Sensible $HBH (-1.09%) sell and in $IWDA (-0.96%) go in. Does the $IWDA (-0.96%) make sense with $IUSA (-1.05%) position ?

Thank you in advance 😊

Posts

50Sensible $HBH (-1.09%) sell and in $IWDA (-0.96%) go in. Does the $IWDA (-0.96%) make sense with $IUSA (-1.05%) position ?

Thank you in advance 😊

Hello getquin community,

I am currently investing 250€ per month in the $IWDA (-0.96%) and 2x 25€ in $BTC (+1.38%). My long-term goal would be an allocation of 70% MSCI World/ $IUSA (-1.05%)20% BTC and 10% individual stocks.

Now my BTC share has risen to 26% due to the price increase and I am considering whether I should sell part of it and switch to my ETF position when the price rises again. However, I would have to pay 27.5% tax on the gains.

I actually take a long-term view on BTC and would like to keep the position and expand it further. But it would also be tempting to take something in the bull run in order to buy more in bear phases.

What do you think? Does it make sense to take profits or should I just let the position run and focus on long-term growth? I would be delighted to hear your opinions - thanks for your input!

It can't hurt to have it in your portfolio if you're in the mood to invest and don't quite know where to put your money 😂

Otherwise I think the ETF is super😊👍, the annual costs of 0.07% are limited and I also get them back through my Blackrock dividend 😂👍

PS. Don't worry, I won't be reallocating anything and the Ultimate Homer will continue to run 😊👍

I'm facing a challenge that, as is so often the case on the stock market, is all about timing. Specifically, I'm planning to buy a larger tranche of an ETF - let's call it for the sake of simplicity $VUSA (-0.98%) or $IUSA (-1.05%) .

As the US elections are just around the corner, there are various scenarios. Currently, one could assume a 50% chance of Trump winning and an equal chance for Harris.

If Trump wins, there is a realistic possibility that the markets will behave in a similar way to his last election: an initial slump followed by a sustained, euphoric upswing.

The situation is different if Harris wins. Here we would have a kind of "black swan": the first female president of the USA and a defeat for the more business-friendly Republican. The market reaction would be difficult to predict. I could imagine that there would initially be a certain amount of euphoria, followed by slight falls and a phase of sideways price movements, whereby individual sectors could come under particularly strong pressure.

Of course, the election result cannot be reliably predicted, and even less so the reaction of the markets to it. Nevertheless, from a scientific and statistical point of view, one of the following buying strategies is likely to be more advantageous and promising than the others. But which one?

a) I invest 100% of my capital today.

b) I wait for the election results and then invest 100% on November 11, for example.

c) I divide the capital into 4 tranches and invest 25% today, 25% on November 1, 25% on November 6 and the remaining 25% on November 10.

d) Feel free to suggest other buying strategies in the comments 🤓

Which strategy do you think makes the most sense under the current conditions?

Part I

---------------------------------------------------------------------------------------------------------

