show how efficiently investments generate income and whether capital expenditure is being used strategically.

- Compounder Rating

An indicator that shows how companies that I classify as value compounders perform over different time horizons. The aim is to be able to better assess the long-term quality and stability of such companies.

I look forward to working on these topics and sharing them with you. If you have any suggestions or specific questions, please let me know!

ETF customization

Happy New Year everyone! We are starting the new year with adjustments to the Sina ETF. (The performance here below somehow no longer corresponds to the actual performance, but so be it...) After this post you'll have peace and quiet from my ETF again :D

I sold some stocks and invested the dividends I received last year. That left me with 19 euros in cash, so it's still a 40-share ETF ;)

If this were my only portfolio, I would probably have held more cash and not reinvested directly, as the entry point doesn't always seem optimal. But I also proceeded without regard to entry points.

For the question of how high the profits or losses were, please refer to the portfolio.

Out are:

$STLAM (+0.76%) (loss)

$AFX (-0.24%) (loss)

$MC (+1%) (loss)

$OR (-0.18%) (loss)

$7203 (-1.29%) (loss)

$D05 (-2.11%) (Profit)

$RHM (-0.6%) (Profit)

$ENR (+0.4%) (Profit; also dropped from my "real" portfolio)

Partial sale:

$WMT (-0.25%) at 50%

Increased by:

$ASML (-0.36%) Since the position was down over 20%, but I am convinced in the long term

New additions:

Trending Securities

Top creators this week