Hello traders and investors,

Today we are taking a look at the ASML share. The equipment supplier to the semiconductor industry is valued at over 291 billion euros on the stock exchange.

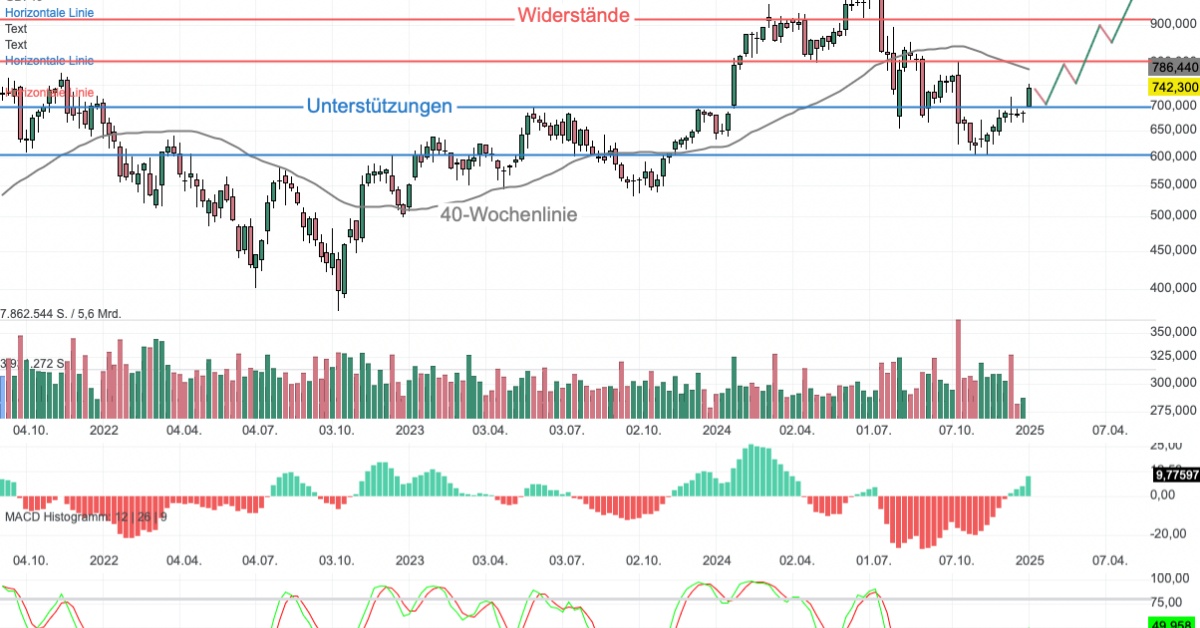

In 2022, the ASML (ASME) share price plummeted. In October, the share was trading at around 375 euros. Then the bulls took over. In November, it crossed the 40-week line. By May 2023, the ASML share had risen to 698 euros. We then saw a setback that caused prices to slump to EUR 534. This was followed by a v-shaped recovery. After an acceleration, the share price rose to a record high of 1,021.80 euros. The share then came under pressure here. With large bearish candles, it headed south to EUR 605 by November 2024. At this level, the slow stochastic indicator triggered a buy signal in the oversold area. Following the rise of the last few weeks, there has now been a strong impulse above the resistance at EUR 700. The next hurdles are at around 800 and 900 euros.

The booming topic of artificial intelligence will remain a key driver for shares in the semiconductor industry in 2025. ASML manufactures the most advanced chip production systems in the world. In December 2024, the Dutch specialist for lithography systems confirmed its forecast of achieving net sales of EUR 30 to 35 billion in 2025. It is well known that companies such as Microsoft, Meta, Google parent Alphabet and Amazon are investing billions in their AI capabilities. Now there are concrete figures. Microsoft has announced that it will invest around USD 80 billion in the expansion of data centers for AI in the financial year to the end of June alone. The visit by Italian head of government Giorgia Meloni to Donald Trump is also providing a tailwind. The meeting could improve the mood with regard to the threat of US punitive tariffs on imports from Europe.