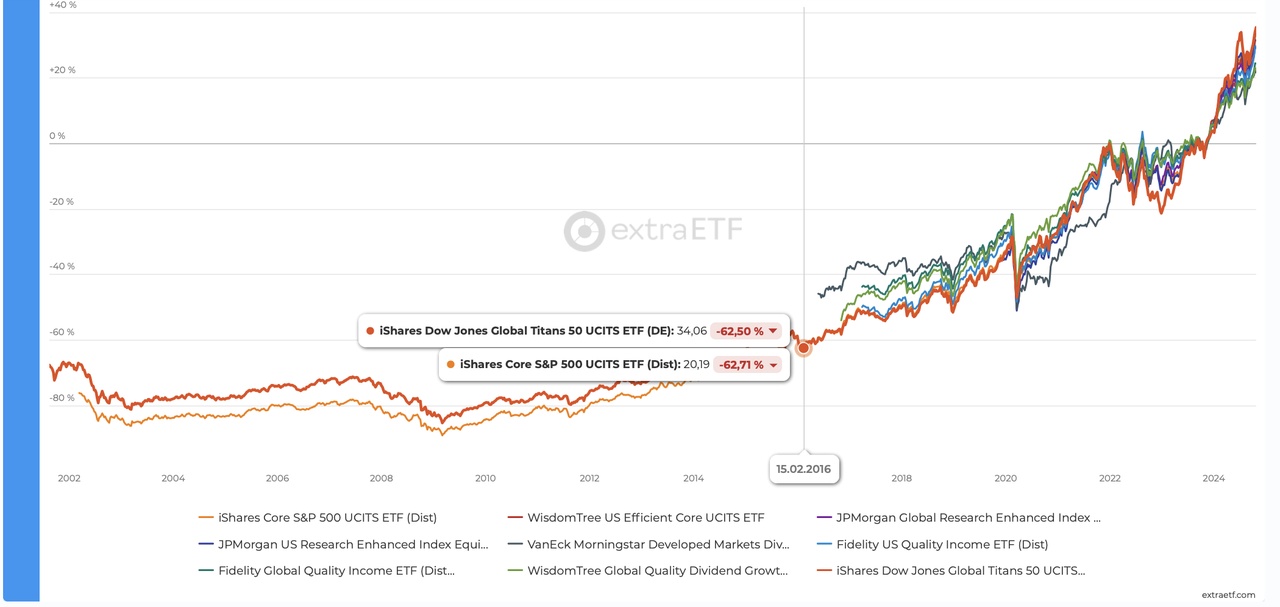

So far, the core of my portfolio has consisted of the MSCI World $HMWO (-0.96%) and has brought me around 26% price gains and a few distributions. However, comparisons and back tests have shown that the MSCI World is not the best choice for the portfolio.

---------------------------------------------------------------------------------------------------------

The satellites consisted mainly of shares in well-known, large and often safe companies. I have gradually changed this over the last few weeks and you could say that the portfolio is changing in the direction of growth stocks with significantly higher risk and return potential. Whether and how successful I will be here is not too important in principle, as I still have a solid core, but it is precisely this core that is in the dock today.

---------------------------------------------------------------------------------------------------------

After spending the last few weeks looking at my portfolio and getting a lot of positive input, information and tips here on Getquin.

I have found the following ETFs that could perhaps form a better core for my portfolio.

A) The best known first, the S&P 500 $IUSA (-1.05%) . If I were to start investing again today and did not know the following ETFs, I would opt for this one instead of the MSCI World.

B) The ETF mentioned by @Epi mentioned ETF, $WTEF (-1.65%) . A portfolio concept consisting of 60 % US equities + 40 % bonds. Almost like the ARERO 😜 $LU0360863863 (-0.58%) only much better. Because the performance so far has been very close to that of the S&P500. And I think that in turbulent stock market years, bonds will provide stability and returns. However, the fund is only one year old and so there is still little data available.

C) Then we have my favorites so far, 2 actively managed ETFs from JP Morgan.

One is the global variant $JRDG (-0.91%) including emerging markets. Here, undervalued companies are overweighted according to fundamental data. Since its launch in September 2021, this fund has returned 11.88% p.a.

And then the counterpart to the S&P500 $JRUD (-1.09%) the aim of this ETF is to outperform the S&P500 and to this end it also includes US equities that are not included in the index.

Since launch, December 2019, 16.5% p.a. has been achieved.

D) Then we have four dividend growth stocks. These have also beaten the MSCI World at times: $TDIV (-0.5%)

$FUSD (-1.1%)

$FGEQ (-0.84%)

$GGRP (-0.69%)

The $FUSD (-1.1%) with a return of 13.66% p.a. since its launch in March 2017.

E) The iShares Dow Jones Global Titans 50 $EXI2 (-1.04%) which has outperformed the S&P500 for many years and has realized 17.38% p.a. over the last 5 years, for example.

---------------------------------------------------------------------------------------------------------

I did some back testing to see how you could build a portfolio with these ETFs. However, most ETFs have not been around long enough to provide meaningful data. I also find the backtest very tedious as no perfect allocation is calculated or suggested, instead I have to work my way forward percentage by percentage. In short, I was not successful in backtesting.

I used these websites for the tests and comparison:

https://www.portfoliovisualizer.com/backtest-portfolio#analysisResults

---------------------------------------------------------------------------------------------------------

I would prefer to take them all and only buy the ones that are doing badly at the moment. But that wouldn't work because these ETFs overlap a lot and the correlation is therefore very high. ☹️

Perhaps the most dispensable would be the "dividend ETFs", $TDIV (-0.5%) and $GGRP (-0.69%) . These have some of the highest fees and the weakest performance. However, these are precisely the ETFs that overlap the least with the others. $TDIV (-0.5%) could pass as Europe (55%) share of the portfolio. If you want to take Europe into account. It would be interesting for me if one region is doing well and the other is doing badly, because I could then make counter-cyclical purchases.

If overlaps and correlations are very high and costs are similar. Then it wouldn't matter whether I have them all in small chunks or large shares of one or a few ETFs. The difference should then be marginal. 😅

---------------------------------------------------------------------------------------------------------

Should I really only choose one or a few? What am I missing out on? How do you find the right one(s)? Has anyone built a portfolio from these ETFs? How do you make the right decision?

---------------------------------------------------------------------------------------------------------

Part II

Hi guys need your swarm knowledge.

I am looking for a stable dividend ETF that

distributes quarterly in February, May, August and November.

Strong dividend or price growth is not a criterion but is welcome. My main concern is that there are no strong price fluctuations.

Something like the $IUSA (-1.05%) but less USA

Top creators this week