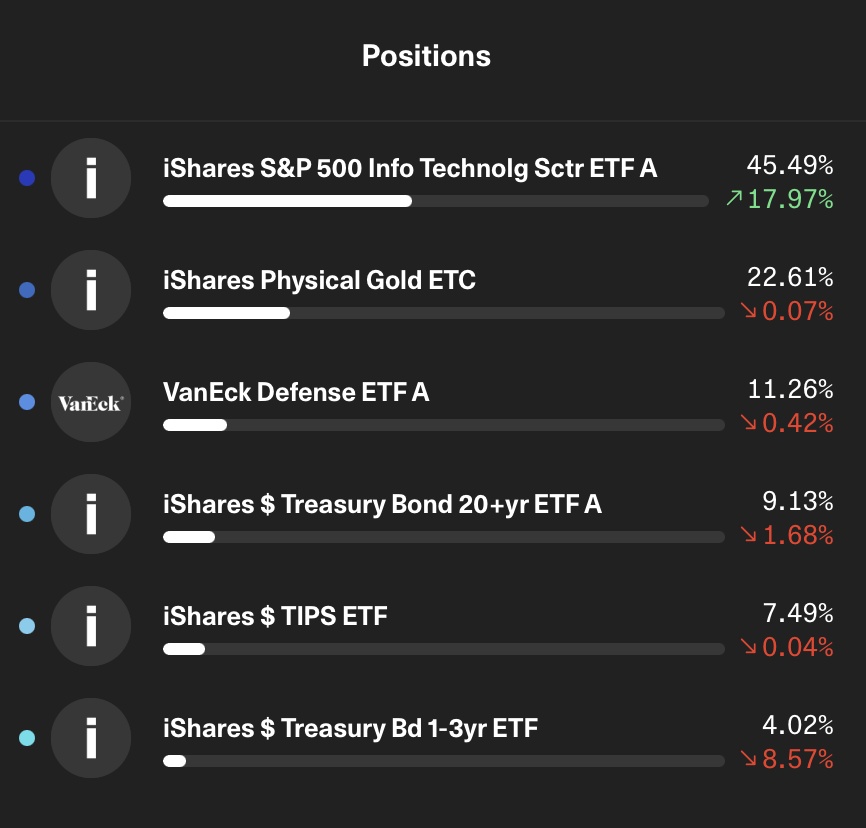

My ETF portfolio

Only completed this month, so the gains and losses are perhaps a little strange.

The Information Tech ETF serves to invest as focused as possible in all the compounders, I would generally prefer the equal weight variant, but unfortunately it is not yet available in Europe as far as I know. The VanEck ETF is intended to protect the portfolio somewhat from geopolitical risks, and the companies are also quite interesting and all have the state as a major customer, either directly or indirectly, which I think is a very good addition. Weighting is around 55% at the beginning and will be rebalanced as soon as the equities exceed the 80-85% threshold. In this way, I hope to take as much upside as possible and leave the equity area largely unhindered.

The 22% weighting is based on the post from dear @Epi regarding gold.

Like gold, the combination of bonds is intended to take out some volatility and provide an alternative cash position. However, I am considering possibly exchanging the 1-3 year bonds for BTC.