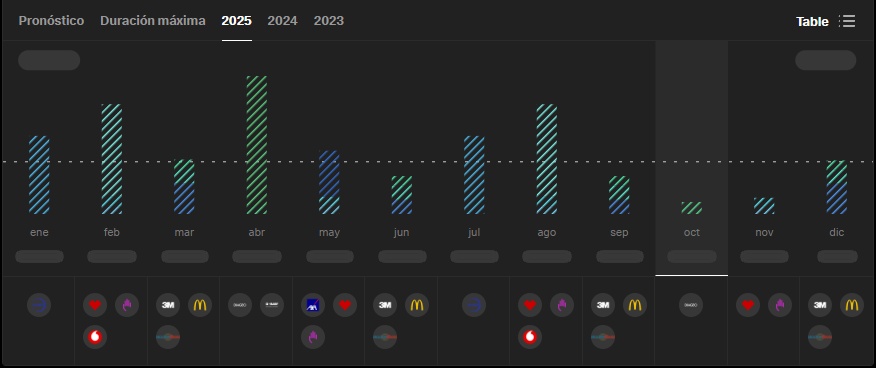

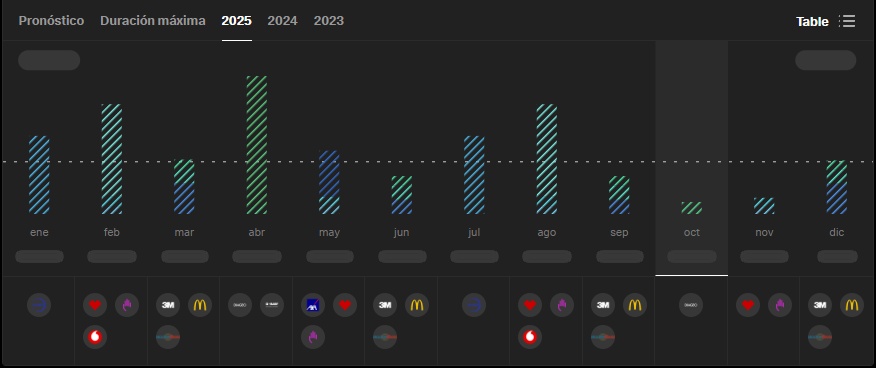

I'm considering buying British American Tobacco and W.P. Carey to boost my #dividends for October and November.

What are your thoughts on $BATS (+0,8 %) and $WPC (+0,38 %) ? Is now a good time to buy, or are there better options available?

I'm considering buying British American Tobacco and W.P. Carey to boost my #dividends for October and November.

What are your thoughts on $BATS (+0,8 %) and $WPC (+0,38 %) ? Is now a good time to buy, or are there better options available?