$NU (+0.08%) buy more or wait and see? What do you say

- Markets

- Stocks

- Nu Holdings

- Forum Discussion

Discussion about NU

Posts

144Depot roast

Hi dear community!

I would like to hear your feedback.

I currently have a savings rate of 2k per month and am building up a cash position (at 2k currently).

The following positions are saved via a savings plan:

$VWRL (-0.84%) 100€ pM

$BTC (+1.63%) 100€ pM

$JEDI (-2.18%) 100€ pM

The remaining €1700 is therefore available for individual purchases.

As an example, I am currently waiting for an entry point at $NU (+0.08%)

A quick word about me... In my mid-30s and neither getting a euro nor any financial intelligence "from home"... Social cases, alcoholics, drugs etc.

My big goal is to be financially free and currently I still have a condominium (~280k € value, bought very cheaply - luck!) which still has to be paid off with ~9k €. That means the project will be completed in 2025.

In the future, I don't want to live such an ascetic life and buy myself something nice from time to time.

Thanks for your great contributions here and the community :)

Regards

Tobi

The performance of your portfolio is still not great. B&H ACWI would have easily beaten you.

Have you ever thought about strategy diversification? You are slowly getting to an age and a portfolio size where a systematic reduction in risk could be relevant.

🚀🚀 Raffle of 21,221 getquin coins or the equivalent of a GQ Patagonia jacket 🚀🚀

As announced in my post, I am giving away all the coins that I have collected or won with this post. In addition to the 20,000 coins, there are 1,221 coins that I held as at 31.12.2024.💸💸💸💸

Every user who has donated to a recognized charitable organization in December 2024 is eligible to participate.

To participate in the raffle, all you need to do is comment on this post with the link of the organization you donated to. ⚡Please only those

who can also prove the donation in the event of winning (by means of a post / screenshot of the donation receipt - the donation amount can be concealed).

In one week I will determine the winner from all the comments.

Legal recourse is excluded. The raffle is a private action of mine

and is not connected with getquin.

@christian Thanks for the#feiertagschallenge 🙏

$BTC (+1.63%)

$NVDA (-2.38%)

$MSTR (+0.28%)

$MSFT (-1.24%)

$META (+1.53%)

$NU (+0.08%)

$NOVO B (-0.16%)

$GOOG (-0.09%)

$TSLA (-0.03%)

$VWCE (-0.87%)

$VUSA (-0.82%)

$CSPX (-0.83%)

#feiertagschallenge

#moneymanagement 💸💸💸

"The whole secret of stock market success is to lose as little as possible when you're wrong."

A good idea from @christian which I like to use as an opportunity to combine knowledge contributions with a good cause.

All GQ Coins from this post, including all GQ Coins that I hold as of 31.12.2024, will be transferred to a randomly selected community member who has donated to a recognized charity in December 2024.

Legal recourse is excluded. The random principle applies - one of the donors wins! There will be a post from me after the end of the challenge, where everyone who has donated something can comment on it. One of these users / comments will then be selected at random. As soon as the donation is documented by a screenshot, I will transfer all my GQ Coins to the randomly selected donor.

Those of you who donate regularly anyway can be rewarded in this way, as well as those who may be motivated to donate.

But now to the contentAfter the rally of the last few weeks, I would like to take another look at a topic that I wrote a post about 2 years ago. It's about risk management, in particular one part of it, the money management.

What will you read below?

1. what are risks?

2. what is money management?

3. money management using an example

4. money management and you

5. conclusion

In my more than 25 years on the stock market, money management was and is the "key to success" for me in order to sustainably limit losses in the event of wrong decisions.

Investing in the stock market involves risks. But don't worry, we have control over some of them. Money management is your best friend. It helps you to limit losses and protect your profits.

Imagine you're building a house. You plan carefully, set a budget and insure it against damage. It's similar on the stock market. Money management is your blueprint that ensures that your "house" - your portfolio - remains stable, even when it storms.

In a figurative sense, money management can be thought of as an insurance deductible. With this deductible, your risk is limited and calculable.

