📈 COMMODITIES 2024: PROSPECTS FOR INVESTORS 🛢️

This year will be extremely exciting for commodity prices.👀📈

Even if you are not interested in investing directly, the original article is definitely worth the 2 minutes of reading time.

Analysts predict that prices could rise again for the time being.

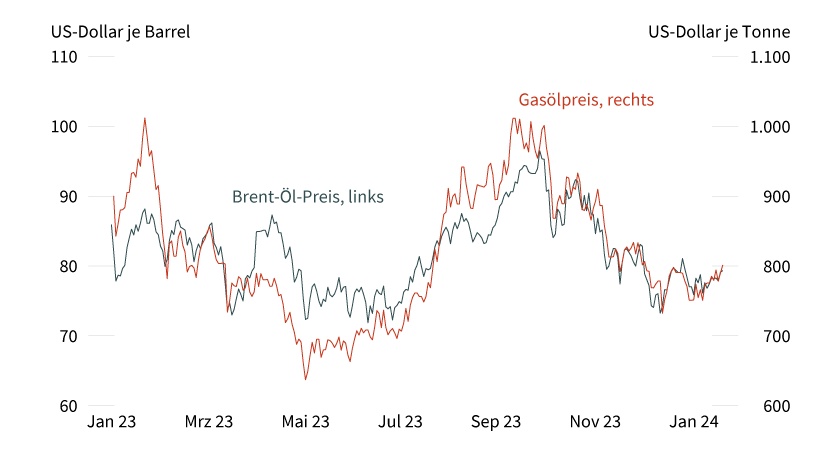

For example, the current weakness on the oil market ($IOIL00), caused by demand concerns and an oversupply, could stabilize by mid-2024 according to experts and lead to a price recovery. (1)

Precious metals such as gold ($EWG2 (+0,41 %) / $965515 (+0,61 %) / $4GLD (+0,11 %) ) and silver ($965310 (+0,41 %) ) could also benefit from changing interest rate expectations. In particular, the prospect of interest rate cuts by the US Federal Reserve will have a strong influence on the price of gold. (2) (Image 1)

The situation with industrial metals such as copper, whose prices were under pressure in 2023, is particularly exciting for me. A possible shortage of supply could drive prices up again. (3) Similarly with the CO2 price, although the situation here looks rather modest in the short term. (4)

Do you agree with this or has something important been overlooked?

(1) Section "Exaggerated concerns on the oil market"

(2) ibid. "Precious metals under the spell of interest rate expectations"

(3) ibid. "Better times on the industrial metals markets in sight?"

(4) ibid. "CO₂ price in EU emissions trading"

#rohstoffe

#finanzen

#marktausblick

#commodities

#marketsentiment

#finance 📊

This article is part of an advertising partnership with Societe Generale