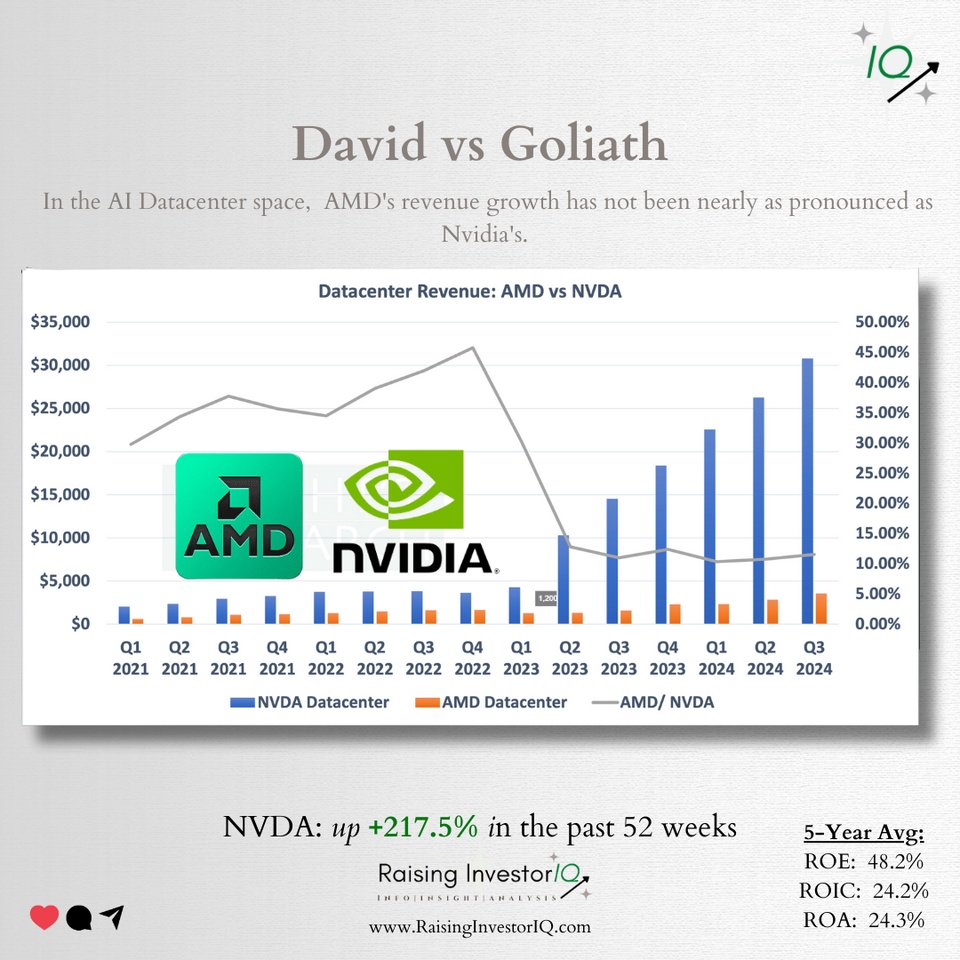

Over the past few years, revenues for $NVDA (-1.2%) and $AMD (-0.85%) have both experienced solid growth. But clearly the revenue growth for $AMD (-0.85%) is not nearly as pronounced.

On the other hand, $AMD (-0.85%) has seen a stabilization around Q2 2023, when AMD announced the MI300A and MI300X. And there is optimism around the upcoming MI350 series launching in the 2nd half of 2025

Despite shares trading lower in recent quarters, $AMD (-0.85%) 's underlying fundamentals improved. Revenues for the third quarter reached a record $6.82BN for the quarter, with gross margins also setting a new record at 53.56%.

All-in-all, the stock for $AMD (-0.85%) is too cheap to ignore...Keep an eye on it. Thoughts 🤔