1 What are risks?

There are essentially two types of risk:

Risks that we cannot influencesuch as the general market environment, political events such as the war in Ukraine, or the interest rate policy of national banks such as the FED or ECB.

Risks that we can influence such as "no" diversification, "no" knowledge or simply "no" risk management.

Money management is also an area that we can influence. Alongside diversification, it is the most important risk management for me.

2 What is money management?

Money management determines the capital investment and the position size on the basis of the maximum loss to be accepted. It is about determining the optimum position size.

Why is money management important?

- To limit losses: A 50% loss needs 100% profit to be made up.

- Maintain discipline: It's easy to be led by emotions. Money management helps you stay rational.

- Ensure long-term success: You can build your wealth over the long term through consistent risk management.

The 3 most important tools:

- Diversification: Spread your money across different investments.

- Money management: Determine how much you risk per investment.

- Stop loss: Set an automatic sell order if the price falls below a certain limit and limit the loss.

3. money management using an example

How much should I risk?

A common rule is: Never risk more than 0.5% to a maximum of 2% of your total capital per investment position.

Example: Your total capital is €10,000 and you want to buy shares. According to the rules of money management, you want to risk a maximum of 1% of your total capital per position. The position size of this share is now derived from your stop loss, which limits the position to a loss of €100.

Calculation of the optimum position size using the example of €10,000 capital:

- Total capital: 10.000€

- Maximum loss: 100€ - that is 1% of 10,000€

- Difference between purchase price and stop loss: e.g. 2€

- Number of shares: 100€ / 2€ = 50 shares - in this example, this is the optimum position size to limit the loss to 100€.

Why is this so important?

- Protection against large losses: Even if several investments perform poorly, you still retain a large part of your capital.

- Sleep soundly: You know exactly how much you are risking.

Everyone catches bad stocks or gets in at the wrong time. Imagine your assumptions are 10 times wrong. With good money management, you can still secure 90% of your capital. If, on the other hand, you lose 50% of your capital by taking too large a position, you would have to achieve 100% performance with the remaining capital just to get back to "0".

4. money management and you

Money management is not a magic potionbut a valuable tool. It requires discipline and consistency. But it's worth the effort. Well thought-out money management can help you achieve your financial goals.

There are of course differences between short/medium-term traders and long-term investors. For traders, money management and risk management in the form of stop prices is essential. For long-term investors, diversification is the means of choice; money management is more or less already done when the savings plans or the investment amount are determined.

But I also recommend that the buy-and-hold investors among you think about money management. In reality, it is not so easy to distinguish between the two, the transitions are blurred. What short-term traders need to keep an eye on at all times, long-term investors should also do from time to time. Check your position sizes and think about exit pricesi.e. adjust any stops. "Easy come, easy go" would be a shame, especially after recent bull runs.

5. conclusion

There are many imponderables on the stock market. But there is one thing you can control: your risk. With money management, you can consciously manage this risk and thus increase your chances of long-term success.

I would like to conclude my post with the well-known rules of Warren Buffet:

Rule number 1: Don't lose money

Rule number 2: Never forget rule number 1

A long post, but hopefully not TL:TR for you! Enjoy the festive season and take time for your loved ones! But I don't mean your shares or coins! 🎄🎁🎇

Sale of Palantir

30% Sold and reinvested in $NU (+0.08%) reinvested. If Palantir corrects a little, I'll put my foot in again🚀

