My last stock presentation for January and this one has it all. It covers what I consider to be an insanely fascinating area, namely outer space. You always hear a lot about Musk's Space X, Jeff Bezos' Blue Origin or companies like Boeing and Lockheed Martin. These projects or companies are certainly flagships. But you don't have to look that far to invest in the future market of "space":

OHB SE

DE0005936124

OHB SE is a technology and space company operating throughout Europe. OHB serves international customers with solutions and systems. Its portfolio includes solutions for the entire value chain of satellite development, construction and operation, data transmission and processing as well as the development and construction of scientific payloads and aerospace structures. The company is also working on projects for equipping and operating the International Space Station (ISS) and on concepts for exploring the solar system.

Key figures:

P/E RATIO 21: 23.1

P/E ratio 22e: 17.3

Net debt 2022e: 5.5 million

Net income 2022e: 37,5 Mio

Net margin: 2.37

Gross margin: 41

Dividend yield 2021: 1.29%.

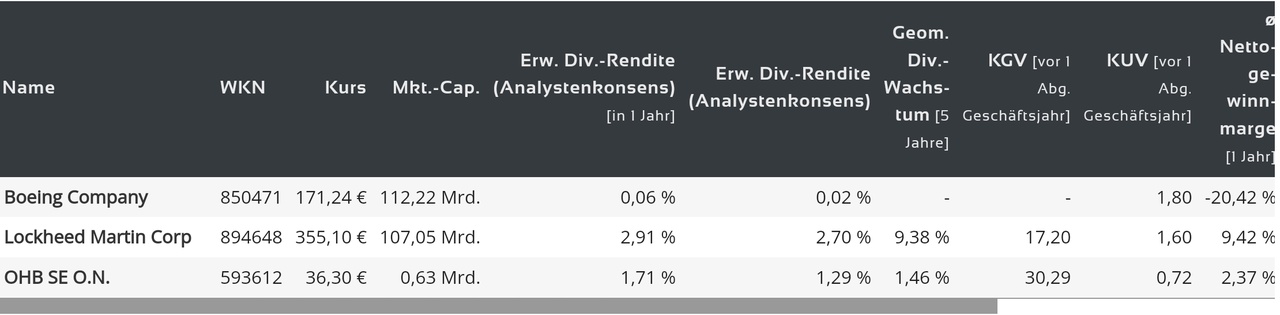

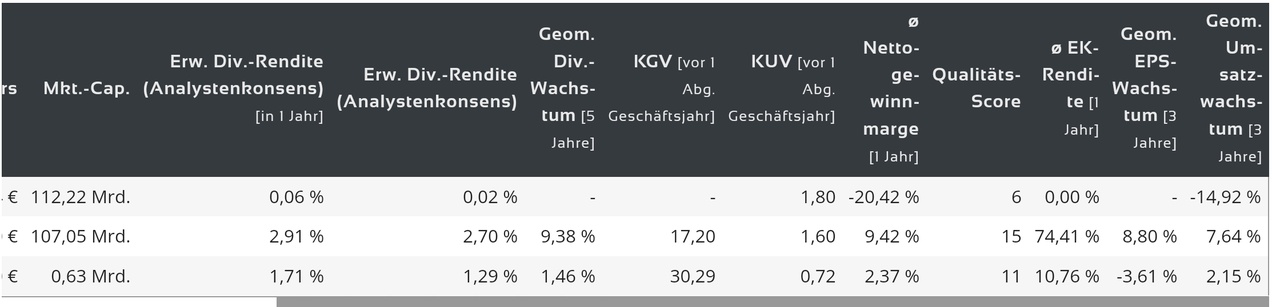

Biggest competitors:

