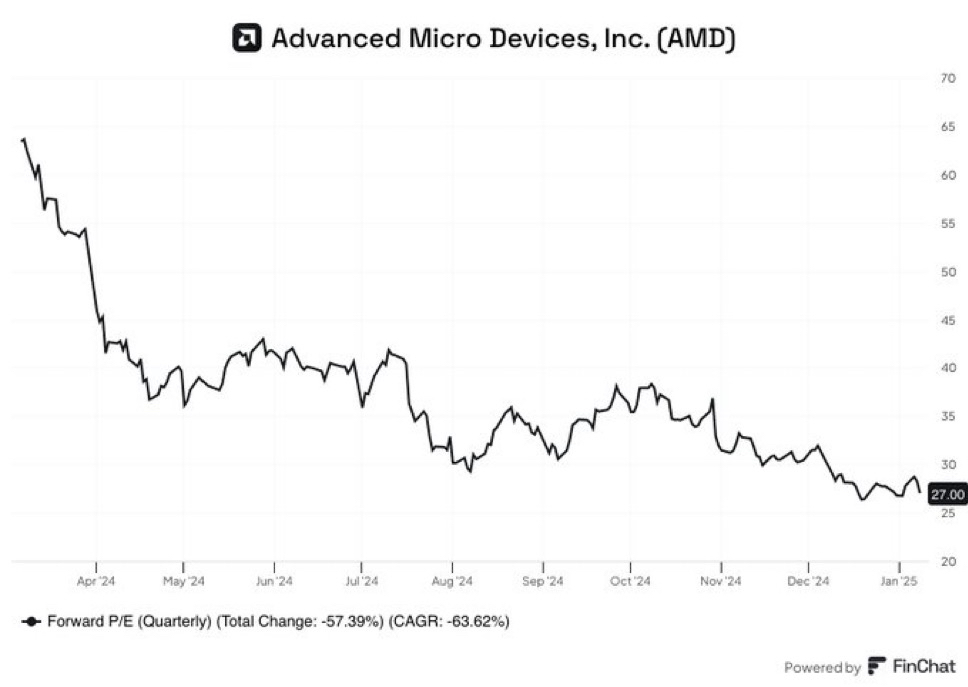

AMD's valuation has halved in the last year.

Current forward P/E: 27x

Jensen Huang says - "For every million autonomous cars on the road, $2 billion to $3 billion worth of data centers are needed."

There are 291 MILLION cars on the road in the US alone

If his calculations are correct, there is a lot of growth here. 🚀

S&P GLOBAL upgrades credit rating $AMD (-3.38%) up to "A"

According to S&P, AMD's market share gains in CPUs and strong AI-accelerated chip sales will lead to revenue growth of 13% in 2024 and 24% in 2025. The stable outlook reflects AMD's solid free cash flow, strong balance sheet and conservative financial policy. Data center performance will drive growth.

What does Goldman Sachs and

Goldman Sachs downgrades $AMD (-3.38%) from "buy" to "neutral" and lowered the price target from 175 to 129 US dollars.

Analyst comments: "While we remain optimistic about AMD's ability to take market share from Intel in x86-based computing on PCs and traditional servers, we are increasingly concerned that the rise of Arm-based specialty CPUs and increased competition in accelerated computing will do the following:

(a) hurt AMD's revenue growth relative to competitors,

b) put upward pressure on AMD's operating costs; and

c) impact the stock multiple.

Since being added to the Buy list on November 4, 2020, the stock has gained 50%, while the S&P 500 has gained 72% over the same period. We believe this underperformance is due to weakness in PC and traditional end demand as well as slower than expected growth in data center GPUs.

We now expect the stock to remain range-bound until the market regains confidence in AMD's future growth and profit margin performance."

Analyst: Toshiya Hari

We will see ✌️