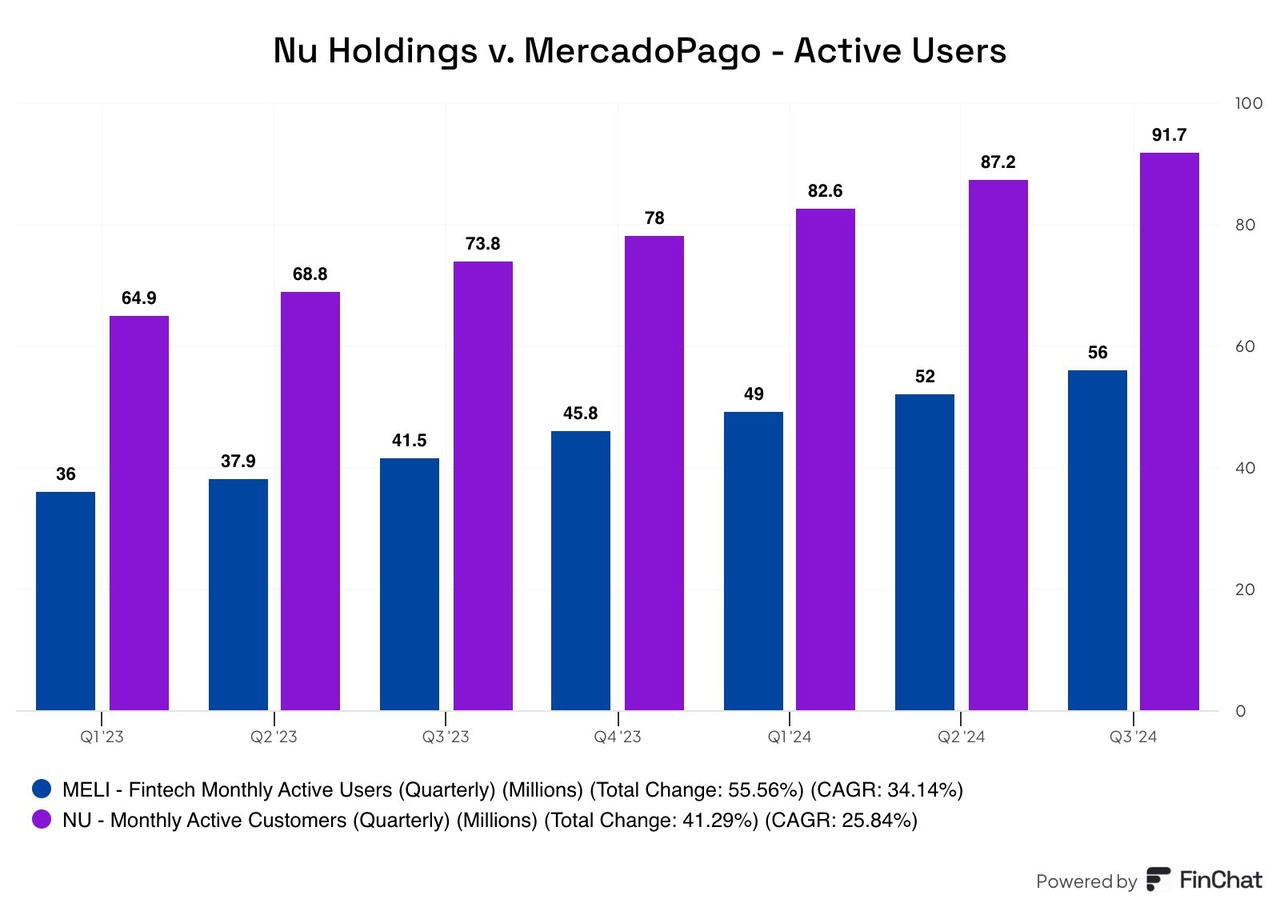

Nu Holdings vs MercadoPago - Active users 💳

The development of active users of Nu Holdings

$NU (+0.08%) and MercadoPago

$MELI (+0.22%) in the period from Q1 2023 to Q3 2024.

During this period, Nu Holdings recorded an increase monthly active customers of 36 million to 56 millionwhich corresponds to growth of 41.29 % (CAGR: 25.84 %).

MercadoPago grew from 64.9 million to 91.7 million active users, an overall growth of 55.56 % (CAGR: 34.14 %). Despite the lower percentage growth at Nu Holdings remains MercadoPago remains the leader in the number of active users.

10 stocks to hold in your portfolio in 2025 💎

Nu is a leader in digital banking in Brazil and Latin America

1. Nu reaches around 53% of the adult population in Brazil.

2. Customer acquisition cost (CAC) of USD 7, and service cost per customer around 85% lower than traditional banks.

World leader in lithography equipment, ASML is a key player in the semiconductor industry.