-Lockheed Martin

-Boeing

-Thales

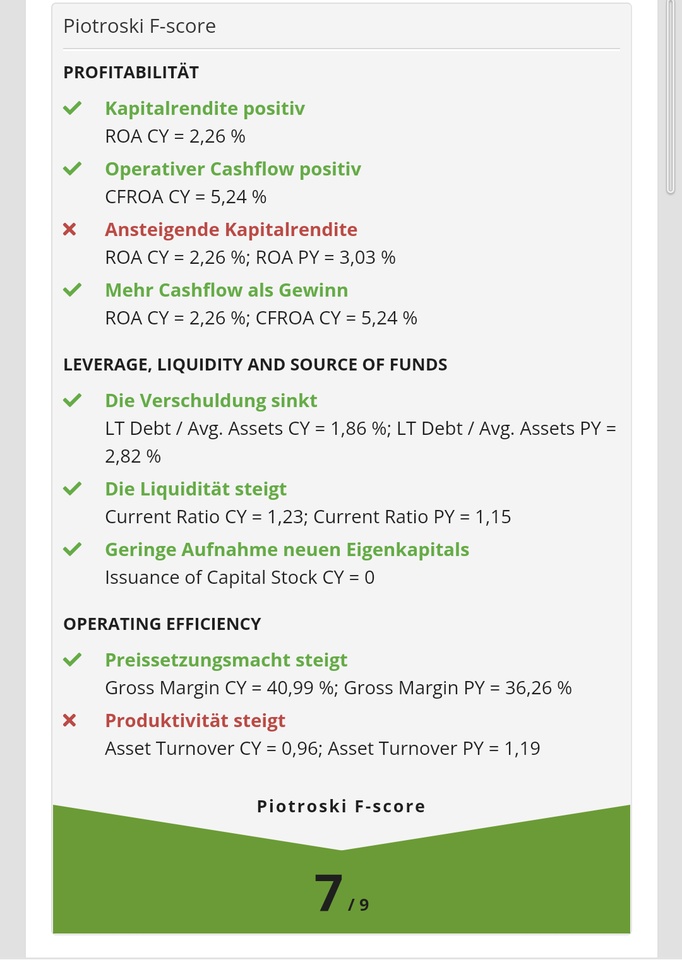

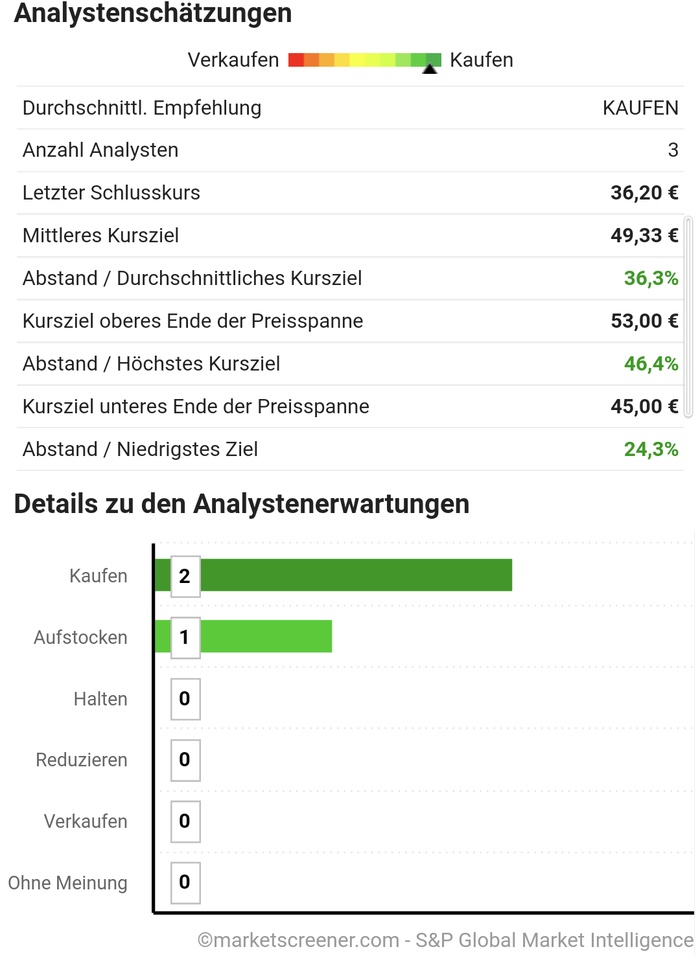

OHB is very well positioned fundamentally. They are hardly indebted. Both the medium-term (5Y) and long-term (10Y) sales and EBIT growth is intact. However, the competition is strong and the valuation is not cheap but rather moderate. Asset-intensive companies usually have a somewhat lower P/E/E ratio. Nevertheless, OHB promises good growth, which makes the valuation, compared to the peer group, still somewhat plausible. Nevertheless, I find it exciting to have such an emerging, comparatively small, company in Germany. Demand in this area will certainly increase in the future. I have them on the WL, but am not yet invested.

What do you guys think of OHB? Do you already have them on the WL?

No investment advice!