1. ASML has a worldwide monopoly on systems (extreme ultraviolet lithography)

2.31% ROIC and 51% EBITDA margin above industry standards

Major player in cryogenic technologies applied to the transport and storage of liquefied gases

1. Key market for the energy transition, growing by CAGR 27% 2024-2032

2. Exceptional EBITDA margin of 54.9

3. Portfolio of 3,295 active patents

Leader in cloud-based data management

1. Premium customer base: 542 customers generating over $1m and high net retention (127% in Q3 FY2025).

2. Multi-cloud architecture with advanced capabilities for secure data collaboration

A key player in logistics and technology services for e-commerce

1. Same-day or next-day delivery to over 90% of the Chinese population thanks to its logistics park

2. Attractive valuation (PER 11.52x)

International retailer specializing in lifestyle and design products

1. Rapid growth in key regions such as Latin America (+18.7%) and North America (+89% by 2024).

2. Innovation: 940 new products introduced every month

European leader in defense and mobility technology.

1. Visibility of revenues: order book of 38.3 billion euros

2. Diversification between defense and civil mobility

Global Leader in Security, Healthcare and Optoelectronics Technologies

1. Technological advantage with products such as CertScan® or RTT® 110

2, 40% recurring revenue from turnkey solutions and maintenance

Specialized in drilling and pressure control technologies for the oil and gas industry

1. Market leader in the United States

2. Return on Equity > 30

Company specializing in the manufacture and installation of glass for the construction industry

1. Sector leader in the US where construction will benefit from D. Trump's policies

2. EBITDA margin > 25% and 2-figure growth over the last 3 years

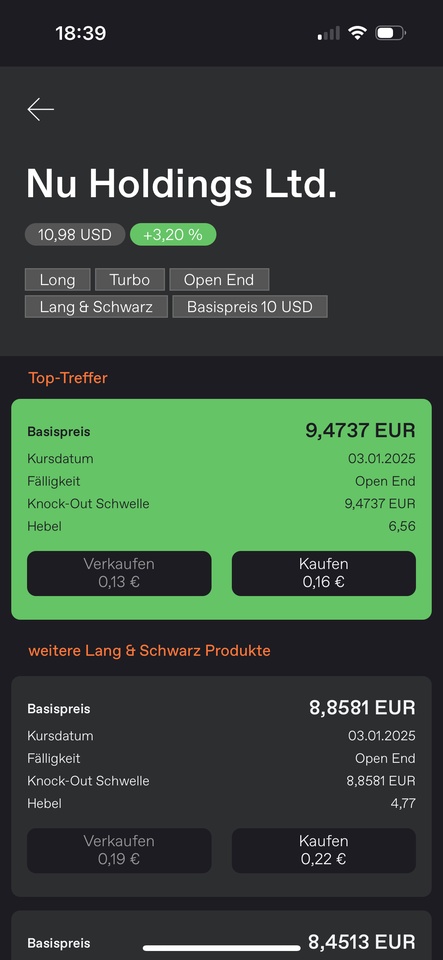

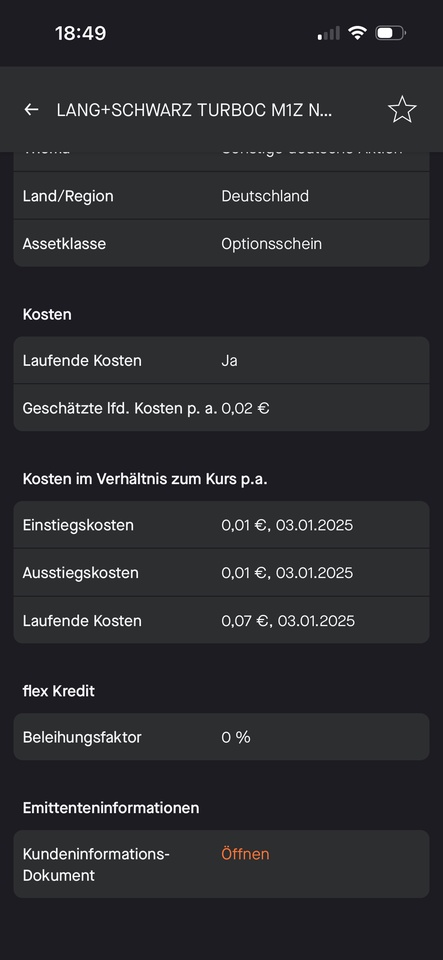

Leverage products & certificates Functionality

Question of understanding:

Dear community, since there is not really a sample portfolio at flatex, or you can test this without losing money 😁, can someone explain the mechanics to me ?

Using the example of $NU (+0.08%) when will I be undocked ? When does the bill expire?

Assuming I now buy 10,000 shares at 0.16 = 1,600.00 euros, how much of a loss do I have to make for it to become worthless?

Is the strike price equal to the knock-out threshold? Or do I have to start from the USD 10.98 (about 10.65 euros) and at -11 % the bill expires ?

Perhaps someone here has some experience, learning by doing could be quite expensive, especially as I am not yet sure how the costs will be affected ?

Maybe it's a display error because of the weekend? 😁

The explanatory videos from flatex are usually not helpful here.

Thanks in advance ✌️

minus. The spread should be no more than 1 cent.

Value Investments for 2025

Hi all,

I have been researching investments to make for 2025 which I consider to be undervalued and have upside potential to beat the market in 2025. An equal amount will be invested in the S&P just incase I’m not a genius investor.

I would appreciate any advice/information that people have on these investments.

Nu Holdings $NU (+0.08%) - Huge growth potential and good buy opportunity.

Micron Tech $MU (-0.69%) - High demand in High Bandwidth Memory.

Alphabet $GOOGL (+0.06%) - Great position to profit from AI and big year for Waymo.

Evolution AB $EVO (-0.37%) - Great growth and a good price to buy in.

Block $SQ (-4.58%) - Good product sweet with huge growth potential.

Transmedic Group $TMDX (-14.62%) - Great YoY growth, recent pullback in great buy opportunity.

Many happy returns!

Technical analysis - Nu Holdings

After the nice fundamental analysis of @BamBamInvest and the hype, I thought I would take a brief look at the technical indicators at $NU (+0.08%) .

No investment advice.

I am invested in Nu myself. In the pictures 4h-Candles in EUR are used (unless otherwise stated).

Possible bullish signals

- Nu has been in a relatively strict downtrend for more than a month now. downward trend which is now breaking down. The trend line has been broken and the price is currently hovering ~9% above support (recently rising).

- The last support has a comparatively high volume, which stabilizes the price. (Bar on the right in the picture)

- The MACD (Moving Average Convergence / Divergence) shows increasing upward momentum, and MACD and signal line are approaching the zero level from below, which could indicate a transition to an upward trend. (above: impulse-adjusted MACD, below: standard MACD)

- It is noticeable that the price has formed lower lows since mid-November ( -> downtrend), while the MACD has formed higher lows. This bullish & reversible divergence shows that although the price continues to fall, the downward momentum is decreasing and the trend is therefore tiring.

- The RSI (Relative Strength Index) currently currently higher lows and is therefore rising. Buyers are more active again and the momentum is shifting towards "bullish".

Possible bearish signals

- The price is still in a downward downward trendeven if the previously entered trend line was slightly broken.

- Even after the last rise, the price is still below below most of the moving averages. In addition, the 50-EMA is below the 100-EMAwhich is considered a downtrend. However, these intersections are often strongly delayed. (In the picture: 50-EMA light blue, 100-EMA dark blue and 200-EMA band in gold).

- The Stochastic Oscillator was at 90.30 at the close of the last 4H-candle and could therefore (at least in the very short term) already be considered overbought already overbought.

- The recent bullish momentum has weakened in the last few trading hours, but this and the previous feature are more interesting in the short term. (In the picture: 1H Heikin Ashi candles)

After a possible rise, further solid support and resistance levels with high volumes await the price. In order to reach the ATH of ~€15, the price would have to rise by around 42%.

I hope this article was helpful. If you find any errors or contradictions, please let me know.

All presented are merely my interpretation of the data.

Technical analysis involves risks and is no guarantee of future performance.

For information purposes only, own research is recommended.

Pictures from TradingView

+ 3

Investors should probably realize that now.

It's not like LVMH here

Trending Securities

Top creators this week